How to Budget for Disaster Planning

Your Future Emergency Savings

What If It Happens To Us?

Proud Member of the HubPages Apprenticeship Program and Team Member of the ScribeSquad.

The last thing you want to have to think about and plan for is a major disaster. You probably don't most of the time unless prompted to by the media that tell stories of disasters in places far away. But the truth is we live in a very scary world. One day things are totally normal and the next day the balance can crumble and our common day way of life could vanish in a moment of great dispair. But if you are prepared for these types of disasters the entire scenerio can play out in a much more organized and civilized way. Having the money to start building your disaster kit and food storage for an emergency by using your disaster savings and then saving more money for what you may need when the disaster takes place.

So having a plan in place with the right emergency gear and kits on hand can keep your family safe, alive, healthy, and informed. But there is something not many people may think about when planning for a disaster. In a disaster your access to financial information and funds may be suspended because of complications caused by the disaster. It is important to have a back up for unexpected expenditures. This is a personal financial insurance policy for a disaster event only.

Even if you don't have much income making the investment into a disaster fund can be done by planning in advance where to spend the funds and watching any surplus money of a set budget. Saving this money has to do with how willing you are to make critical adjustments to your lifestyle. You must assess what income is coming in each month and what the output must be, this means what you find are your core needs for moderate happiness. This is a sacrifice that you will thank yourself later for if a disaster ever does strike. So we know it will take great commitment and personal sacrifice for you to reach your disaster goal. Use this experience as training yourself to be able to adjust easier than others when the disaster takes place and take comfort in that.

What You Need to Have List

Get yourself a safe and fill it with the items on this list:

- Gold at least 2k

- Silver at least 1k

- Coins in rolls and jars

- Travelers’ checks

- Cash in similar denominations in rolls bands

- Guns and ammunition

- Valuables like watches and jewels

- Insurance cards and information

- Car information

- Identification copies of each family member

- Bank account information

- Birth certificates of each family member

- Keep copies of your low risk investments like retirement accounts (IRAs), and 401 (K)s, and Annuities information in a file folder.

- Important photos and certificates.

- Pens, pencils, sharpeners, erasers, a paper, journal. and a planner

Are You Prepared?

Do you have a disaster fund?

