How to Start Investing- An Introduction to SIP

1. SIP(Systematic Investment Plan)

The best method to achieve your long term goals is via SIP. SIP basically, is an agreement between your bank and the AMC(Asset Management Company-> This is where your money goes. These companies employ qualified professional fund managers. These are veterans of the industry who research vigorously day and night, and handpick stocks to invest your money in) allowing the latter to deduct a fixed amount of money each month and investing it in the fund of your choice(This fund, as we call it, comprises of select stocks chosen by fund managers. Depending on fund type they can be sectoral or diversified. E-mail me if you wish to go deeper. I'm always available for brain storming).

1a. How it works

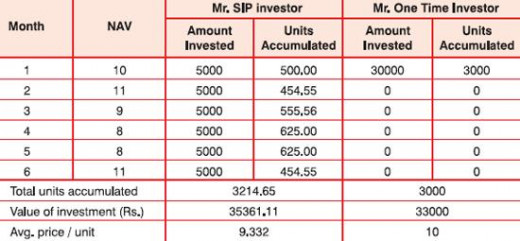

This is best explained by an example.

Say you invest 50$ every month. And you buy 5 units(of your Fund) of market value 10$ each(We call this value NAV). Now depending on market sentiment, NAV either rises or falls. Suppose there's some really bad news regarding the fund and the NAV falls to 5$ per unit(This is an extreme case and is only used for When share price becomes 5, you get 200 units. Eventually you accumulate more units and generate more return when market rises later. In the figure below you'll see how a fall in NAV(Net annual value) contributes to rise in no. of units bought. With more units you generate more returns.

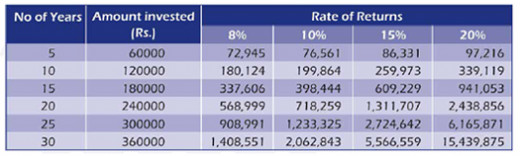

1b. Power of compounding

With simple interest, you earn interest only on the principal (that is, the amount you initially invested); with compounding, you earn interest on the principal and additionally earn interest on the interest. To understand better, let's take an example.

Say you've invested Rs.10, 000 for 10 years and it makes 10% interest per year.

In case of simple interest, you will make Rs. 1000/- per year. At the end of the 10th year you will get back your principal of Rs. 10,000 and you would have accumulated total interest of Rs. 10,000.

In case of compound interest, in the first year, you make Rs.1, 000 in interest. But in the second year, you'll make Rs.1, 100 (not only does your initial investment of Rs.10,000 accrue interest but so does the additional Rs.1,000 you made in the first year). In the tenth year, you'll make Rs. 2,358. In 10 years, the power of compounding will grow your total investment of Rs. 10,000 to Rs. 27,070 as compared to only Rs. 20,000 in case of simple interest.

Why SIP?

In today's world of ever-rising inflation, investing has become a necessity. Gone are the days when people considered it a luxury for those who had more than enough.

Banks and fixed deposits just aren't going to be enough. In my country India, it is already way less than what people think:

Banks give 4.5% interest per annum. Inflation in our country is 6% per annum. You think you're generating income? Do the math.

90% of the country is still under the illusion that fixed deposits make enough money. Do you know income from fixed deposits is taxable whereas returns generated from an investment in equity mutual funds are not? Moreover, fixed deposits give a maximum of 9.5% returns, lesser after tax. And if you go to moneycontrol.com you will find worst performing equity mutual funds standing on 9% of returns. WORST! And that too, tax free!

For people who are STILL skeptical, try SIP. Give it time, invest diligently, and in a disciplined manner. Forget about the money for a decade and a half, and that's it. You will have made yourself a small fortune by only investing a minimal quantity of money each month. The returns generated seem as if they are won on lottery. No really, I could calculate in Excel and show you.

Start your SIP NOW!