How to Plan your Retirement

Upon reaching a certain age, you are required to withdraw from your employment. This procedure is known as 'Retirement'. In some instances, you are allowed to reduce your working hours and continue your employment. This is known as 'Semi-Retirement'.

The average retirement age varies from country to country. According to an article published in the Finnish Centre for Pensions, the retirement ages of different countries are listed below,

Country

| Male

| Female

|

|---|---|---|

Croatia

| 65 Years

| 62 Years

|

United Kingdom

| 65 Years

| 65 Years

|

Ireland

| 66 Years

| 66 Years

|

Netherlands

| 66 Years

| 66 Years

|

Canada

| 65 Years

| 65 Years

|

USA

| 66 Years

| 66 Years

|

Switzerland

| 65 Years

| 64 Years

|

Retirement Ages of different countries.

On average, a Citizen of the United States lives about 20 years after his or her retirement. You need to have a steady income after you retire to spend a comfortable retirement. So that you are not going to be a burden to your children and your loved ones.

What is Retirement Planning

Retirement planning can be defined as the process of setting the retirement income goals and identifying the steps & actions required to accomplish the retirement goal. You need to identify the following areas when you are planning for your retirement

- Identify the income sources

- Estimate the expenditure

- Research on any suitable saving plans focused on retirement

- Determine future cashflows

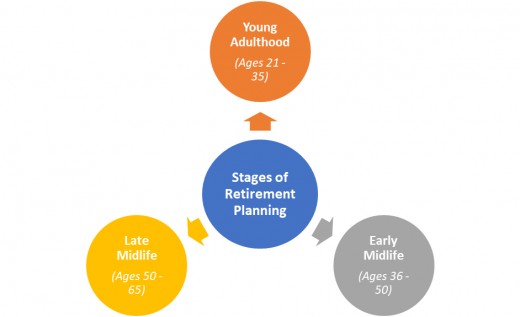

There are three main steps in Retirement Planning.

Young Adulthood - (Ages 21 - 35)

This is the period where you start earning money. however, you don't have a large sum of money to invest but you have plenty of time for your investment to mature.

Young adults should reap the maximum out of the employer-sponsored retirement funds like 401(k). Your employer has the opportunity to contribute to your retirement fund through these employer-sponsored schemes.

Early Midlife - (Ages 36 - 50)

This is the period where you face several financial constraints like Housing & car loans, Credit card debt, student loans etc.

People at this stage should take the maximum out of any employer-sponsored retirement plans. You should also invest in life insurance from a reputed insurance company. If something unexpected happens to you, this will ensure that your family can survive without depending on the retirement fund

Late Midlife - (Ages 50 - 65)

At this point, your existing retirement savings are matured. There are a few advantages for those who haven't planned their retirement fund. At this point, your income levels are higher and your financial commitments ( Loans, Credit card debt etc.) are almost over which leaves you with more disposable income to invest in Retirement funds.

Tips for Retirement Planning

- Do the Math

Work on the calculations. Estimate how much money you need for a comfortable retirement. Consider inflation when you are doing the math.

- Use online tools to monitor your savings

There are plenty of online tools which helps you to keep a track of your savings for your retirement.

- Consult the Experts when planning for your retirement fund

Its always good to obtain advice from a Certified Financial Planner or CFP. They are well-trained professionals who can help you to evaluate your financial reality and advice you on planning your Retirement savings more effectively.

- Fine-tune your portfolio

You have to keep a track of the charges of various retirement planning schemes. Always make sure that you select the most cost-effective scheme which gives the highest Return on Investment (ROI).

- Create your will

You have to make sure to update your will whenever there is a major milestone in your life. This will enable your dependents and loved ones to have sufficient funds to carry out their daily activities.

- Save more when you earn more

There are some instances where you get a lump sum like Annual Performance Bonuses. Before spending it, why don't you invest that portion for your retirement?

- Create more income sources

You should never depend on a single income source. You should at least have two or more income sources. You can work overtime, involve in home-based or part-time jobs to earn extra pennies. But you should always make sure that you balance your work life and your personal life. Spending time with your family members are also important like earning money.

- Diversify your investments

"Don't put all your eggs in one basket?". The same concept applies to your investment portfolio. To diversify your investments, your investment should include low-risk, medium-risk and high-risk assets.

Do you have any other tips on planning your retirement fund? please let us know in the comment section.