How to Stop Debt Collector Harassment

Dealing with Bad Debt

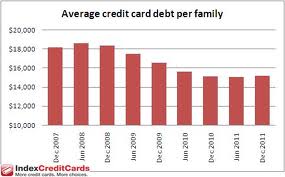

In today's fragile economy, more people are finding themselves knee deep in debt. Unfortunately, this causes many of us to be unable to pay the bills that are due each month. In most cases, the credit card debts are set aside for better days in order to meet everyday living expenses. This may lead to the beginning of the constant phone calls from credit card companies that want to be paid. How do you stop the phone calls, and what do you do if a debt collection agency decides to file a suit against you in court? These are the questions that will be addressed to help reduce the stress that builds when these situations arise.

Debt Collection Phone Calls

Have you ever been called by a debt collection company regarding a credit card bill?

Dealing With the Phone Calls

If you are behind with your credit card payments, the dreaded phone calls from debt collectors have either started already or will begin in the near future. The constant phone calls can leave you feeling overwhelmed. There are several ways to handle phone calls from debt collectors.

1. Whether you can afford to pay the debt or not, it is best to communicate with the debt collector when he calls. You are not obligated (and should not be forced) to explain your financial situation to them. The only thing you need to tell them is whether or not you can make a payment at that time. They may ask you if you want to set up a payment plan, but do not agree to this unless you know you will financially be able to follow through with it. The clock resets on the Statute of Limitations every time you make a payment, even if it is just once.

2. If you do not believe you owe the debt, you may tell the debt collector that on the phone and request written information proving that the debt is yours. They will be obligated to provide you with the information that you requested. Do not agree to make payments on a debt that they have not validated for you. If they do not send you what you requested by phone, then follow up with a letter of validation, which will include who the original debtor is, the account number, when it was opened, and when the last payment was received. The debt collector will now be obligated to respond as you have written documentation of your request.

3. Debt collectors are prohibited by the Federal Trade Commission (FTC) to harrass, threaten, or lie to you when calling or writing you. They are not allowed to call you at inconvenient times or places, either. They may contact a third party to get information on how to locate you, but they may not discuss the debt with them. If any of these situations have occurred, you may file an action suit against the debt collection agency.

4. If you decide you do not want to be contacted by the debt collector by phone anymore, you may send them a letter stating that fact. Be sure to send it by certified mail, so you know that they have received your letter. Once they have received it, they are not allowed to contact you by phone again, except to tell you they will not be pursuing the collection any longer or to tell you that they intend to take further action (like a lawsuit). If they continue to harrass you after they have received this letter, they can be reported to the FTC and you may file an action suit against them.

5. If you are being called by multiple creditors, another option is to contact a debt consolidation company to assist you. This company will deal with the creditors, attempt to decrease the amount of debt you owe with each creditor, and combine all your bills together to give you one low payment a month. If you know the debt is yours, and you know there is no way you can pay all of your past due accounts, this is a viable option. One word of caution: choose a reputable company that has well-known success. There are many scams out there, so protect yourself by doing a little research before making a final decision.

General Exemptions from Wage Garnishment

My spouse’s separate earnings

|

Supplemental Security Income

|

Veteran’s Benefits

|

Social Security (Disability, Retirement, Survivors)

|

Federal Civil Service Retirement

|

Federal Title IV Student Loans

|

Employee Retirement Income Security Act (ERISA) Pensions

|

Proceeds from Disability Insurance

|

City and State Employee’s Retirement Benefits

|

Child Support Payments

|

Disposable earnings (earnings less deductions required by law)

|

Earnings necessary to support family

|

Federal pension money

|

Unemployment compensation benefits

|

Public assistance grants & payments

|

This is a general list, not all-inclusive. Check with your State to see what income (and assets) are exempt from wage garnishment.

Facing a Lawsuit

The scariest thing to happen when you are already overwhelmed with your financial situation is to receive a Summons from the Courts stating that you are being sued by the debt collection company. There are several choices to make at this point.

1. As frightening as it may seem initially, it is important that you answer a Summons in the time frame the courts have set forth, or the collection agency will get a default judgment awarding them whatever amount they requested. You will have have no recourse if this happens. You must decide who is going to handle this situation. Whether you decide to handle it yourself or use an attorney, this first step must be done in a timely manner.

2. When you answer a Summons, it is important that you answer every important point the debt collector's attorney has stated. If a statement is true, then agree with it. If a statement is false (any part or all of it), deny that it is true. You do not have to go into detail about how you feel it is false, just state that it is wrong. If you do not know if it is true or false, then state that as well and request clarification from the attorney.

