How to Report Medicare Fraud and False Claims Act

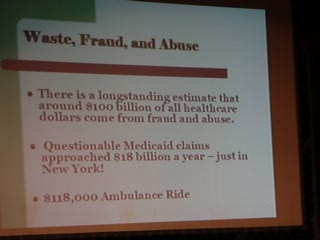

On July 16 , 2011, 94 people were arrested and accused of healthcare fraud, submitting claims to the government that amounted to more than $251 million dollars in procedures and services that were never performed. Medicare beneficiaries were involved, allowing the healthcare providers to bill for the services under their ID number, accepting cash payments in return.

In 2009, the Department of Justice collected approximately $1.63 billion dollars in settlements and judgments against providers accused of fraud. This number is small in relation to the estimated $60 billion per year that is lost to Medicare fraud, and this is only an estimate. There are no accurate numbers, because not everyone who commits fraud is caught. The federal government, usually, must rely on an employee to step forward and report his or her employer.

This takes an incredible amount of courage. It also requires that an employee has a conscience. Unfortunately, it is easy for employees to ignore what is occurring. Some people have a “who cares?” attitude. Other people are afraid of losing their job. However, an employee's failure to report fraud makes them just as guilty as the provider and can include fines and be found guilty of a misdemeanor.

If you believe your employer is committing fraud and abuse, it is my hope that after reading this, you will make the right decision and report your employer. Not only is your employer ripping off taxpayers, but unsuspecting, sick senior patients, too. If your employer is committing Medicare fraud, a federal offense, then certainly your employer is committing fraud and abuse against private insurance companies and cash-pay patients--you probably are well aware of this.

I’m going to outline how to identify Medicare fraud, how to report it, what information you need to supply to the government, what to expect after you report it, and how to pursue a False Claims Act.

IDENTIFYING MEDICARE FRAUD

Listed below are the most common types of Medicare fraud encountered in a provider's office.

Billing for Services Not Performed or Items Not Furnished:

Self-explanatory and easy to prove, this is commonly done with diagnostic testing (labs, x-rays). This type of fraud is easy to prove because medical records do not exist. However, sometimes falsifying medical records comes into play when a provider bills for a procedure that is routinely performed in the office or an item is supplied by the office. When the patient receives a remittance advice (RA) from Medicare, their first phone call is usually to the provider--not to Medicare. The patients are informed there was an error and to disregard the RA. When patient co-insurance amounts are consistently written off for these procedures or items, this is a good indication the procedures were never performed and/or items were never supplied.

Up-coding:

This happens when the bill reflects a higher procedure than what was performed in order to obtain higher reimbursement. Only 2% of Medicare claims are audited to look for this type of fraud, so it is highly unlikely that your employer will ever be caught for this practice unless you report it.

Misrepresentation:

Medicare will only pay for procedures that justify medical necessity in relation to the diagnosis code. Providers will often change a diagnosis code in order to obtain procedure reimbursement for costly diagnostic testing, like nerve conduction studies and surgeries. Additionally, procedure codes are often changed to depict a different service than what was actually performed when Medicare does not cover a certain procedure.

Unbundling:

Unbundling is common with surgical procedures, laboratory tests, and x-rays. Unbundling breaks down components that are included in one service and billing for each item separately. For example, a common lab test is a CBC which includes a dozen or so separate tests. Instead of billing for a CBC, the unbundled bill would reflect all tests performed by listing them separately. Sometimes, in order to avoid the chance that Medicare does an automatic bundling, the tests will be divvied up by utilizing more than one bill.

REPORTING YOUR EMPLOYER

There are two ways to report fraud. The first, and least preferable, is by an anonymous tip. By submitting an anonymous tip, your information is going to be on the low end of priorities. It may never be reviewed for a number of reasons, from lack of credibility to incomplete information.

If, however, you do decide to take this route, I would recommend that you spend both the time and money required to submit a detailed explanation. Include examples of the fraud being committed, including copies of documents. The more information you submit, the more likely it will be investigated. Information on what type of documents to include is below.

You can report fraud, anonymously, to one of two entities:

Office of Inspector General

Department of Health and Human Services

Attention: Hotline

PO Box 23489

Washington, DC 20026

You can also call OIG and speak with someone and still remain anonymous. 800-447-8477.

FBI: You can call or mail in a complaint to your local FBI office. The link to obtain the mailing address and phone number to your local FBI office can be found here.

If you have decided to report your employer and don’t feel the need to remain anonymous, contact your local FBI office and ask to speak with an agent that works in the Medicare Fraud and Abuse Department and schedule an appointment to meet.

ESSENTIAL INFORMATION SUPPORTING YOUR COMPLAINT

Both the OIG and the FBI’s Fraud and Abuse Department will require proof of the allegations you are making. You will need supporting documentation: the provider's name and all relevant information; patient information, including names, dates of birth and id numbers; dates of service; dates of payments; copies of medical records, super bills, RAs, and account printouts; any e-mails that could help prove the accusation. Never take original documents, unless they are internal documents (company related information: employee handouts, employee handbook, company policies, etc.).

