How to Pick a Good Stock to Invest In

Introduction

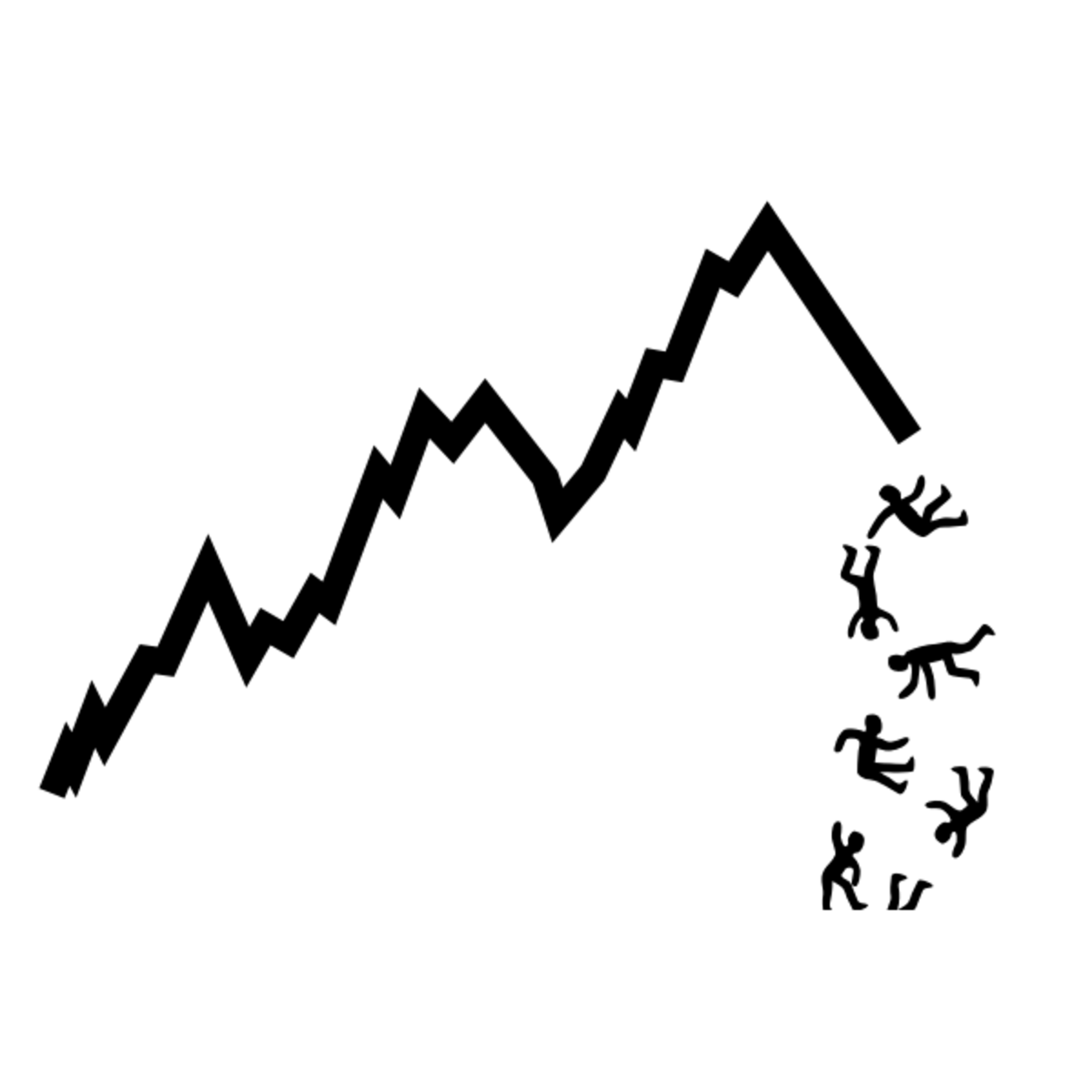

Picking a good stock to invest in involves finding a stock likely to outperform the market. Yet the efficient market hypothesis (EMH) says its impossible to beat the overall market on a risk-adjusted basis because the financial markets efficiently set stock prices at levels reflecting all relevant information. If you accept the EMH, you should reject the conventional ways to pick stocks to invest in because their outcomes are already reflected in existing stock prices. In other words, you'd do as well picking a stock by throwing a dart at a dartboard. This leaves only one way for individual investors to pick a good stock to invest in: use personal information that is not generally known but is relevant to a company's future stock price.

