How to Create a Diversified Portfolio for Investing

Diversified Investment Portfolio

Diversification is Not Putting All Your Eggs in One Basket

Financial diversification involves not putting all of your investments eggs in one basket. If one of your investments should fail, you don't want the rest of your investments to fail simultaneously.

It's easy for investors to create a diversified investment portfolio using readily-available financial products. However, it's also easy to misuse these products and end up with a poorly diversified portfolio that exposes the investor to unnecessarily high risk.

Here is how to create a diversified portfolio that will decrease risk without hurting long-run investment returns, and how to avoid pitfalls in creating such a portfolio.

Asset Allocation for Diversified Portfolio

How to Create a Diversified Portfolio

A diversified portfolio reduces risk without hurting long-run returns by investing in a variety of assets unlikely to move in the same direction. Risk is reduced because, even if some assets lose value, others will likely gain value to at least partially offset those losses.

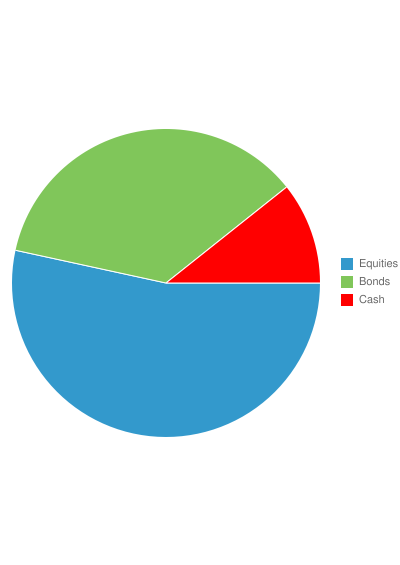

A basic diversified portfolio includes investments in stocks, bonds and cash. Stocks are the most aggressive investments with the highest potential gains but also the highest potential losses. Bonds are less aggressive investments which generate regular interest income and tend to move in the opposite direction from stocks. Cash (and cash equivalents such as money market funds and short-term certificates of deposit) have stable prices but generate relatively low long-term returns.

The percentage of a portfolio invested in each asset category depends on the risk tolerance of the investor. Generally, aggressive investors will want a portfolio with higher percentages of stocks, while conservative investors will want higher percentages of bonds (and even cash).

A generally-accepted rule of thumb is that the percentage of stocks in a portfolio should equal 100 minus the investor's age. Thus, if the investor is 40 years old, he would want to invest 60% of his portfolio in stocks and the remaining 40% in bonds and cash (e.g., 30% bonds, 10% cash).

Some financial advisers criticize this rule of thumb as too conservative. They point out that a 50 year old investor can expect to live another 30 or more years, and so needs more growth than would be expected from a 50%-stock portfolio. Thus, this rule of thumb can be modified to say the percentage of stocks should equal 110 (or even 120) minus the investor's age. Thus, a 50 year old investor would then strive to invest 60% (or even 70%) of his portfolio in stocks.

An investor using a 401k retirement savings plan at work should first review his plan's investment options to identify the stock, bond and cash options. He should then select which of these options he will use for each investment category. (A good way to select the best option is to find the best combination of long-term performance and low fees.) He should then set up his retirement plan to direct his new investments into his selected options according to his desired asset allocation. For example, a 40-year old investor could decide to direct 60% of his new investments into an S&P 500 index stock fund, 30% into an aggregate bond fund, and 10% into a stable-value fund.

The investor should also consider the problem of how to keep his 401k plan invested according to his desired asset allocation over time. For example, he may find his 401k holdings drift over a few years such that his stock holdings move up to 70% of his portfolio rather than his desired 60%. To correct for this drift, he can set up his retirement plan to periodically re-balance his portfolio to his desired allocation. Re-balancing at a periodic interval of one year is typically sufficient. (If his 401k plan does not have an automatic re-balancing feature, he can re-balance manually.)

Many 401k retirement plans have begun offering target date retirement funds designed to automatically allocate investments in percentages appropriate for an investor who retires during a certain year selected by the investor. While these funds are useful financial products, the investor should review the funds' targeted asset allocations before deciding to invest in any of them.

As an investor becomes more sophisticated, he can direct some of his investments to other asset classes beyond the traditional asset classes of stocks, bonds and cash. For example, an investor may wish to add a small position (e.g., 5% to 10% each) of real estate investment trusts (REITs), commodities (e.g., gold, silver, farm products, timber) or other asset classes. The goal is to look for non-traditional asset classes which tend to move independently of the traditional asset classes.

More sophisticated investors will also want to diversify their investments within an asset class. For example, the asset class of stocks includes sub-classes of large-cap, medium-cap and small-cap stocks, along with international stocks. These sub-classes offer additional diversification because their values tend to change somewhat independently of each other in different economic climates.

Similarly, the asset class of bonds includes sub-classes of treasury bonds, inflation-protected bonds, savings bonds, high-quality corporate bonds, junk bonds and municipal bonds. More sophisticated investors will want to diversify their bond investments among these sub-classes.

Pitfalls to Avoid

Potential Pitfalls

|

|---|

1. Buying Multiple Investments with the Same Underlying Assets

|

2. Buying Too Much of Your Employer's Stock

|

3. Buying Too Much Stock of Other Companies in Your Industry

|

4. Not Coordinating Financial Assets with Other Aspects of Your Life

|

Pitfalls to Avoid in Creating a Diversified Portfolio

Unfortunately, many investors who believe they have created a diversified portfolio have inadvertently created a portfolio of many investments which tend to move in lock-step with each other and therefore do not provide the benefits of a well-diversified portfolio.

A common pitfall is buying multiple investments that own the same underlying assets. For example, many investors buy two or more mutual funds or exchange traded funds that own large-cap stocks. Since these multiple investments own the same assets, they rise and fall together. Other investors fall into the trap of buying multiple investments which own the same or similar assets because they have multiple accounts with different financial service companies. To avoid this problem, investors should coordinate the allocation of their assets among their multiple financial accounts.

Another common pitfall is to buy too much of an employer's stock. Many investors buy too much of their employer's stock because they are familiar with the company and believe in its future. This is especially dangerous because, in the event the company does poorly, the investor may lose his job along with his investment. Many advisers recommend a limit of 5% of investments into an employer's stock. The author even questions why anyone should buy ANY of their employer's stock, unless its the only way to get a company match or an employee discount on that stock.

Yet another common pitfall is to buy too much stock of other companies in your industry. Since your job is already tied to that industry, why double-down with your investment dollars?

Another common pitfall is to not coordinate your financial investments with other aspects of your life. For example, if you own an expensive home, it's best to avoid investing your retirement dollars in a real estate investment trust. For another example, if you're a retiree with a large pension (or you anticipate receiving a large pension once you retire), you shouldn't need to invest as much money in bonds since the pension payments will effectively replace your need for bond income.

Other Investment Articles

- Earn More Income Without More Risk

Automatic rebalancing is a simple way to improve investment returns without increasing risk, especially for retirement plans such as IRAs and 401Ks.

- How to Fight Inflation

By using these 10 ways to fight inflation, you can rest easier knowing that the purchasing power of your savings should be preserved even when inflation starts to rear its ugly head again.