How to be rich and make passive income using dividend?

Passive Income, explained by Robert Kiyosaki, the financial teacher

Passive Income or Passive Money

Passive money is much different from active income. For active income, we need to do physical work continuously and the month we stop doing it, we stop getting our paycheck. For passive money, however the story is different. You once work hard and create a stream of income that may continue to come even after you stop working month after month.

Most parents, have no idea about passive money. When children don't study, parents tell their kids, study hard or else you will not get job. If you don't get a job, you will not be able to earn money. So, since young, we are brainstormed with ideas that when we have a high salaried position, we are worthy and rich. Then, when difficulty comes, like recession, we lose our job and money. We go into depression and some of us commit suicide, robbery, theft and what not. Passive money is never taught by parents or by schools.

There is much better way than this. Robert Kiyosaki has taught financial education to millions of people and continues to teach. He teaches us to get out of rat race and be financially free. We need to focus on passive money instead of active income. He says that true wealth is how many days you can survive after you lose your job.

Financial Health Check

Is your passive income more than your expenses?

Dividend as source of monthly passive income or passive money

Here, I am going to discuss one of the simplest ways to make consistent passive money with flexibility of time and money. One warning is that there are risks associated with any type of investment and users are suggested to do their extensive research before applying any of the below principles.

Dividends is a good source of cash flow or passive money which comes when we own stocks. It is similar to banks which give you interest rate when you deposit your money. However, the interest rate provided by banks is generally unable to overcome inflation. Dividends come when we own stocks or other products like REITs.

Buying stocks and becoming shareholder has dual advantage. Firstly, if it is a good blue chip company or organization, there is a probability of increasing in value over period of time. This capital gain can help you overcome inflation. Secondly, good companies tend to provide you monthly or quarterly dividends if you own stocks. This dividend income can be a good source of passive income or passive money. It is quite consistent and although the companies can change the dividend amount any time, they generally do it in positive side. When the companies pay good dividend, it attract more investors and it finally benefits the organizations.

Other than stocks, there are REITs, Real Estate Investment Trusts. REITs are becoming increasingly popular with the individual investors. They require less attention and give consistent passive money. Many countries have introduced REITs as an investment product. United States is leading in this area. REITs in United States tend to have high liquidity and less spread, which gives an additional advantage to the individual investor.

- How to trade REITs in United States - Interactive Brokers vs Optionsxpress

Trading REITs in United States can be done by using Online Brokers. Here, is a brief overview of good online brokers like Interactive Brokers, Optionsxpress.

REITs are famous for providing an extremely high and attractive dividend yields that are paid quarterly or even monthly. They can offer an annual dividend of 10-20% which is quite high as compared to normal blue chip stocks. Some REITs have long history of paying dividends which can give us good idea how they performed during bad and good times. Few examples, are given here:

- American Capital Agency Corp - Home

American Capital Agency Corp. (Nasdaq: AGNC) is a mortgage REIT that invests exclusively in agency securities for which the principal and interest payments are guaranteed by a U.S. Government agency (such as the Government National Mortgage Associati

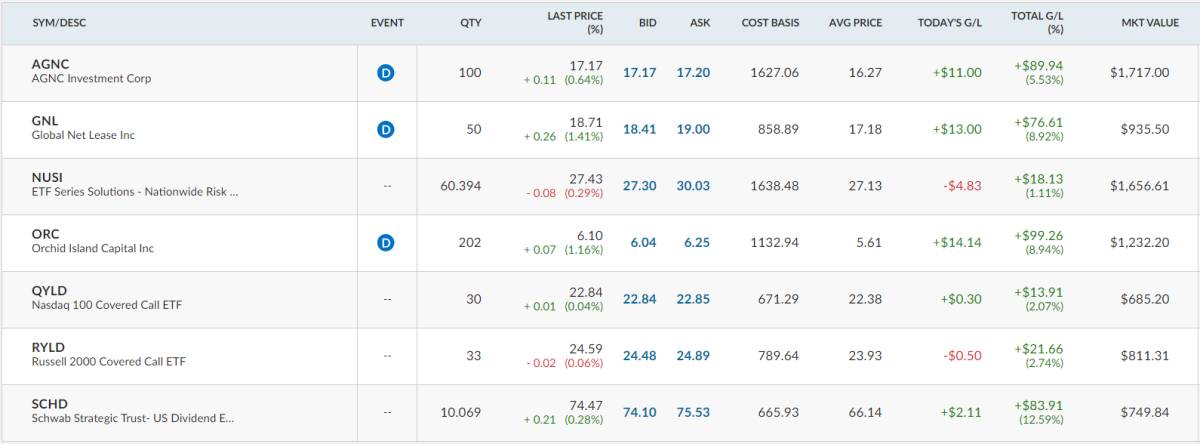

Hence, REITs like AGNC, NLY, etc. can be a good source of monthly passive money. NLY has a very long history of around 20 years which gives us a good glimpse how the company reacted to the recession or economy boom times.

However, some precaution is required. REITs work best in an economy where the interest rates are low. So, if the interest rates are trending upward, you need to do more research and fine tune your investment portfolio accordingly.

Disclosure: I buy and sell REITs, my favorites at the time of writing are AGNC and NLY.