3. Just because an attorney has submitted a Summons, it does not mean that the debt collector's case is solid. Find out what the Statute of Limitations (SOL) is in your state for collecting a past due debt. Many times the collection agencies will try to collect money from debts that are no longer eligible because the person being sued has no idea that there is a SOL. This starts on the date of your last payment on the debt. Also, collection agencies are hoping for a default judgment because they do not have to prove anything in court if you ignore the Summons. That is how they win most of their cases. Also, if you have income that is exempt from wage garnishment, be sure to put that in your Answer to the Summons (see list of exemptions). If your only income is exempt, and you do not have any assets that the debt collector can attach, they often will decide not to pursue the suit any longer.

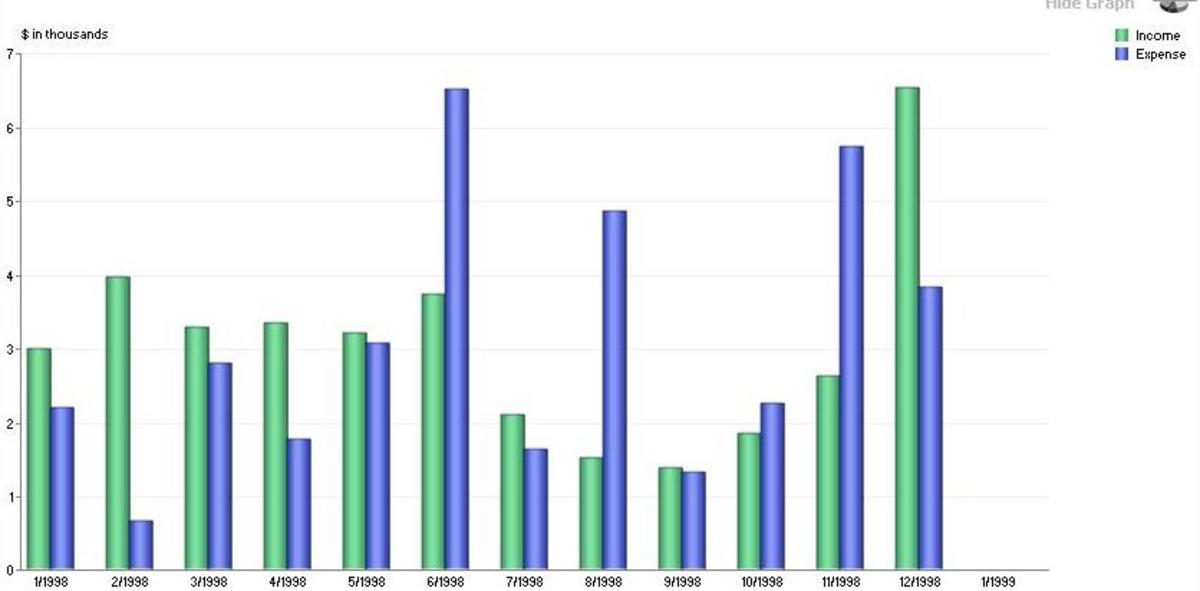

Getting Behind in Credit Card Payments

Going to Court

You answered your Summons in the time frame allowed by the Courts. Now what? One of two things can happen.

1. You may receive a letter from the attorney stating that the collection agency is no longer interested in pursuing your case. Make sure you keep this record in a safe place. If anyone attempts to collect this debt from you at a later date, you will have the letter to show that you have already addressed this debt in the past. Send them a copy of the letter. That should be the end of it for you.

2. You may receive a Notice to Appear in Court. It will give you the date, place, and time of the hearing. If this happens, show up for hearing, or you will lose the case by default. The attorney will be directed to try to work out details with you before speaking to the judge. This intimidates many people, but you still have the right to deny the obligation. Most attorneys will try to make it seem that it is in your best interest to make a deal with him before going before the judge, but if you refuse, then the judge will not give a judgment at that time, and the attorney will have to present any requested facts before filing again. This will often end any collection efforts by the collection agency because it will cost too much money to pursue it. DON'T BE BULLIED! This decision affects you much more than it does the collection agency.

Living in Debt

How many credit cards (include store cards) do you presently own and use?

Moving Forward

While you are going through this turmoil in your life, it feels like it will never get better. Give it time. The most important factor at this point is to learn from your mistakes. Take the time to make a budget and stick to it. Do not rely on credit cards to get you through each month, or you will end up in the same situation again. If you can not afford it in cash, you do not need to buy it now. Plan accordingly, and try to put money away in savings for a rainy day (or month or year)! Living within your means is difficult at first, but with practice it gets easier, and you will have much less stress in your life.