How to make passive money while waiting to buy REITs at low price?

Do you trade REITs and options?

Making passive money while waiting to buy REIT at low cost:

"Investing isn't risky; not being in control is risky."

Quote by famous financial teacher, Robert Kiyosaki.

Before I start this advanced topic, I would recommend readers to read How to generate passive money from dividend yielding REITs. to understand what are common REITs and how their dividend income can help them.

Now, in this article, I am focusing on how to buy REITs cheaply and getting handsome passive money while waiting. Good dividend yielding REITs tend to have option chains. These option chains are a combination of puts and call options spread over various months and years.

There are risks associated with option trading and readers are required to read and understand the risks before doing option trades. It is advisable to do paper trading or virtual trading under a financial expert to improve your financial skills before putting any real money.

Put option is basically a contract between two individuals to exchange an asset at particular price and date. Selling put option basically means that you have the obligation to buy the asset if buyer uses the option.

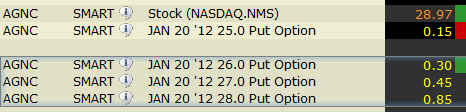

Here, is an example of dividend yielding REIT, AGNC which you want to purchase at cheaper price:

To keep it simple and easy to understand:

Last sale price of AGNC in this picture is 28.97. There are various put options available with different strike prices like 25, 26, 27 and 28. If we want to buy this REIT at price of 28, quantity =100, we can simply sell off the put option with strike price of 28. We get 85 dollars immediately in our account and if the REIT price falls to 28, we get the REIT. Otherwise, we get 85 dollars and the put option expires worthless. The only downside is that if the REIT price falls down very, very low like 5, we still need to buy it at the price of 28. The risk is unlimited in that case and that is why it is called risky product. However, to keep it simple, the risk is similar to the stocks that we purchase without any insurance.

In summary, when we want to buy a good quality REIT at low price, the strategy of selling put option helps to get some handsome money while waiting for the transaction to take place at our selected price. However, there is no guarantee of the transaction and again, the risk can be unlimited if we do investment without proper understanding. The best suggestion is to do paper trading or virtual trading where no money is involved. You need to practice your investment skills until you become proficient and you can handle real money with ease and no emotional attachment. Good investment training and continuous practice is recommended before trying any of the above strategy.

Disclosure: While writing, I am long in AGNC and I do option trading.