Three Profitable RSI Stock Trading systems

The RSI indicator can be a valuable tool in creating fast profits trading in the stock or option market. The methods I will describe are bullish and bearish divergence, secondary oversold bounce, and the multiple bottom pattern. But first it’s important to learn what RSI really is. Investopedia.com describes it as “a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset. The RSI is displayed as an oscillator (a line graph that moves between two extremes) and can have a reading from 0 to 100.”

Secondary Oversold Bounce

A stock that experiences a fast sell off can most often have an oversold bounce. This is caused by several reasons. A lot of short sellers could be covering to collect their profits, bullish traders are betting on a recovery, and other traders are expecting an oversold bounce. I don’t typically trade this bounce as it is usually short lived and hard to predict. I prefer to wait for what I call the secondary oversold bounce. This is used following the RSI. The stock goes into oversold on the initial sell off below the 30 RSI and then makes its first bounce. It is at this time my stock screener picks it up and I begin to stalk it. I wait til the price recedes and the RSI drops back to the 30 line. The second bounce can be really significant, often times by as much as 30%. As always this is best traded after a reversal candle which is usually a hammer or simply a bottoming tail. Confirmation must be assessed using price action the next trading period as this can move before waiting on the candle to close. I have made large profits trading this system.

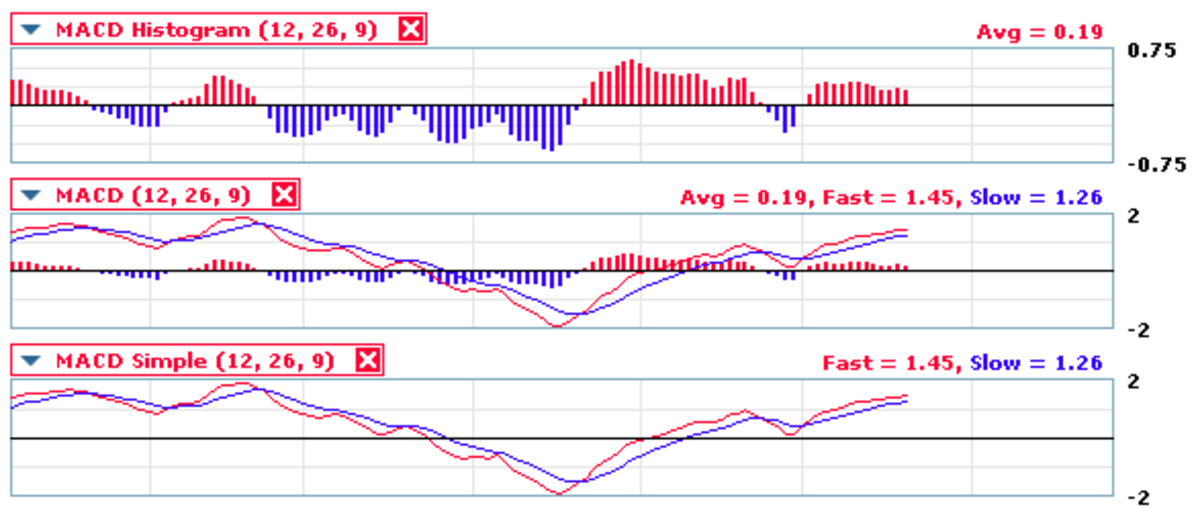

Divergence

Another popular trading system used by stock traders and especially futures trading is bullish and bearish divergence. This is also used following the RSI indicator. Basically a trend in the stock is going one way and the RSI trends another. I look for lower lows in the trend of the stock and higher lows in the trend of the RSI. This is called bullish divergence. The opposite is true for bearish divergence. For bullish divergence I wait for the RSI to curl up and a reversal candle with confirmation the following day to enter a trade. Some traders live and die by this technique and it can be a successful method. The key as always is to have confirmation of a reversal candle.

Multiple Bottoms

Of the three methods proposed in this article multiple bottom trading is by far the simplest. Stan Weinstein, author of Secrets to Profiting in Bear and Bull Markets proposes there are four stages to the cycle of a stock. The first stage is consolidation at the bottom with swings up and down trading in a range. The second stage is a large move to the upside finished sometimes by a parabolic move up. This sets up the 3rd stage which is consolidation and a 4th stage with a big move down to start all over again. For the multiple bottom pattern we are only concerned with stage 1. I prefer to trade the second or third bottom. This doesn’t always have to be a bottom at the same price but it is important to have a bottom of the same RSI. This is usually at the 30 but once again you can have a higher low in the RSI creating bullish divergence making this pattern even more potent. Always wait for a reversal candle at the bottom with confirmation the next trading period to enter a trade.