How to Understand Your Personal Finances

Understanding your personal finances doesn't have to be a difficult thing. You don't have to know much about finance in general to be smart about your own finances. Whether you're a young adult just starting out, or you're older and have never had to deal with your finances before, here are some easy tips to understanding your personal finances.

Know how much money you make

You'd likely be surprised to discover how many people aren't aware of the exact amount of money they make per month or per year. It's nearly impossible to make an accurate, thorough budget without first knowing how much money you have coming in. Whether you're working full- or part-time, or you're on disability, unemployment insurance, social assistance, or you're self-employed, you must know how much money you're making every month. If your income varies, add up what you made in the last year, divide it by twelve and you'll have the average amount that you made each month.

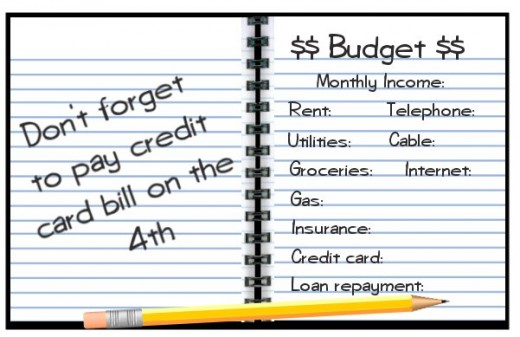

Make a budget

Once you know how much money you make each month, you can make a monthly (or weekly) budget. Figure out all of your expenses in a month, including rent/mortgage, utilities, insurance, telephone, cable, internet, transportation, groceries, debt repayment (credit cards, loans, any borrowed money), investments, savings, etc. There are many ways to create a budget, and once you find the way that works best for you, whether it's on paper, online, or some other way, it should become an easy task. Seeing things on paper often helps them to become clearer, and when you know how much money you're spending and where, it can help you to cut down on unnecessary spending. If you have enough money to cover all your expenses, you have a balanced budget. If you spend more money than you make, it's time to take a close look at where and how you're spending your money and make some changes to avoid serious debt.

Know the difference between wants and needs

Many people who go over-budget don't seem to know the difference between wants and needs. Needs are necessities - costs that go toward things you can't live without such as shelter, food and transportation. Wants are things you don't need to survive - daily coffees from the local coffee shop, expensive designer shoes, meals out in fancy restaurants, manicures, every tool in the hardware store, etc. It is often difficult for people to cut out their unnecessary spending - we get set in our ways, we like our little (or big) luxuries, we justify them by saying they don't cost much or we have to have them, but they all add up, and if you're having trouble with your finances, the 'little extras' can mean the difference between a balanced budget and going into debt. When you become aware of the difference between wants and needs and put them into practice in your spending habits, you'll likely see a difference in the amount of extra money you have each month.

Pay your bills on time

Most bills have a fixed monthly date by which they are to be paid, but some have a different date each month that is given on your monthly statement. If you're late making payments, most companies will charge a late fee, which can be extremely high. Along with the late fees, you'll have the company calling and asking where their payment is, why you didn't make it, and when you will be able to make it. These calls can become persistent if the problem isn't resolved. Late fees on credit cards, especially if your credit cards are near or over the limit, can make it hard to catch up with payments unless you're able to put a large chunk of money on them. Other companies will put their services on hold until you can make your payment (this is often the case with credit cards), or cut the service off entirely (telephone, cable, internet), and then there are fees to hook them back up again. If you have trouble remembering to pay your bills on time, many companies can make arrangements to have payments taken directly from your bank account (known as preauthorized payment, you can arrange for this by phone and sometimes online) so that you don't have to worry about sending or arranging for payments each month.

Seek help from a financial advisor

Financial advisors aren't right for everyone, but if you need a bit of extra help figuring out how to handle your money, or you want to look into things like investing, saving for your child's education, saving for retirement, etc, financial advisors can be an immense help. Do a bit of research before you settle on a financial advisor, and make sure that you choose somebody you feel comfortable with and who you feel is trustworthy and honest.

If these tasks seem daunting, sit down, take a deep breath and start at the beginning. Have a notebook, binder or file for your finance-related notes, budgets, bills, statements, etc., so that everything is in one place and easy to access, and you never have to go searching for an important document. Knowing the state of your personal finances can be empowering - if you have money left at the end of every month, you can feel good knowing that all your bills are paid and you have extra money to either put into savings, put toward next month's budget, or spend it on things you want. If you aren't able to make your budget balance and you can't handle all your expenses, at least you're aware of the situation and you can take steps to improve your financial situation and either avoid or undo debt.

Thank you for reading

Thank you for reading How to Understand Your Personal Finances. If you enjoyed this article and found it useful, please vote it up, rate it, and/or leave a comment - you don't have to be a member of HubPages to leave comments. If you'd like to learn more about me and read my other articles here at Hubpages, you can visit my profile page. I love writing for HubPages, and would recommend it to anyone who's interested in writing online. If you'd like to join (it's free to join and a great way to make money online), you can sign up here.