How to Trade Shares – Simple Moving Average

Simple Moving Average

The aim here is to show how an ordinary trader can use only a simple moving average to buy and sell stock shares profitably. A simple moving average is the easiest and most popular technical indicator.

The simple moving average is calculated by taking the arithmetic mean of a given set of data values. For example, the basic 5-day moving average of 5, 6, 7, 8, 9 is (5+6+7+8 +9)/5 =35/5 =7.0

As new values become available, the oldest data points must be dropped from the set and new data points must come in to replace them. For example, the basic 5-day moving average of 4, 5, 6, 7, 8, 9 is (4+5+6+7+8)/5 =30/5 =6.0

“4” is the newest data point that has come to replace “9”. Thus, the data set is constantly "moving" to account for new data as it becomes available. This ensures that only the current information is being accounted for. The stock data to be used when computing the simple moving average are the stocks closing prices (end of day data). In this case, 5-day is the period.

Illustration on how to trade shares

In this illustration on how to trade shares successfully using the moving average, I am going to use only three moving averages namely:

1. 15-day moving average

2. 30-day moving average

3. 60-day moving average

The security or shares for this illustration are the closing prices of QQQ Power Shares. From the three moving averages we define two combinations using these three moving averages namely:

1. 30-day moving average and 60-day moving average which is used in determining the trend of the stock. If the 30-day moving average is above 60-day moving average the trend is upside and you go long the stock, and if the 30-day moving average line is below 60-day moving average line the trend is downside and you go short the stock.

2. 15-day moving average and 30-day moving average which is used in determining if you are to trade in the upside position (long stock) or in the upside position (short stock). If the 15-day moving average is above 30-day moving average you go long the stock (but only if condition 1 above has been fulfilled) and if the 15-day moving average line is below 30-day moving average line you go short the stock (but only if condition 1 above has been fulfilled).

We now illustrate the use of the three moving averages using the QQQ stock for 252 days from 18th June 2008 to 17th June 2009. There are two charts as stated in 1 and 2 above.

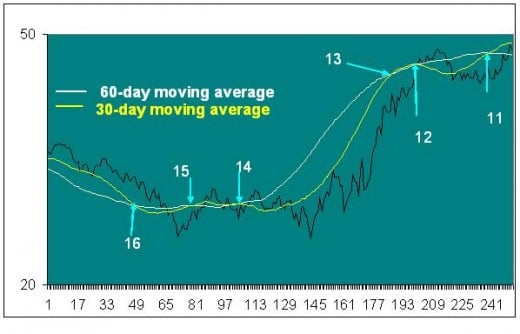

Fig. 1: 30-day moving average and 60-day moving average

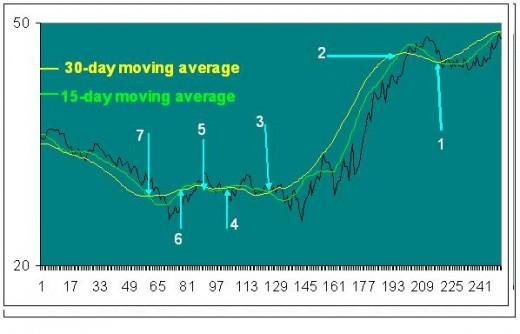

Fig. 2: 15-day moving average and 30-day moving average

From the above Charts

(a) If you look at the trend chart fig. 1, the trend became downtrend at point 11 and you stop your downtrend trades by using fig. 2 point 1.

(b) At point 12, fig.1, the trend become up and you are immediately stopped by point 2 fig. 2.

(c) At point 13, fig.1, the trend become downtrend and you trade downward until you are stopped by point 3, fig.2.

(d) At point 14, fig. 1, the trend become uptrend and you trade upward until you are stopped by point 4, fig. 2.

(e) At point 5, fig. 2, you again trade upward but you are again stopped by point 6, fig.2.

(f) At point 15, fig. 1, the trend become downward and you trade downward until stopped by point 7, fig.2

(g) At point 16, fig. 1, the trend become uptrend and you trade upward.

You can see that some trades are very profitable. In other trades it’s a loss as the trough or crest just last briefly before the trend direction change. This is the biggest drawback of trading using the moving averages.

Is there a cure to that moving averages drawback? Yes, there is because every drawback has an equal or a better advantage which is opposite. Let me ask you: why do casinos impose betting limits for almost every single game? It is because if you keep playing while raising your bet, you will never lose. I will tell you how to use moving averages drawbacks but that will be a story for another day.

If you have liked this article, and you would want this page to keep up and improved, you can help in any way you can. A free way to help would be to link back to this webpage from your web page, blog, or discussion forums.

The Author’s page is designed to help beginners and average readers make some money as an extra income to supplement what they may be earning elsewhere - details of which you can find in My Page, if you will.