Conventional Techniques for Picking Stocks Don't Work for Individual Investors

There are many conventional ways to pick stocks to invest in. However, they are all variants of two basic techniques: fundamental analysis and technical analysis.

Fundamental analysis involves analyzing a company's fundamentals to find the intrinsic value of its stock, which is the true worth of the stock rather than its current price. If the intrinsic value is higher than its current price, then it makes sense to buy the stock. The premise behind fundamental analysis is that the worth of the company should equal the sum of its future discounted cash flows. While there are many ways to conduct fundamental analysis, they all involve adding together the future profits of the company and then discounting these profits to account for the time value of money.

Technical analysis, on the other hand, ignores the fundamentals of a company and instead analyzes statistics about past market activity, prices and volumes to make predictions about future changes in the price of the stock. The premises behind technical analysis are that prices already reflect all known information since the markets are efficient, prices move in trends, and history repeats itself.

The problem with both conventional techniques is they are not useful for individual investors trying to pick a good stock to invest in. This is because individual investors cannot hope to perform these techniques better or faster than professional investors and trading firms. As a result, by the time an individual investor makes a trading decision based on one of these techniques, the market has already been changed based on the actions taken by the professional traders. In other words, because of the EMH, it is already too late for the individual investor to profit from his analysis.

How Can an Individual Investor Pick a Good Stock to Invest In?

Since the EMH makes it impossible to beat the market using conventional methods, there is only one way for an individual investor to pick a good stock to invest in: use personal information that is not generally known to the investing community. Since the personal information is not generally known, the EMH does not apply, and the investor can buy the stock at a favorable price that does not yet reflect the information.

The best way for an individual investor to find personal information that is not generally known to the investing community but is relevant to a company's future stock price is to stay aware of his experiences with new products or services, or with the experiences of his wife, children, relatives, friends, colleagues, or acquaintances. If the experience with a new product is terrific, the company that makes it might be a great buy.

For example, at the end of the 1990's and beginning of the 2000's, many acquaintances raved about their experiences with Apple's products. They loved the aesthetics of Apple's products, the simple yet powerful user interfaces, the bug-free operating systems, and their "coolness". Thus, I had personal information that Apple was designing and selling great products that people truly wanted to buy, which was certainly relevant to Apple's future stock price. Yet Wall Street largely ignored this information, possibly because Apple's products were not popular in the corporate world. This was a perfect time for individual investors like myself to pick Apple as a great stock to invest in because I had personal information that was being largely ignored by the investment community.

Another great source of personal information not generally known to the investment community but relevant to a company's future stock price is children. Children are often aware of trends that are ignored by adults. For example, children are often aware of which new electronic games are "in", which new toys are the "must haves" for Christmas, or which new foods their parents must buy. Parents who listen to their children have access to investing information that is not generally known.

Yet another source of personal information that individual investors can use to pick a good stock to invest in is their job. For example, assume you work in the medical business and attend a trade show where you see one of your smaller competitors introduce a revolutionary new product that you think will be extremely popular in the medical community. You could use this personal information to buy shares in that company before Wall Street realizes the potential of that product. (However, be sure to avoid trading based on non-public information about a company, which is illegal.)

Conclusion

Due to the efficiency of the market, it is almost impossible for individual investors to pick a stock that is likely to outperform the overall market. However, individual investors can use personal information that is not generally known to the investment community to pick good stocks to invest in. They can find this personal information by being aware of the experiences that people they know have with new products and services.