How to Organize and Pay Your Bills on Time

We all hate late fees. According to one large financial website the average American spends $4,600 in late fees over their lifetime. Four thousand six hundred dollars! I can think of a lot of better things to do with that money then give it to financial institutions. In 2009 credit card companies reported that they earned over 20 billion just in late fees.

I don’t really care to contribute to the exorbitant wealth of the creditors, and I am sure you don’t either. That is why I will show you ways to avoid being late on your bills. Using this easy system you will build good credit, avoid paying late fees, and gain excellent standing with not only the credit card companies but with your utilities, landlords, and anybody else you regularly pay money to.

It took nearly two years of fine-tuning my financial system to be nearly fail-proof. I used several computer software programs along with notebook-and-pen systems. I used a financial calendar. I have finally settled into a comfortable and easy to use program that can easily be learned and implemented in a few hours.

What to do first

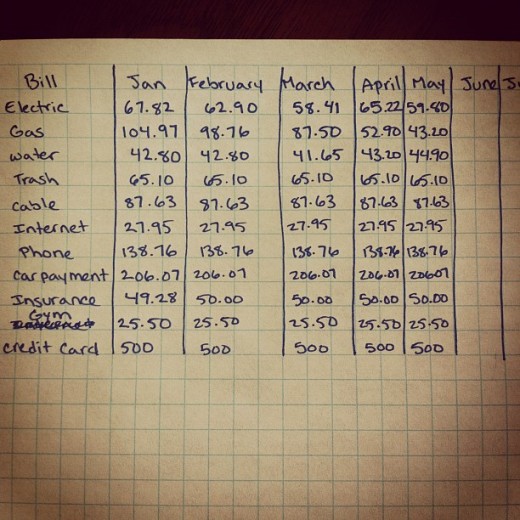

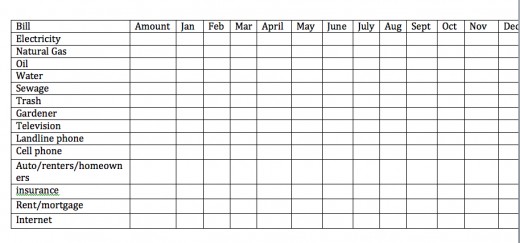

The first thing you need to do is make a list of every single bill you pay, whether it is monthly, bi-monthly, quarterly or otherwise. Here is a sample list to get you started:

· Electricity

· Natural Gas

· Oil

· Water

· Sewage

· Trash

· Gardener

· Television

· Landline phone

· Cell phone

· Auto/renters/homeowners insurance

· Rent/mortgage

· Internet

· Gym membership

· Credit cards

· Loans

Software to Help You

How to keep track of your bills?

Now you need to decide how you are going to keep these organized. You need to be able to know when each bill is due, how much it is (if it varies at least know where it averages), and have a place to mark that you have paid it. I personally use Quicken because it will list all of my bills, tell me when they are due (once it has been set up the first time of course) and if I have already paid them this month or not. Mint.com is also a great online service and it is free. You can also mark a grid on a notebook, with a column for each bill and a box for each month that can be checked as the bill is paid. When I used this, I hung it on the wall by my computer so it wouldn’t get lost. Choose the best method for you and keep that in mind before we move along.

Using Automatic payments:

If you can set up automatic payments or as it is often called, recurring payments, this is ideal. You never have to remember to pay your bill; it just comes out of your bank account or is charged to your credit card each month. If you are following my system to make money using a credit card you will want the latter option. To find out if you can pay a certain bill automatically, log in online and look around, it is often on the left hand side, or in the “payment center”. If you don’t find that option, try calling the company. Oftentimes they can set it up over the phone. Once the payment is set up, be sure to write down on your list which day it will be paid – you don’t want to be caught off guard! Often even things such as your mortgage and your personal loans will have this option. If you are comfortable with doing this, set it up for as many bills as you can, then move on.

