How to Make a Loan Payment Schedule

Don't Get Taken on your Loans

Have you ever been at a car dealership and Slick Willie keeps asking you how much money you can afford each month? He starts rattling off numbers, the price of the car, the mileage, the interest rate, the economy, the RPM, the warranty, the cash back bonus, the trade in amount of your old car, the MPG and on and on until all the numbers start spinning around in your head, and you go home hoping you managed to get back home with enough money left to buy lunch.

Loans are scary for most people, who hope that things will work out all right. Laws were put in place where lenders are required to disclose to you how much money you are paying in total, and how long you will be paying that credit card bill if you pay the minimum due, the annual percentage rate, and things like that. But wouldn't it be nice if you knew everything you wanted to know about a loan without being at the mercy of what the bank or loan shark was willing to disclose to you?

I find it very helpful to do my own calculations. Not only does it help me know when there is an error in the loan calculation, it helps me determine how big an impact a change in the amount of payment will have on my loan. It gives me great incentive to pay extra principal on my loan when I can see that my small payment now will help me shave off a whole month off my loan.

In this article, I will show you how to make a quick calculation of your interest, and also how to create a spreadsheet to amortize your loan so you can keep track of it throughout its life.

Formula for Simple Interest

How to Calculate Interest on a Loan

Calculating simple interest is very simple, as you can see in the formula. You simply multiply the principal amount of the loan times the interest rate times the amount of time period of the loan. Since the interest rate is an annual rate, you would multiply it by the number of years on the loan.

Interest = Principal x Rate x Time

Need Help Amortizing Your Loan?

So if you borrowed $1,000 at 8% interest for one year, you would multiply $1,000 times 8% (which is .08) times one year:

Interest = $1,000 x .08 x 1 = $80.

You will pay about $80 in interest over the life of the loan. I say about, because most banks will not charge simple interest. They will want to compound the interest so they can get as much as possible. They will want to charge you interest on your interest. Some companies will compound monthly, others compound quarterly, others semiannually or annually, and still others even daily. That's why the government makes them disclose the APR, the annual percentage rate, so you can compare rates that are similar.

Banks merge all the time and sell loans. It helps to keep track of your own loan, to make sure that information doesn't get lost during a merger, and you are only paying what you actually owe.

In most loans, you will not wait a whole year to make a payment. As you keep making payments every month, the amount of your principal will go down, so you will wind up paying less than that over the life of the loan.

Creating your own amortization schedule will let you know everything there is to know about your loan, and will help you keep proper track of your own finances.

How to Create an Amortization Schedule

Once you have figured out how to calculate interest on a loan, creating an amortization schedule is very easy. You simply calculate the interest on your loan over and over again. This time, instead of calculating it annually, you calculate the interest based on the payment schedule. So, if you pay on the loan monthly, then you break up the loan into monthly chunks. Let's take the same example above, and calculate it monthly.

Interest = Principal x Rate x Time

The principal balance is what was left over after the last payment. The interest rate stays the same. The time is adjusted to monthly. So instead of calculating for one year, we are calculating 1/12 of the interest.

Interest = $1,000 x .08 x 1/12

Interest = $6.67 for the first month.

For the second and subsequent months, the principal balance will go down as you pay some of the principal each month, so you will wind up paying less interest each month. Since most loans have a fixed payment amount for each month, the remaining amount of your payment will go towards principal.

