How the Social Security System Works: A Graphical Explanation

Ponzi Scheme

A fraudulent investment operation where the investor is gets paid from investors' money or subsequent investors' money, instead of money earned by the organization running the operation, who probably aren't earning money in the first place, except from the money conned out of willing investors. See more detailed explanation at wikipedia.

Note that Social Security isn't fraudulent since it was signed into law. It does, however, have similar characteristics as the scheme explained above.

Overview

Social Security Act was signed by Franklin D. Roosevelt into law in 1935. Taxes weren't collected on it until January 1937, and payouts started on the same month that year.

Most people don't really know how the social security system works. They think their money is saved in some federal account earning interest, and when they become eligible to retire, it comes back to them as their retirement income.

This is simply and absolutely farthest from the truth! As a matter of fact, the social security system works more like a ponzi scheme (see side bar), than a 401K. It was done that way so the government can start paying out as soon as it came into effect in January 1937. Where would they get the money, otherwise?

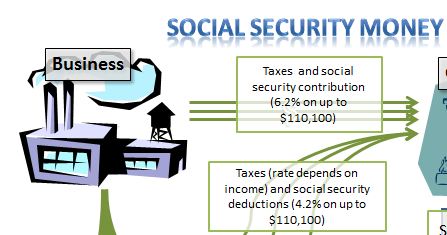

In the images to follow, I hope to clearly explain how the social security system truly works. So here we go.

How the Social Security System Works

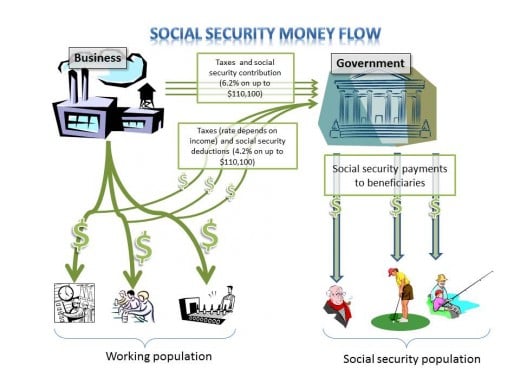

Figure 1 shows how the entire Social Security System basically works. It basically shows that money comes from businesses and people working. The money is fed into the system which then provides it to retirees.

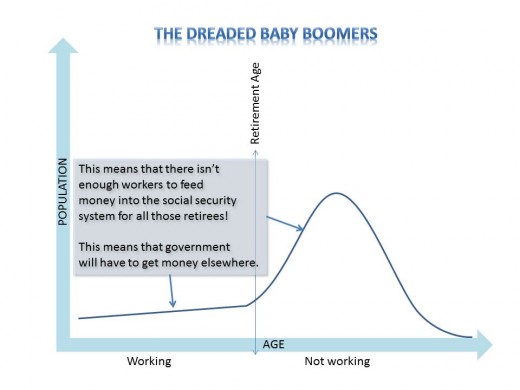

Figure 2 shows how the baby boomers are going to severely impact the social security system by creating a condition where there are more retirees than people working. To compensate, the government would have to do various things, like collect more social security taxes or push the retirement age out even further.

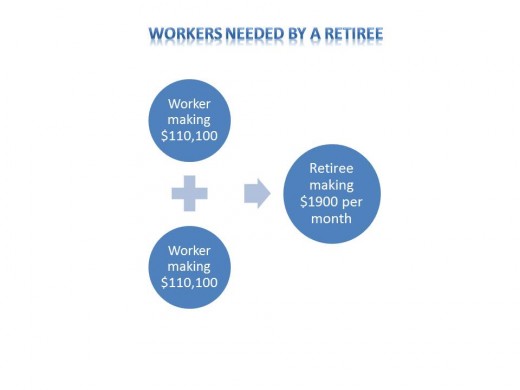

Figure 3 shows a simplified view of where money comes from--showing just from a simple math, and not taking into account any overhead, how many working people it would take to support a certain level of income for one retiree.

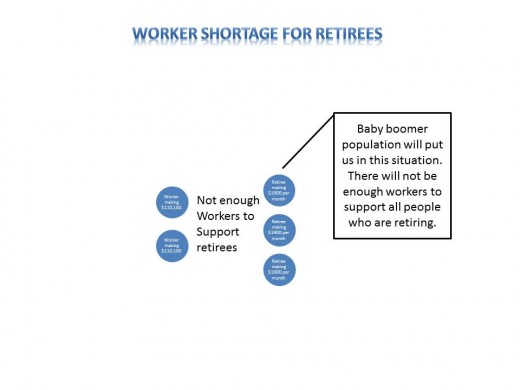

Figure 4 shows a simplified view of what happens when there are more retirees than workers--we end up with less money for retirees.

Need More Information?

The Social Security Administration has done a surprisingly good job at providing more information about Social Security online. Just go on over to http://www.socialsecurity.gov/.

If you qualify, you can even retire online! Or if you aren't qualified yet, you can see how much money you'll be making if you retired now.