How to Estimate Retirement Expenses

Introduction

There are two common ways to estimate retirement expenses. The first way involves estimating pre-retirement spending, and then assuming retirement expenses will be a percentage of that amount. For example, if you spend $4000 per month today, you could assume your retirement expenses will be 80% of that, or $3200 per month. The second way is to forecast what your retirement expenses will most likely be in various categories of spending, and then add up these amounts.

Unfortunately, both of these common ways to estimate retirement expenses are flawed. The first way fails to account for the fact that some pre-retirement expenses will likely increase after retirement, while other expenses will likely decrease. The second way tends to be inaccurate because it’s difficult to accurately estimate future retirement expenses in many individual spending categories, and adding up the results of these many estimations compounds the errors.

Retirement expenses can be estimated more accurately using a hybrid of these common methods. In the hybrid approach, pre-retirement spending patterns are used if more likely to accurately predict post-retirement spending, while forecasts of future expenses are used for spending categories that will likely see substantial changes after retirement. Here's how to estimate retirement expenses using the hybrid approach.

Step 1: Day Dream about Your Retirement Lifestyle

The first step in estimating retirement expenses is to sit back, relax and dream about retirement. After all, its impossible to predict the cost of something unless you know what it will be. Will you stay in your current home, or move to a retirement community? Will you downsize to a smaller home? Will you move to an area where better weather means lower utility costs? Will you travel around the world, or stay closer to home? Will you join a country club, learn to fly, or take up photography? Will you eat out more, or less? Picture your retirement lifestyle. If you are married, discuss your expectations with your spouse. Don’t worry about planning every detail, but picture your retirement.