Amortization Schedule

Monthly Payment

| Interest

| Principal

| Principal Balance

| |

|---|---|---|---|---|

1/1/2013

| $86.99

| $6.67

| $80.32

| $919.68

|

2/1/2013

| $86.99

| $6.13

| $80.86

| $838.82

|

3/1/2013

| $86.99

| $5.59

| $81.40

| $757.42

|

4/1/2013

| $86.99

| $5.05

| $81.94

| $675.48

|

5/1/2013

| $86.99

| $4.50

| $82.49

| $592.99

|

6/1/2013

| $86.99

| $3.95

| $83.04

| $509.96

|

7/1/2013

| $86.99

| $3.40

| $83.59

| $426.37

|

8/1/2013

| $86.99

| $2.84

| $84.15

| $342.22

|

9/1/2013

| $86.99

| $2.28

| $84.71

| $257.51

|

10/1/2013

| $86.99

| $1.72

| $85.27

| $172.24

|

11/1/2013

| $86.99

| $1.15

| $85.84

| $86.39

|

12/1/2013

| $86.99

| $0.58

| $86.41

| -$0.02

|

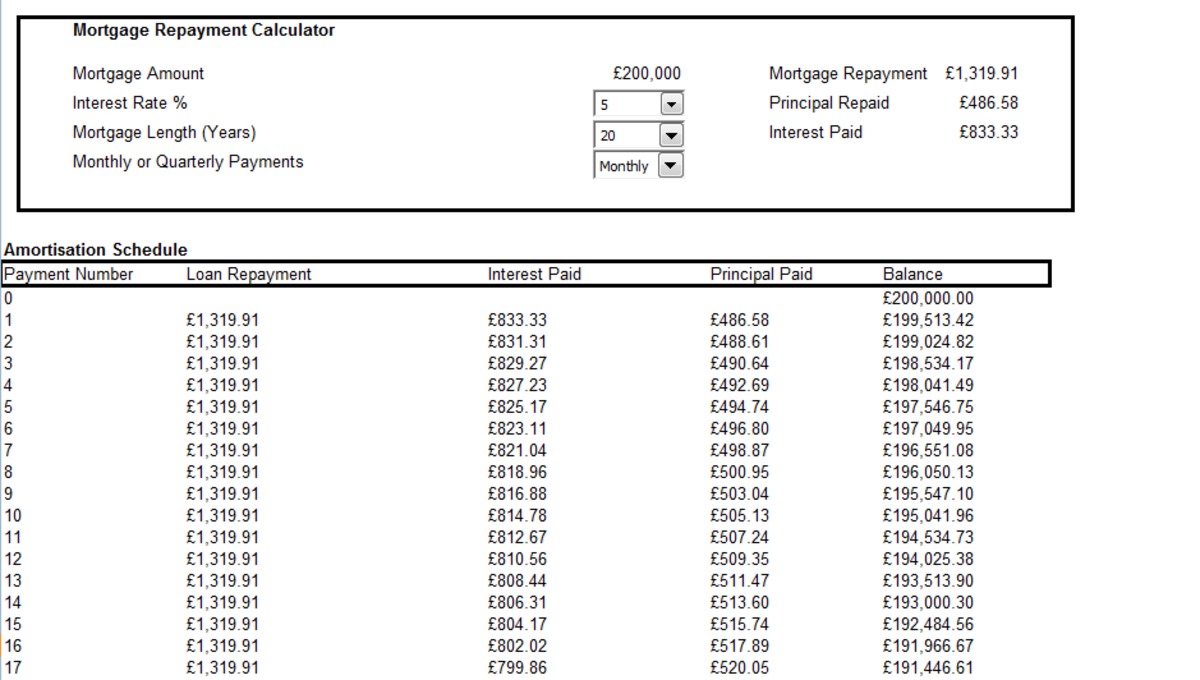

Create an Amortization Schedule Template

Instead of creating a brand new amortization schedule for each loan, I have created a template that helps me create amortization schedules quickly. To do this, I have added a couple extra cells where I input the data:

Principal Balance

Interest Rate

Monthly Payment

Then the formulas in the spreadsheet refer to the original principal of the loan and the interest rate from the input section. I do have to change the dates to correspond to the dates of the loan, but the rest of the formulas remain intact.

I also total all the columns so I know the total amount of principal and interest I will be paying on the loan.

Just a note: if you are lending money to someone and want to determine the monthly payment amount, you can easily just add a number here in the input section and see what it does to your final payment. Adjust the number up and down until you get to a point where the final payment is less than a dollar. The final payment almost always has to be adjusted on any loan to reflect the final balance.

How to Use the Amortization Schedule

Principal Payments

Once you have created the amortization schedule, you can use it to figure out the impact of your extra principal payments. To do that, simply put the principal payment in place of the current principal amount and see how the numbers changed. Your future interest goes down, and you will have your loan paid off earlier.

Interest Rate Changes

To see the impact of interest rate changes if you refinance, you will need to make sure the values of the past interest payments stay the same or create a new schedule for the remaining amount of the loan. I generally just copy the old interest amounts, and paste them as values so they are no longer dependent on the formula. (It is paste, special to copy them as values.)

Variable Rate Loans

If you have a variable rate loan, you will have to add a column to enter your interest rate for each month instead of one at the top for the rate for the entire time.

Uses and Benefits of an Amortization Schedule

There are many benefits of using an amortization schedule.

- Verify that the bank schedule is correct

- Know the total principal and interest you will pay on the loan

- Know at a glance what your current debt is at any time

- Determine the impact of extra principal payments

- Determine the effect on different lengths of loans (I converted my 30 year mortgage into a 15 year mortgage without talking to the bank or paying any conversion fees)

- Compare different types of loans

- Determine the impact of interest rate changes - see if refinancing the loan is worth it

- Amortization schedules can be used for deposits, such as CDs and bonds as well as loans

Online Amortization Calculators

If you don't want to take the time to create your own spreadsheet, there lots of online calculators that will do the job for you. They won't be as easy to customize, but they will give you a general idea about your loan.

http://www.amortization-calc.com/

http://www.bankrate.com/calculators/mortgages/amortization-calculator.aspx

Create an Amortization Schedule

We spend so much time and effort making sure that we use our money wisely, and count the change when the cashier returns it to us to make sure it is correct. But we can wind up losing a great deal of money by trusting the car salesman or bank when it comes to big things like loans. By doing the calculations ourselves, and creating our own amortization schedule, we can determine which loan is right for us, and know what we are paying when we have a loan.

By creating our own amortization schedules, either with an online calculator, or with a spreadsheet we create ourselves, we can thoroughly know our loan and the impact of changes in the loan. We can be more informed and knowledgeable and make sure that the financial decisions we make are wise ones.