How to Reconcile a Bank Account

How much money do you have in your bank account? Really? Are you sure? If you are relying on what your last bank statement tells you, chances are you are wrong. Why? Because in the time since your bank statement cutoff date you've probably written checks and made deposits. And there may be other charges and credits that you are not aware of.

Learning how to reconcile your bank account is something I believe should be mandatory instruction at the high school level, but unfortunately is not taught in most schools. It is the first step in maintaining control of your financial assets once you graduate. And it's really not that hard.

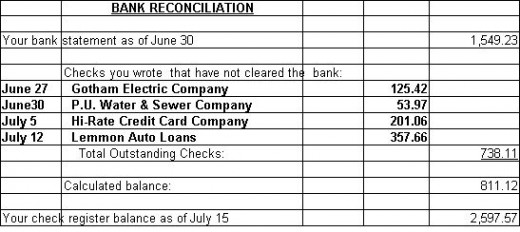

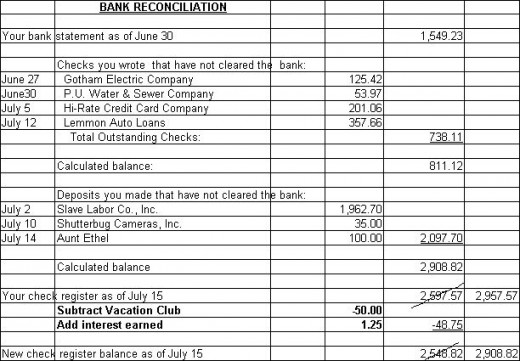

Assume today is July 15. Suppose your last bank statement says your ending balance as of June 30 is $1,549.23, but the balance you have calculated in your check register as of today is $2,597.57 (you do keep a running balance in your check register and/or software, don't you?).

Why the difference? Well, you wrote four checks totaling $738.11 that have not cleared the bank as of the June 30 statement date. So you start by subtracting $738.11 from the $1,549.23 and you get $811.12.

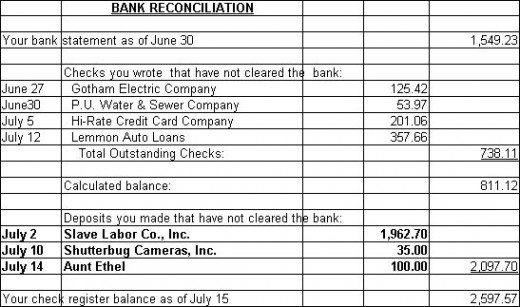

There's still a huge difference between the calculated amount and what you wrote in your check register. So what else do we need to do? Let's see - you deposited your biweekly paycheck for $1,962.70 on July 2, a $35.00 rebate check for that new digital camera you bought on July 10, and $100 birthday gift from dear old Aunt Ethel on July 14. We need to add these to the calculated balance.

Still not there yet. We're still off by $311.25. Did we miss anything? Were there any bank service charges? Hopefully not. If you keep your account reconciled and your check register up to date you shouldn't have any overdraft fees or low-balance charges. I'll bet you forgot you signed up for automatic transfers to your Vacation Club account. There's $50.00. You'll need to write that amount in your check register and subtract it from the balance. And you have an interest-bearing checking account, so look at the bank statement to see how much interest you earned for June - a whopping $1.25. Add that to the check register. Let's see if that does it.

Nope, we're still off by $2,908.82 - $2,548.82 = $360.00.

Tip: If the amount you are off by is equally divisible by 9, then you have a transposition error. $360.00 divided by 9 = $40.00. Check your math in the running balance of your check register. Oops!, you wrote $2,597.57 when it should have been $2,957.57. Just make that correction and you're done.

If your running balance checks out, you need to check individual check and deposit amounts see if there are any transpositions in any of those numbers and correct them accordingly.

To summarize: 1.Subtract checks that have not cleared the bank from the bank statement balance, 2.Add deposits that have not yet cleared the bank to the bank statement balance 3.Check the bank statement for items you have not recorded and add them to your check register, 4.Look for transposition errors.

Update 10/07/09: TD Bank has been in the news recently as a result of a botched computer system conversion which caused many of their customers great aggravation. TD Bank said they would continue to honor checks and reverse any erroneous fees, but based upon news reports the biggest complaint seemed to be that the customers were unable to obtain their account balances. As I explained above, the balance your bank shows is not the true available balance, so it doesn't do them any good to get the balance from the bank anyway. If only these people had kept their accounts reconciled, they would know how much they have available. I have an account at TD Bank, and the problems did not bother me one bit because I keep my banking records reconciled.

Happy reconciling!