Step 2: List Each Category of Spending in Retirement

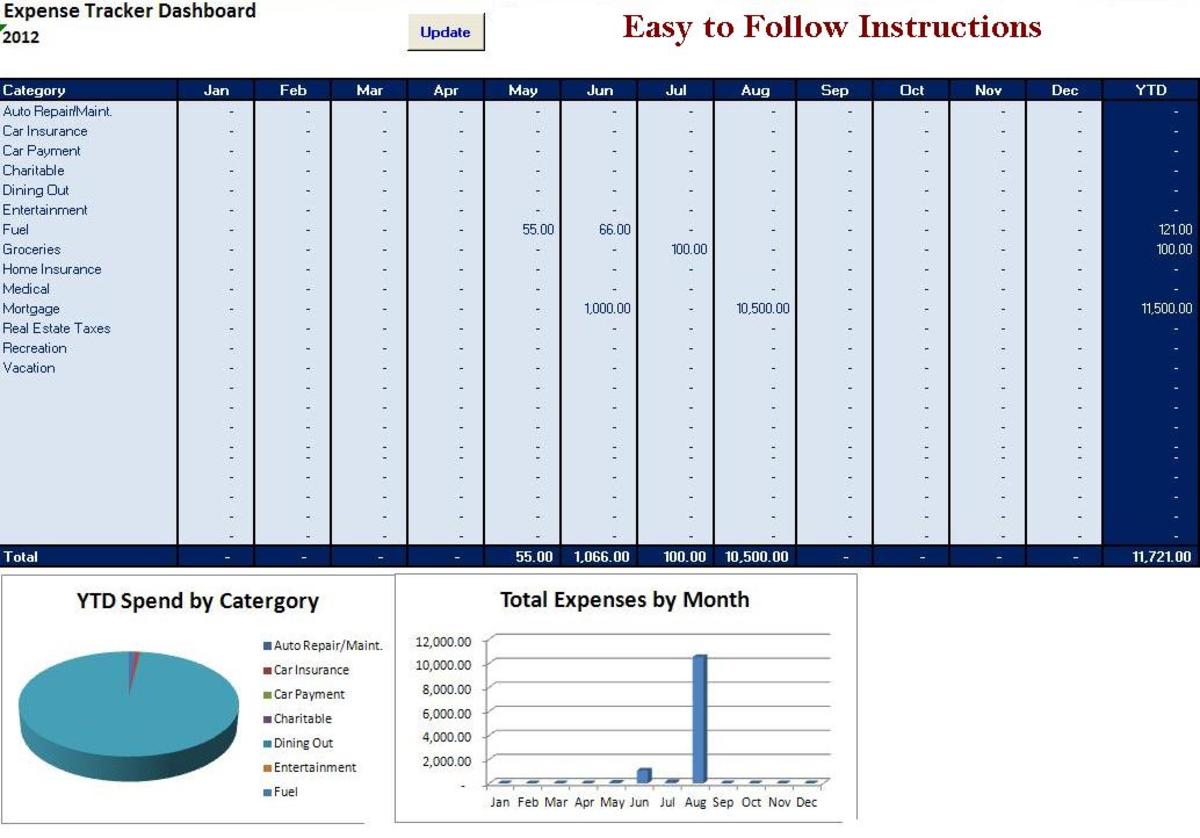

Once you have a mental picture of what your retirement will look like, make a list of each category of expenses you will have during retirement. Your expense categories will likely include the following: housing; food; clothing; transportation; healthcare; insurance; hobbies; travel; taxes; and miscellaneous. If you expect to have other significant categories of spending, such as for a boat, airplane or vacation home, add these categories to the list.

Here is an exemplary list of categories to jump-start this step of the calculation:

Categories of Retirement Expenses:

Category

| Sub-Categories

|

|---|---|

Housing

| Mortgage/rent, maintenance and updates, landscaping, condo association fees

|

Utilities

| Electricity, natural gas, heating oil, water, sewer, Internet, cable TV

|

Food

| Groceries, Eating Out, Entertaining Friends or Family

|

Clothing

| Wardrobe, shoes, etc.

|

Transportation

| Car payments or savings for new car, gas, oil changes, repairs, public transportation

|

Healthcare

| Medical insurance (including dental and vision), co-pays, out-of-pocket costs

|

Insurance

| House/renter's, auto, life, umbrella, flood, long-term care, Medicaid, Supplemental

|

Hobbies

| Golf fees, knitting expenses, flying lessons, scuba diving, stamps, coins, etc.

|

Travel

| Cruises, beaches, mountains, Europe, Far East, visiting the kids, etc.

|

Taxes

| Federal income, state income, real property, personal property

|

Miscellaneous

| Charitable contributions, gifts, etc.

|

Step 3: Select Best Way to Estimate Spending for Each Category

With your retirement picture in mind, select the best way to estimate your retirement spending in each category listed in step 2. For each category, select either: (A) estimate spending based on a percentage of pre-retirement spending in this category; or (B) forecast spending based on a best estimate of what will be spent in this category during retirement. You should select (A) if this category of spending will be similar to what it was before retirement, or (B) if this category of spending will change drastically after retirement.

Here are considerations for which selection to make for different categories:

* Housing: If you plan to stay in your current home, select (A) for the housing category since your expenses in retirement will closely match your current housing costs. If you plan to move, select (B) since you'll need to forecast your costs in your new home.

* Utilities: If you plan to stay in your current home and use about the same amount of heat and electricity, then select (A) for the utilities category since your utility expenses in retirement will closely match your current utility costs. If you plan to move to a different size home, or think you'll change your utility usage in your current home since you'll be spending more time at home, then select (B) since you'll need to forecast your modified utility costs.

* Food: If you plan to eat out about the same amount you do now, select (A) for the food category. But if you will eat out more or less during retirement, select (B).

* Transportation: Most people should select (B) for the transportation category since their transportation costs will likely change drastically after retirement. You will no longer need to commute to your job, but you may drive more for entertainment since you'll have more time.

* Healthcare: Most people should also select (B) for the healthcare category since their healthcare costs will likely change drastically after retirement. You may need to pay more for your health insurance premiums now that they are not being subsidized by your employer. You are also likely to have more healthcare-related issues as you get older.

* Insurance: Many people should select (A) for the insurance category since these costs often stay about the same after retirement as before retirement. But select (B) if your retirement lifestyle involves moving to an area where you'll need to purchase expensive windstorm or flood insurance that you didn't need before.

* Hobbies: Many people should select (B) for the hobbies category since they are likely to spend more on their hobbies after retirement since they'll have more time to enjoy them.

* Travel: Similar to the hobbies, many people should select (B) for the travel category since they'll have more time to travel after retirement.

Step 4: Apply the Selected Way to Each Category, and Add Them

For each category, estimate your retirement expenses using the method you selected in step 3. Once you've completed this estimate for all categories, add the results. The sum should be a good estimate of your retirement expenses.

To increase the accuracy of your calculation, and make sure it adapts to changes in circumstances, periodically update your calculation. For example, update your estimation of retirement expenses at about the same time each year.