(If you are submitting an anonymous tip and mailing the information, attach a piece of paper to each document describing what each document represents. Explain the fraud in as much detail as possible.)

If you are meeting with an FBI agent, you can write this information down on paper, or make copies of all of the information. You will not be committing a crime by doing this. Despite confidentiality agreements you have likely signed with your employer, when an employer is committing fraud and it is your intention to report it, you will not be prosecuted by any entity for taking these documents. You are not doing anything wrong, and as a matter of fact, you are doing the right thing by gathering as much information as possible. The more information the government has, the easier and faster it will be to conclude an investigation.

Removing the information from your employer’s office might be problematic but can be done in small increments or, even, large increments. Bringing a book to work with you and folding up documents and placing them inside is one way to do this; utilizing a purse is another approach.

To remove documents in large quantities, bringing a small cooler for “lunch” is very handy. By keeping your lunch at your desk, you can shove numerous documents inside of it all day long, and nobody will ever know.

WHAT TO EXPECT WHEN YOU MEET WITH THE FBI

Once you report your employer to the appropriate authorities and set up an appointment to meet with the agent(s), you will be expected to outline, with great detail, what is occurring. Bring all relevant documents with you to this meeting, and the more documents you have, the better. The agents will usually be able to determine at the conclusion of the meeting if the information you have is worthy of an investigation.

You will be asked to what extent you are willing to cooperate. This decision is completely up to you. You may only want to give the information you have supplied at the time of the meeting and no more. If you brought only a small number of documents or no documents with you, there will not be a high-priority investigation. If you brought in hundreds of documents to support your claim, they are more likely to pursue it without your direct involvement.

If you agree to cooperate and obtain more information in order to speed up an investigation, the FBI will ask you for specific documents like medical records, specific account numbers and printouts, e-mails, etc.

You will be expected to sign a form that shows you are willing to be a witness and cooperate. You will be given a code name, because you will remain anonymous to everyone except the agents that you are dealing with directly.

The FBI might ask you to wear a wire to engage people in conversation. This is a great opportunity to speed up an investigation and can feel exhilarating when a discussion occurs about the fraud, and you are able to get it on record.

- Choosing a False Claims Act Attorney

Because an attorney has Esquire behind his or her name does not mean that they are qualified to file any sort of lawsuit, especially a False Claims or Qui Tam case.

PURSUING A FALSE CLAIMS ACT

The False Claims Act is federal legislation that encourages people, called whistleblowers, to come forward and report fraud by giving the whistleblower a financial incentive. The financial incentive is anywhere from 15%-30% of what the government recovers from the provider. The legislation also provides for attorney fees and expenses separately, so the amount granted to a whistleblower is the amount a whistleblower keeps.

A whistleblower must find an attorney to qualify for the award that specializes in qui tam. The attorney files a lawsuit, called qui tam, and it is sealed in order to protect a whistleblower's anonymity and preserve the integrity of an investigation. It is sealed when filed, and it remains sealed for the duration of an investigation. Nobody, including press, defendants, and members of the public and court, has access to the contents inside. Also, because the legislation provides for attorney fees, an attorney will not charge any fees associated with filing a qui tam lawsuit.

It is important to realize that only one person is allowed to file a qui tam lawsuit. If someone has already filed a qui tam, you are not eligible to file; however, your cooperation would still be appreciated by the government, the taxpayers, the patients, and future employees of the provider.

Deciding to pursue a qui tam lawsuit can be a difficult decision. However, if your cooperation has been detrimental to an investigation, this means you have, undoubtedly, supplied the authorities with an incredible amount of valuable information, which can sometimes be extremely stressful.

Medicare fraud is a dirty, white-collar crime committed by cowards. These cowards hide their criminal activity behind a respected profession with no regard for anybody except themselves. They also expect employees to take part in the criminal activity. Most of the time, there is only one person that is capable of putting an end to the fraud and abuse, and that person is you, the employee.

Though reporting your employer for committing Medicare fraud might not be an easy thing to do for some people, it is the right thing to do. It is something to be extremely proud of; it is honorable, courageous, and admirable--all of which are wonderful qualities for a person to possess.

- Dozens Arrested on Charges of Defrauding Medicare of $251 Million - NYTimes.com

Ninety-four suspects were indicted, and several doctors and nurses were among those arrested in Miami, New York, Detroit, Houston and Baton Rouge, La. - Disgraced eye doc admits Medicare scam UPDATE | SILive.com

Prominent ex-ophthalmologist pleads guilty to performing unnecessary surgeries, faking medical records and stealing $1M from insurance providers - Four sentenced in HIV Medicare fraud cases - South Florida Business Journal