How to Balance Your Checking Account

How Checking Accounts Have Changed

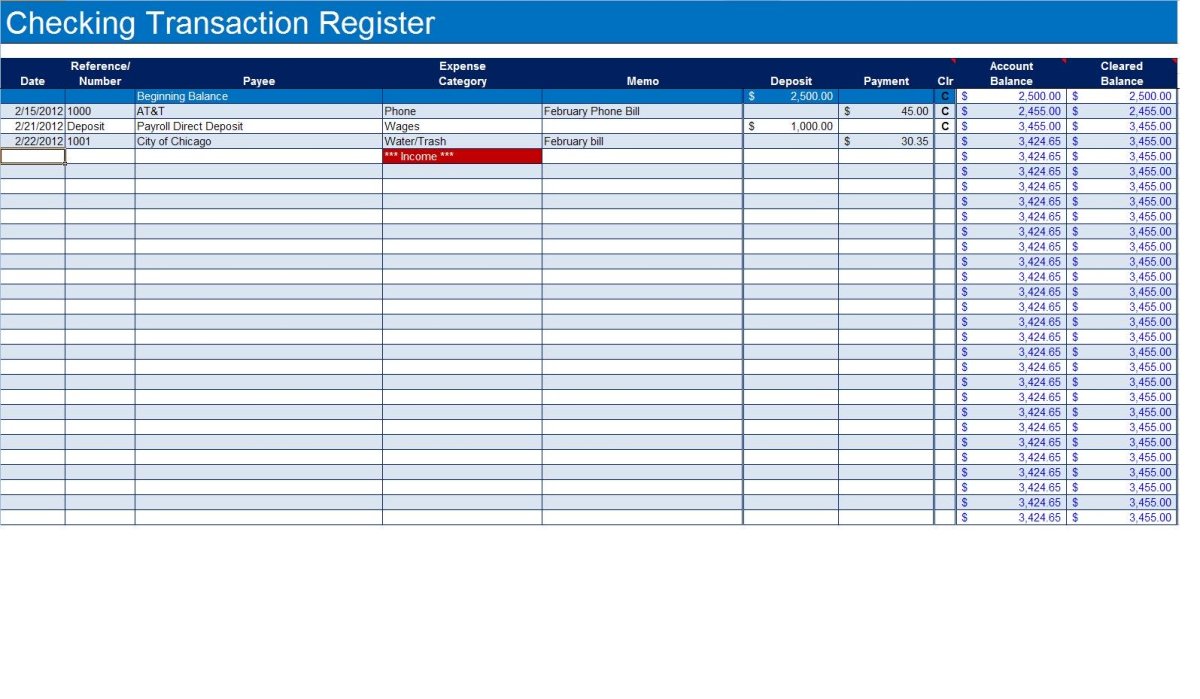

It used to be much easier to keep track of your transactions when you wrote checks. You could enter the amount in your register as you wrote the check. Even better for balancing a checkbook were the duplicate checks that many people used. You had an exact copy of the check you wrote for reference later.

Today, only 60% of retail purchases are made with a check. That means the rest of the transactions are done by another method such as cash, debit, or credit card. It can be easy to forget where you spent your money when you don't write it down immediately. With automated bill payment options, you may even forget to keep track of bills that have been paid.

So how do you keep track of the money in your account to make sure you aren't spending something that isn't there? Here are a few tips to help you balance your checking account.

Save all receipts

Tip 1: Ask for Receipts

Always ask for a receipt when you pay with cash or a debit card. Select "yes" when you pay at the gas pump with a card. Then put them in a place where you will remember them for later. A great idea is to keep an envelope or small bag in your car to hold them until you are ready to balance your checking account.

Tip 2: Balance Your Account Daily

Take a few minutes every evening to balance your checking account with the receipts for the day. Don't wait a week and then sit down and try to do it. For one thing, it will take much longer when you have several days' worth of receipts. It will also be much harder to remember if you're missing a receipt for a purchase.

The other issue with not balancing your account daily is that if you carry a low balance and you're estimating in your head, you can end up with a negative balance or overdrawing your account. This can result in fees and be a costly mistake.

Of course, if you don't spend money on a daily basis, you won't need to balance your account each day. However, it's still a good idea to check your account if you have online access to make sure you haven't forgotten something or no unusual activity is taking place.

Tip 3: Subtract Automatic Payments First

It doesn't matter if your bill is paid on the day you get your paycheck or a week later, subtract it immediately. Any bills that are set up to come out for a certain paycheck should come off the top. This allows you to see exactly how much money you have left for other expenditures.

Keep a record of your automatic bills so that you don't forget one. If you get paper statements, keep them with your checking account register. If you get your statements through email, keep those notifications in their own folder. Check each month to make sure you got everything from the last month; this keeps you from forgetting to subtract one from your balance.

Also, check the due dates on your automatic bills. Not all of them are due the same day each month. If they operate on a 30-day cycle or other plan, the due date can vary by several days. You don't want to find out after the fact that your bill was submitted to be paid before your depost was in the account.

Tip 4: Do Not Rely On Your Online Balance

Do not assume that the balance of your checking account online is correct. Payments may be outstanding that have not been processed. If you have written a check to someone, it can stand out for days, weeks, or even months. One time I paid for something with a check and it did not make it to the bank until seven months later! That can be an unwelcome surprise if you have not planned for it.

Tracking all of your dollars and cents is essential.

Your Checking Account is Your Link to Financial Success

Your link to financial freedom is how you handle your money or your checking account. If you monitor your account daily and record every transaction so you know exactly where your money is and where it is going, you will develop a new understanding of your finances.

This may not be a pleasant job, but it is necessary to avoid unexpected issues such as bounced checks or overdrawn accounts. Learn to balance your checking account on a regular basis and you will know how much you have available at all times.