How to Save for a Disaster Fund

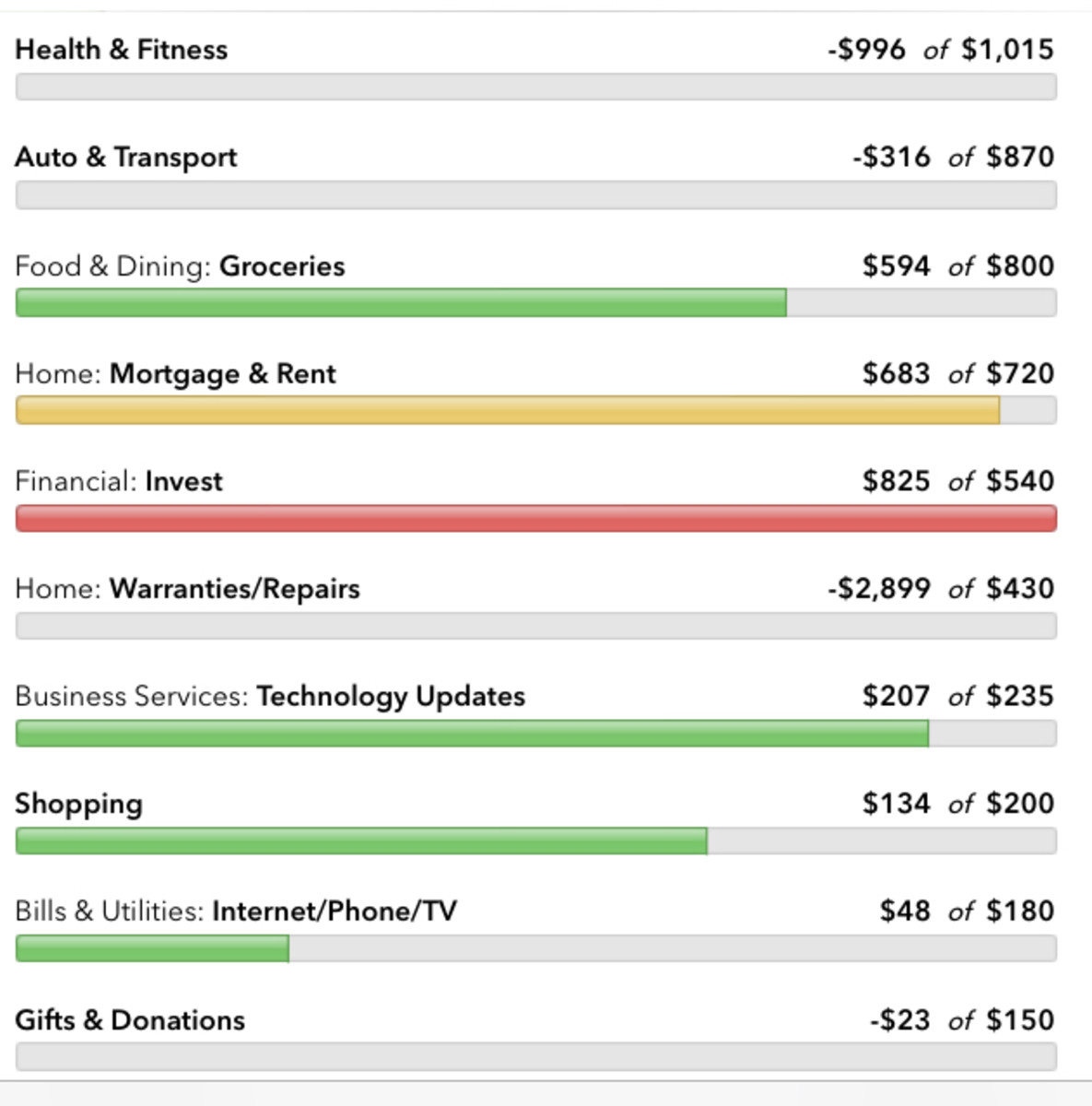

Making a Budget: A budget allows you to see all your necessary expenses, this lets you calculate how much you can set aside for your disaster savings.

Having a Time Frame: You should have a time frame that you can use - put aside your disaster savings each month after you have paid your bills. It is best just to treat the money like it is just another bill.

Income: You need to know how much income you have coming in each month, take your total annual income from a past year and divide it by 12. From there you can look at your expenditures from each month and find out how much you have to set aside each month and what total amount you should have in your emergency fund at the end of one year.

Expenses: Here you'll have to figure out just exactly how much money you have each month and then you must figure out what you are spending each pay period. Even though some expenses like rent, insurance, and bills are consistent and easy to gauge others are not so easy to regulate. Utilities are notorious for this; bills like food, gas, and electricity, and water are all different each month. What you must do is average each month over a three month period. Keep good records on what you spend on everything you pay and buy. This will help you see what you are spending all your money on. Figure out from this where you can make cuts to your spending and put that money (your surplus) away in your disaster fund.

Keep Accurate Records of Your Disaster Savings

Have Gold and Silver: I know that sounds cliché but it’s the truth, throughout history

Keep Your Coins: Yes I know it doesn't sound like it will make a difference. Just try it. There can be small gold mines you just dismiss as clutter in your home. Put it in a Jar.

Invest in a Safe: I know that is weird to say but honestly if the banks are affected you are going to have a snow balls chance in the middle summer getting any of your money. Keep gold, silver. coin jars, travelers checks, cash, guns and ammo, and valuables like watches or jewels in these safe keeping boxes. This is also where you should keep your most important documents as well, insurance copies, bank account information, birth certificates and copies of all family members I.D.s and school I.D.s, contact lists and addresses of important people like family, close friends, and doctors. Always keep a small collection of keep sakes in your safe as well.

Try to Pay Off Debts

It is my suggestion that as you do this keep paying on your debts. I have another financial savings article with a snowball debt how to. Living Within a Budget, Paycheck to Paycheck

Thanks for taking the time to read this article and I do hope it is useful to you. Thanks for reading.