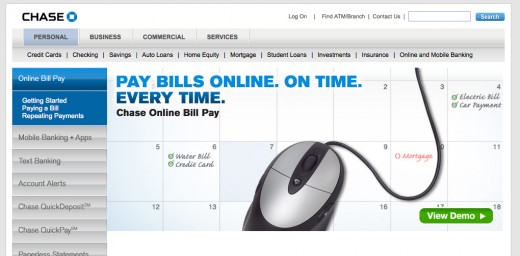

Consider using your bank’s bill pay options

Many banks have a bill pay option, where they send out a check in a specific amount, on a specified date. Bill pay is an excellent option for bills that are the same amount each month. This means you do not have to write a check, stamp the envelope, or remember to mail it. You bank does all of this for you. Many banks offer this service for free; others charge a small monthly fee. If your bank offers it for free this could be a very beneficial service. Say your rent is $1200 each month. On your bank’s website you will enter in all the information for your landlord, including his address, how much your rent is, and the day the check needs to arrive by. Your bank will then cut a check giving it enough time to arrive before the due date. Aside from setting up the payment, you do nothing else. One thing you do need to be aware of is that some banks take the money from your account on the day it is mailed, not when the person receiving it cashes it. This is very nice because you do not have to wait and wait for it to clear, but you need to be sure that the money is in your account far enough in advance.

Once the above two options have been reviewed and possibly set up, it is time to move along. We now need to work on paying those bills that you will pay manually each month. I am going to outline the rest of the system assuming you get paid twice monthly, on the first and the fifteenth. If you get paid on different days it won’t be hard to adjust the plan to fit your paydays.

When to pay each bill

Split your bills into two categories: The first being all bills that need to be paid from the fourth of the month, until the eighteenth. The reason it is not divided by the first and the fifteenth is so that you have three days to get in and work on your budget each paycheck in case you are busy, out of town, etc. Then categorize the rest into bills that need to be paid from the nineteenth and the third of the month. Allowing yourself this buffer of three days will reduce the chance of late payments, and the stress of trying to find time on often busy paydays.

Put the plan in action!

Now, let’s say your payday has come around and it is the first of the month. Look at all bills due between now and the eighteenth. Pay them all. Don’t wait until the twelfth to pay that cable bill because that is when it is due. Pay it now, while you still have the money and are thinking about your bills. You might forget and let the twelfth pass you by - incurring a late charge. Be sure to pay those due in the first three days after you get paid next, because you don’t want to allow room for error.

Once the fifteenth rolls around, you will pay all bills due from the fifteenth until the third of the month. You may need to take a few months to switch to using that paycheck for the rent or mortgage. If this is not possible, leave the rent to be paid on the first, as this is the bill least likely for people to be late on. I guess nobody wants the worry of losing his or her home. Be sure to mark in your computer program or on your notepad that the bill has been paid. Before I had this system I would occasionally pay a bill twice on accident not realizing that I had already done so, or worse - not paid it at all thinking that it had been paid.

One of the perks of this system is that you are able to see how your bills balance out. If you are finding that the first of the month is heavy with bills but the fifteenth is light, consider calling some of the companies and asking for a different due date – one that falls after the fifteenth. Or, you can pay that bill in advance out of the fifteenth paycheck and always be ahead of your payments. This will help you to balance out your budget and not be so tight 15 days out of the month.

Let’s recap what you will need to do here:

1.List all of your bills, and their due dates

2.Try to get them set up on automatic payments

3.Consider using your bank’s bill pay option

4.Arrange your payment schedule – figure out which bills need to be paid with which paycheck

5.Get ahead of the game. Don’t wait until the bill is due to pay it!

6.Pay your bills on schedule each month.

Using this plan, you will likely spend only a half an hour each paycheck paying your bills – versus the two or three you might spend if you lacked a plan or schedule. This doesn’t include the time in the car or awake at night worrying, wondering if you remembered to pay this bill or that bill. You will always know, will always have peace of mind that everything is paid and you won’t be paying more next month in late fees, or worse getting those uncomfortable phone calls from creditors.

Now you have the tools, enjoy your system, your peace of mind, and enjoy being free from late fees!

- How to Make Money Using a Credit Card

I use my credit card for everything. In three years I have MADE over $3,000 just by using my credit card. Read on and I will tell you how I did it, and how you can do it too. - Six Best Rewards Credit Cards

Are you looking to sign up for a credit card but not sure which one to get? I have compiled a list of what I believe to be the top ten credit cards that offer rewards, from the opinion of a reward credit card user.