How to make money on Stock Market

Who doesn't like to make extra money?, To make some extra money Stock market is one of the options, but some people think it is gambling. Some people think it is hard to make money in stock market. Some people think it is very easy to make money in stock market.

As per me to make money from Stock Market is not gambling or not easy. Stock market is one type of business. To make money from Stock Market you need good knowledge of Stock Market.

1. Basic Terminology

In stock market investors and analysts always talk about stock price. Stock price is showing the value or strength of a company. To find out how well a particular company's stock doing, you need to figure it our various factors of the company. To understand and analyze those factors you need to know some terminology fist of all.

1. Preferred Stock: Generally there are two different types in stock. 1) Preferred stock and 2) Common Stock .

Preferred stock is listed distinctly from common stock and trades at a different price. Preferred stockholders are not usually authorized to voting rights, but they do have advanced right in assets and earnings than common stockholders. Preferred stockholders are guaranteed a fixed dividend and are paid before a company decides whether it can pay its common stockholders.

2. Common Stock (Ordinary Shares): Common stock denotes ownership in the company. Common stock holders have rights to vote for major policies changes and management decisions. Common stock holders may or may not get dividends. Most dividend companies pay dividend regularly basis, but company has right to stop dividend any time to their common stockholders. In the event of liquidation, common shareholders have rights to a company's assets only after bondholders, preferred shareholders and other debt holders have been paid in full.

3. Outstanding Stock: This refers to the total number of shares of a company held by all its investors. This number is used to calculate other key metrics like Earnings Per Share and Price to Earnings ratio.

4. Dividends: After reaching at a certain level of steadiness and profitability, company may decide to start paying dividends. During a growth period, profits are generally reinvested in a company so it can grow more (which also benefits investors), but once growth stabilizes, a company may decide to pay dividends to shareholders.

5. Earning Per Share: The amount of money that a company earns per share of stock. It is calculated as a company's net income minus dividends on preferred stock divided by the average outstanding shares.

6. Market Capitalization: Market capitalization gives you an idea of how big the company is in market.Market cap is the current share price multiplied by all outstanding shares. By comparing two company's market cap can help you to know which company is big in market.

7. Price per Earnings Ratio (P/E Ratio): Price per earnings (or "P/E") is a company's current share price divided by its EPS. This amount will show you about what investors are willing to pay per dollar of earnings. It can also show you how much a company is over or undervalued.

Good Knowledge

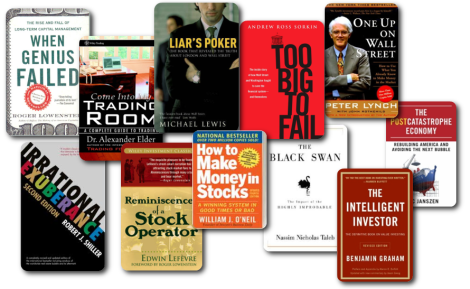

To make money in stock market you should read some good books related to stock market. Good books will give you really good knowledge like how stock market works, why company's stock price goes down or up, what are the factors are effecting the company.

Here, some of good books names,

- The Intelligent Investor by Benjamin Graham. Get this book and read it 2-3 times, it will make a lot of sense. Focus especially on Chapters 8 (market fluctuation) and 20 (margin of safety). (Warren Buffett recommended this book.)

- Buffettology, The New Buffettology and The Tao of Buffett, all by Mary Buffett and David Clark. These are basic books on the investment methods of Warren Buffett. The New Buffettology can be purchased on audio CD.

- The Interpretation of Financial Statements by Benjamin Graham and Spencer B. Meredith. This is a short and concise treatise on reading financial statements.

- Security Analysis by Benjamin Graham and David Dodd. This book is considered the bible of investing and will tell you how to analyze corporate finances thoroughly.

- Common Stocks and Uncommon Profits (and other writings) by Philip Fisher. Warren Buffett once said he was 85 percent Graham and 15 percent Fisher, and that is probably understating the influence of Fisher on shaping his investment style.

- One up on Wall Street and Beating the Street, both by Peter Lynch. They are easy to read, informative and entertaining.

Create Portfolio

You can build a portfolio based on knowledge. Some people like to invest in Blue chip stocks, some like to invest in penny stocks. Based on your interest, requirement and knowledge you can build a small portfolio of 8-10 different stocks.

How to pick a company

When you're choosing which stocks to invest in, most strategies can fall into one of two categories (and an ideal investor will have both in their portfolio): Growth Stocks and Dividend Stocks

Growth Stocks:

Growth stock generally does not pay dividend, company prefer to reinvest in company's projects. Generally growth company's stock is overvalued. Generally people buy growth stock because they are expecting to grow more in future by those companies and think stock price of those companies will go higher. Growth stocks can be volatile too.

Dividend Stocks:

Generally people believe dividend stocks are safer way to invest money in stock market. In stock market some companies pay regularly dividends. Generally those types of companies stock price don't move too much, but due to regularly dividend you can make safe money.

Some Good Tips

There are few tips that could be helpful to invest in Stock Market

- Don't invest solely in one company. This is an amateur mistake that can cause a lot of problems. An ideal investor will have a diversified portfolio. This means you'll have money in a variety of stocks with different goals. There's no need to choose between growth and dividend stocks. Buy both companies stocks.

- Even healthy companies will go down in value.

- Buying for the short term is much more dangerous than long term investing.

- A great track record does not guarantee strong performance in the future.

- You can't tell how expensive a stock is by looking only at its price.

- The value of any investment is, and always must be, a function of the price you pay for it.

- Buy what you know.

- Warren Buffett said "A simple rule dictates my buying: Be fearful when others are greedy, and be greedy when others are fearful."