How to Place a Market and Limit Stock Order Online

Ready to experience the unparalleled excitement of delving without safety net into your first stock market transaction? The following customized, step by step guide, which was prepared by a former, successful Wall Street financial professional, contains essential stock investing information related specifically to the art of placing an online stock buy order. If read, studied, and used correctly, the tips contained herein will save you a considerable amount of time and possibly even hard earned money. The primary goal of this detailed instructional module is to provide the novice with valuable insight and working knowledge to enable the reader to gain a basic fundamental understanding of the distinct and critical trade defining differences between a limit and market order, and envision exactly how the open bidding process conducted daily within the various exchanges, actually works. Which order should I use? A Market? Limit? Day Order? Good until Canceled? All are very important and relevant questions which need to be addressed prior to logging on to your account and inputting data which may indeed lead to unintended consequences for the novice, or even professional investor.

Let's assume you've already had the pleasure of filling out the appropriate application and your discount brokerage account is now open, funded, and ready to go. We'll also assume you've invested the required amount of time to research potential "BUY" candidates using your new Discount Broker's wealth of interactive online tools and are now ready, willing, and able to begin building a mid to long term growth oriented portfolio, or to start participating in the fast, and at times frenzied paced world of short term day trading.

HOW TO PLACE AN ONLINE BUY ORDER

- Limit Buy Order

If a "Limit Order" is an unfamiliar concept to you , simply put, it's a pre-determined bid within the overall order structure which contains a specified maximum price to be paid for a stock, option, or other security. You decide upon a maximum price you're willing to pay without exceeding this set amount, then type it into the designated order window for pending execution. ( EXAMPLE $20.25 ). If the locked in price designated on the limit order is not reached for the duration of the open order, it will not be executed, you will not purchase shares, and the order will not be filled thereby relieving you of the obligation to purchase the designated number of shares. At this point, you can either discontinue your pursuit of the stock, or, you must adjust the limit price accordingly to buy or "Chase" the stock.

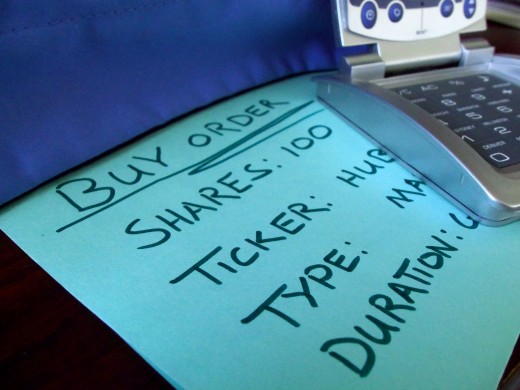

A standard online discount brokerage account typically includes a designated space or several spaces for applicable data input related to the terms and conditions of the specific order or "Trade". Within the typical full or discount brokerage online order screen layout, there is a separate box for the type of transaction which would be either a buy or sell, another space or "Window" into which you type the stock name and or security ticker symbol, yet another to annotate the desired limit price, and finally, a click down component to designate the time duration of the order, for example "Good til' Canceled" ( Can remain open for weeks or even months ) or a "Day Order" ( Valid, open, and active for the entire trading day from market open to close ).

All spaces within the designated field must be filled in with the applicable data or the order will not be processed. Once all the boxes are filled to completion, a "BUY" button needs to be depressed ( Your brokerage account might have a different component to trigger the electronic order process ). Before clicking the "BUY" button, a safe, common sense practice, as with all other agreements which can legally bind you, is to double and even triple check all the specific terms of your order, especially the PRICE and QUANTITY (Number of Shares). If a unilateral mistake is made, such as inputting the wrong price or number of shares and the order is subsequently executed before any changes can be made to reflect your genuine intent, the mistake will cost you dearly because you've just entered into a legally binding contract, which in most cases will be very difficult if not impossible for you to rescind or cancel unless you can irrefutably prove an electronic malfunction occurred with the brokerage firms software. Even then, with evidence in hand, it will be extremely difficult to amend the terms, or cancel the transaction in its entirety. - Always double check your order before "Clicking" -

