How to Know When You Really Have A Good Credit Score…

Credit scores are one of the most important—if not most important—factors when determining a borrower’s risk of default. Credit scores, also known as FICO scores, have entered into the ubiquity of mainstream American culture. You can’t even turn on a television, radio or browse the internet without mention of these three digits. We all know why having a good credit score is so important—namely, a good credit score equates to low rate loans, such as prime credit cards, 0% APR car loans and even sweeter deals on home mortgages—in a nutshell it saves you money. But what exactly is a good credit score? Most consumers would be surprise to know that when it comes to figuring out if he or she indeed has a good credit score the proverbial response is always the same: It depends!

Credit Scores Are Based on a Range of Numbers…

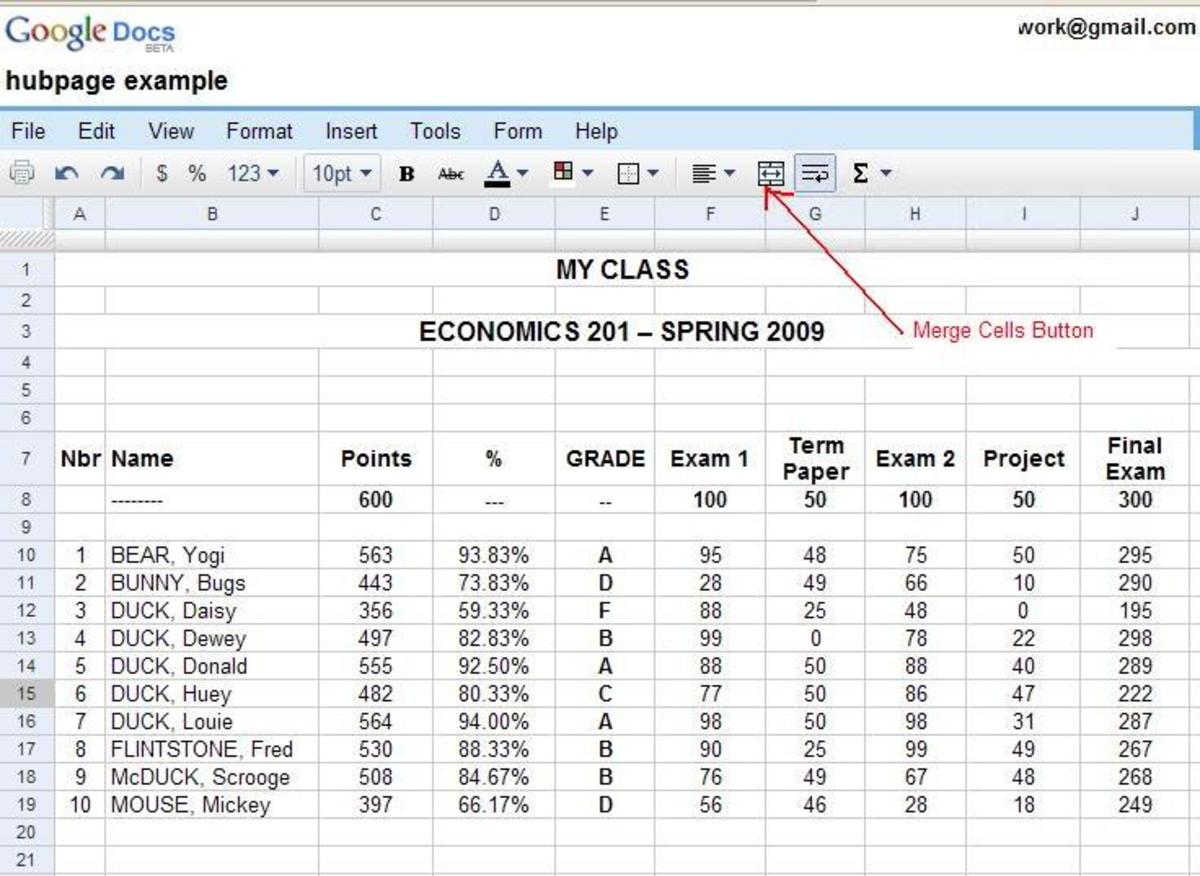

When scoring the risk of default Fair Isaacs Company, better known as FICO, has claimed hegemony over its competitors. There can be very little doubt that a good FICO score is considered the law of the land. In fact, VantageScore—as headed by Experian—doesn’t even compare. But here is where there are some similarities: both scoring models seem to operate within a range of numbers. Within that range, there are different categories, which of course swing from bad to excellent. The range of numbers is a follows:

• Excellent Credit:

| 750

| |

|---|---|---|

• Good Credit:

| 700-749

| |

• Fair Credit:

| 650-699

| |

• Poor Credit:

| 600-649

| |

• Bad Credit: below

| 599

|

Typically most financial pundits will tell you that a score of 680 is considered good. Caveat emptor: the subjectivity of FICO’s scoring model would say otherwise. In fact, each lender will have his or her own set criteria of what constitute a good credit score and what doesn’t. Although a score of 680 is considered industry standard, it’s not uncommon for creditors to request an even higher score, approving only the fortunate few that have been able to earn scores of 750 or higher.

Credit Scores Are Generated by Mathematical Formula…

Created in 1956 by a couple of science geeks, the FICO scoring model was designed to help financial services companies make complex, high-volume decisions. The general line of thinking by Bill Fair and Earl Isaac, the company founders, isn’t too hard to understand: “Lets create a scoring model based on a mathematical formula!” In short, what the formula does is rewards good financial behavior and penalizes bad behavior—this is all based on set criteria. This set criteria are as follows:

- 35%: Payment history—Late payments on bills, such as a mortgage, credit card or automobile loan, will cause a FICO score to drop.

- 30%: Credit utilization—The ratio of current revolving debt (such as credit card balances) to the total available revolving credit or credit limit.

- 15%: Length of credit history—As a credit history ages it can have a positive impact on its FICO score.

- 10%: Types of credit used (installment, revolving, consumer finance, mortgage)—Consumer can benefit by having a history of managing different types of credit.

- 10%: Recent searches for credit—hard credit inquiries, which occur when consumers apply for a credit card or loan (revolving or otherwise), can hurt scores, especially if done in great numbers; often three to five points per inquiry.

The Joys of Having a Good Credit Score…

A good credit score open up doors to limitless possibilities. To put it in more concrete terms, a good credit score is considered a financial asset—that is to say, if by chance your credit score exceeds the 750 threshold for excellent credit, your borrowing power (aka buying power) becomes that much stronger. In addition, consumers with high FICO scores can rest securely at night knowing that they’re not slaving themselves to pay back a loan with an astronomical interest rate. Paying less over time for borrowed money is one of the joys of having a good credit score.

Consider the savings: Let’s say you get approved for a $300,000 mortgage with a 30 year fixed prime rate, which is considered the best rate given to individuals with very high FICO scores. In theory, you could end up saving more than $90,000 more for the house over the life of the loan than if you had qualified for a 15 year adjustable sub-prime rate, which is the worst rate given to consumers with very low FICO scores.

In final, a good score means money!