How to Get a Good Credit Score While Using a Credit Card

Using a credit card, when done responsibly, is a good way to establish credit. You can even use your credit card to build credit without carrying a balance from month to month or accruing interest. To understand how to have a good credit score while using a credit card, it's important that you understand the basic components of a credit score.

Credit Score Factors

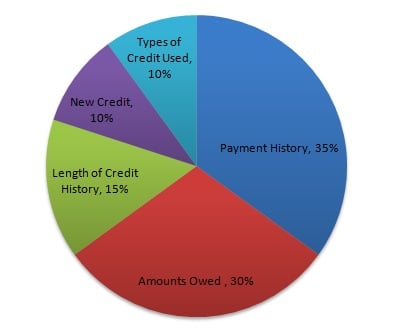

There are number of factors that are taken into consideration when calculating your credit score and it's important to be aware of these factors in order to maintain a good credit score. The two factors that have the most weight on your credit score are your payment history and the amount of debts owed. Other factors that impact your score are the length of credit history, number of inquiries on your report and the credit mix or different types of credit accounts.

Your payment history and amount of debts owed together have the most weight on your credit score, more than any of the other factors combined. What this means is that if you are using a credit card to build good credit, you need to keep your balances low, ideally around 20%, and make sure that you are making your payments on time. These two pieces of advice will have the most impact on your score.

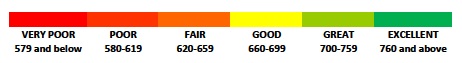

What Is a Good Credit Score?

As you can see from the graph above, once your score starts dipping into the mid to low 600s, you will have some trouble getting new credit and your rates will likely be higher. The best rates and offers are reserved for those with credit scores in the 740+ plus range.

What Credit Score Do You Need for a Credit Card?

The answer to this question really depends on your personal credit profile.

If you have little or no credit history, you might have to initially accept offers for low credit limits or you may have to start out using a secured credit card. A secured credit card is one in which you make a deposit on the card and then the amount of your deposit becomes the credit limit on your card. Once your establish a record of good financial behavior, your limit may increase and your initial deposit may be returned to you. This is a good way to begin to establish good credit for those that are just starting out.

If you already have an established credit history but a low credit score, it may be more difficult for you to open new credit cards. However, even with poor credit there are some companies that will be willing to offer you credit, though you will have few, if any, rewards, higher interest rates and stiffer penalties. It is a better idea to get the accounts you already have into good standing, rather than open new accounts to try to improve your score.

Your Credit Card Balance and Your Credit Score

You want to avoid maxing out your credit cards in order to maintain a healthy credit score. As discussed above, the amount of debts you owe, which includes your credit card utilization, has a high impact on your credit score. It is recommended to keep your credit card balances at a combined utilization rate of 20-30% or less. This means that you only want to use around 20% of your available credit limit or it may begin to negatively impact your score.

The credit limit that is placed on your card may be impacted by your credit score. If you have a high credit utilization, it's not likely that you will be able to get the limits increased on your cards. Another factor that lenders take into consideration when determining the limit of your credit card is your income. Though your income is not used in computing your credit score, lenders may look at it to help determine how much debt you can afford to take on.

If you have recently applied for a number of new accounts, lenders may choose to offer you lower credit card limits because they see that you are in pursuit of new credit and therefore consider you more of a risk. Whenever you apply for new credit, hard inquiries are placed on your report and will decrease your score. Hard inquiries drop off your report after 2 years.

Key Factors that Impact Your Credit Score

Opening a New Credit Card and Your Credit Score

There are a few different ways that your credit score can be impacted by opening a new credit card. The first is that it may improve your score because it increases your total account limits and therefore decreases your credit card utilization. Also, having more accounts open may improve your score because it says that lenders are willing to give you credit. That being said, it may also hurt your score by adding hard inquiries to your credit report. You receive hard inquiries on your credit report anytime that you apply for credit. If you have a lot of hard inquiries on your report, it tells lenders that you are in pursuit of new credit and therefore a higher risk.

All things considered, it is probably not a good idea to open new accounts in order to try to improve your score. When it comes to credit cards, you only want to open accounts that you will use and plan on keeping open.

Canceling a Credit Card and Your Credit Score

In some instances, canceling a credit card will hurt your credit score. If you cancel a credit card that you have had open for a while, it will make your credit history look shorter and therefore decrease your credit score. Another reason why closing an account may hurt your credit score is because it will decrease your available limits and in doing so increase your credit card utilization. For example, say you have a $10,000 combined credit limit on your credit cards. You have $3,000 in total balances on your cards, which is a 30% credit card utilization. You decide to close one of your credit card accounts that has a credit limit of $2,000. This would mean that your total available credit on all of you cards would decrease to $8,000. Because you still have that $3,000 balance on your cards, you have actually increased your credit utilization to 38% and possible decreased your credit score.

Before canceling your credit card, you want to check which cards you've had open the longest. If possible, you want to keep your oldest accounts open and active. If you no longer wish to use your credit cards, carry a $0 balance and wait for the card issuer to close the account.

Amount of Credit Accounts and Your Credit Score

In general, having more accounts open will give you a higher credit score because it shows that more lenders are willing to give you credit. However, by opening new accounts in an attempt to improve your credit score, you actually might be hurting yourself by decreasing the average age of your accounts and increasing the number of inquiries on your report. Another point to keep in mind is that your payment history and amount of debts owed carry a much heavier weight on your credit score than the amount of credit accounts on your report. It's best to build your credit profile naturally over time.

Tips for Maintaing a Good Credit Score with a Credit Card

Having a credit card, when used responsibly, can be an excellent way to begin to establish credit or improve your credit score. When using a credit card, keep these tips in mind:

- Make your payments on time: A long record of on-time payments is the best way to have a good credit score. Your payment history has the biggest weight when your score is calculated.

- Keep your credit card utilization to 30% or less: Your credit card utilization also has a heavy weight on your credit score. If you want to keep your credit healthy, keep your balances on your cards low. You can use your cards to make everyday purchases and then pay off your balances every month. This way, you'll be keeping your cards active and making on-time payments without accruing any interest!

- Consider opening new accounts carefully: Only open accounts that you plan on using and keeping open for a long time. Opening and closing accounts to move around debts or just to receive promotional offers may actually hurt you more than help.

- Keep your oldest accounts open and active: The average age of your credit card accounts will impact your score. By keeping your oldest accounts open and active, you will increase the age of your credit history and therefore improve your score.

- Consider a secured credit card if you have a limited credit history: After a year of on-time payments, you will have established enough credit to apply for cards that are unsecured.

You can use the credit simulator on Credit Karma to see how different scenarios will impact your credit score. Play around on there and you can see how paying off debts, making on-time payments or making late payments might impact your score.

The best way to have good credit is to use your credit responsibly and build a long history of on-time payments. It takes time to prove that you are a responsible borrower, so allowing your credit to grow over time will give you the best results.