- Market Buy Order

In stark contrast to the aforementioned limit order, where an exact price you're willing to pay is specified within the terms, a market order allows for cost flexibility. There is no specific price indicated and the order will be swiftly executed at the next available "Market" price unless an unforeseen incident occurs such as a halt in trading activity which is rare, but not uncommon. The standard market order typically results in a transaction that is executed much faster and more efficiently verses all other orders, so be prepared to be a virtual immediate, proud owner of shares. The buyer essentially agrees to pay the next price a seller is willing to sell the same amount of shares for. - Rapid Execution with no Price Protection -

Placing a market order essentially entails the same fundamental procedure as a limit order, the only demonstrable difference or distinguishing feature is the fact that it takes significantly less time to be filled unless the security you are interested in purchasing is halted or removed from trading just prior to placing the order. A distinct yet highly unlikely possibility.

As briefly touched upon above, a limit order affords you as buyer, price assurance which empowers you with complete control or management with regard to the cost aspect of the trade ( You know precisely how much it will cost before submitting the order ). A market order provides the exact opposite experience. You're allowing the fluid, free flowing trading activity of a specific stock or index to control and ultimately dictate the final transaction price point which can work in your favor, or act as hostile agent of detriment. Something to consider very carefully before placing the order especially if the exchanges in question are experiencing unusually volatile conditions, an event which can potentially lead to a highly magnified or tremendously enhanced upward or downside bias in price action. But if the stock seems to be at the genesis of a sustained breakout to the upside following a robust earnings report or other influential news which could positively impact the issue, and time is of the essence, paying a little more for the shares now, might just pay off in the end.

- NOTE: In a fast moving market, the difference between a real time or delayed stock quote, and the buy order execution price can be substantial.

Read More About Personal Finance:

- What is a Mutual Fund? Basic Concept Defined

In general, a - How to Read and Understand a Mutual Fund Prospectus

When researching different Mutual Funds one of the most important things a person can possible do is read the entire prospectus from beginning to end. The information contained within this guide will provide... - What is a Stock Split?

- How to Choose the Best Qualified Financial Advisor o...

Internet Background Check? When researching a

- Commission Schedule

There are certain advantages to both types of orders, for instance, if swift, guaranteed execution verses price protection and cost management is your primary objective then working with a market order might suit your specific needs best. If price protection is essential to satisfy strict budgetary considerations, even if the risk entails the realistic possibility of missing a fleeting opportunity to buy shares at that precise point in time due to non-execution, a limit order might be the best route. Discuss the differences between the two orders, both pros and cons with your advisor.

Typically, a discount brokerage firm will charge significantly less in fees for a market order due to swift, efficient execution. In contrast, a limit order can remain on the specialists book for an extended period of time which means your data must be maintained and monitored by either a professional or computerized tracking system until it's executed or canceled, thereby incurring more overhead costs which are then passed on directly to the customer. - Some discount brokerage firms offer special commission rates and or fee schedules for active investors -

- Regardless of the type, once the order is successfully executed, standard industry procedure is to inform the customer that the order was filled. Official notification should be received from the Brokerage Firm via E-Mail or other mutually agreed upon method of communication within a reasonable time period. Thereby, the firm has met its obligation by delivering an acknowledgement of a successfully processed order transaction. You as customer/client, should also receive either a hard copy or online virtual version of the "Confirmation Statement" to be used for tax purposes -

- Written - Designed - Created By Alternative Prime -

|

|---|

NOTE to Visitors - The "Links" listed below within the "Discover More Hubs" segment are randomly selected and placed by HubPages, not the author of this specific entry - Alternative Prime does not necessarily recommend or endorse the articles nor guarantee quality of the content contained therein -

|

|---|

About the Author <> Alternative Prime is a highly respected expert in the field of financial markets who has attained 5 star status by acquiring and utilizing a virtual wealth of invaluable hands on experience in several divergent subjects including the Stock Market, Banking, Business Development, Corporate Training & Educating - Stellar credentials which have paved the way toward fostering cherished long term working relationships with several high profile celebrity clients in the Beverly Hills Ca area and cultivating stimulating social interaction with innumerable readers and acquaintances domiciled throughout the world <>

|

|---|