How to Save Thousands

The average person under the age of 35 got both their first credit card and their first debit card when they were about 21 years old. (Source: "The Survey of Consumer Payment Choice," Federal Reserve Bank of Boston, January 2010)

-

41 percent of cardholders from the ages of 18 to 29 made only the minimum required payment on a credit card in some of the past 12 months. (Source: FINRA Investor Education Foundation, "Financial Capability in the United States," December 2009)

Slightly more than half of Americans -- 51 percent -- said that in the past 12 months, they carried over a balance and was charged interest on a credit card. (Source: "Financial Capability in the United States," FINRA Investor Education Foundation, December 2009)

Average credit card debt per household with credit card debt: $14,750

-

609.8 million credit cards held by U.S. consumers. (Source: "The Survey of Consumer Payment Choice," Federal Reserve Bank of Boston, January 2010)

Why do we have such an addiction to credit? There are several reasons. The way we value ourselves is the seed of this addiction, our lack of patience plants the seed, and irresponsibility waters it.

Poor is the man who does not know his own intrinsic worth and tends to measure everything by relative value. A man of financial wealth who values himself by his financial net worth is poorer than a poor man who values himself by his intrinsic self worth.

Sydney Madwed

In order to save money we must undergo a major paradigm shift. We must alter our personal sense of value. People should be measured by their values, such as honesty, integrity, work ethic, accountability and other such things. Because of the mass media these things are no longer important and have been replaced by physical attractiveness, financial standing, and occupational stature. Do we really respect someone because they are beautiful, live in a mansion, or drive a BMW? Changing the way we look at ourselves is empowering and essential to saving thousands of dollars.

For anything worth having one must pay the price; and the price is always work, patience, love, self-sacrifice - no paper currency, no promises to pay, but the gold of real service.

John Burroughs

Adopt the pace of nature: her secret is patience.

Ralph Waldo Emerson

In a society where the quality of ourselves is based on the quantity of our possesions and the need to be accepted is so prevalent, patience has no place.

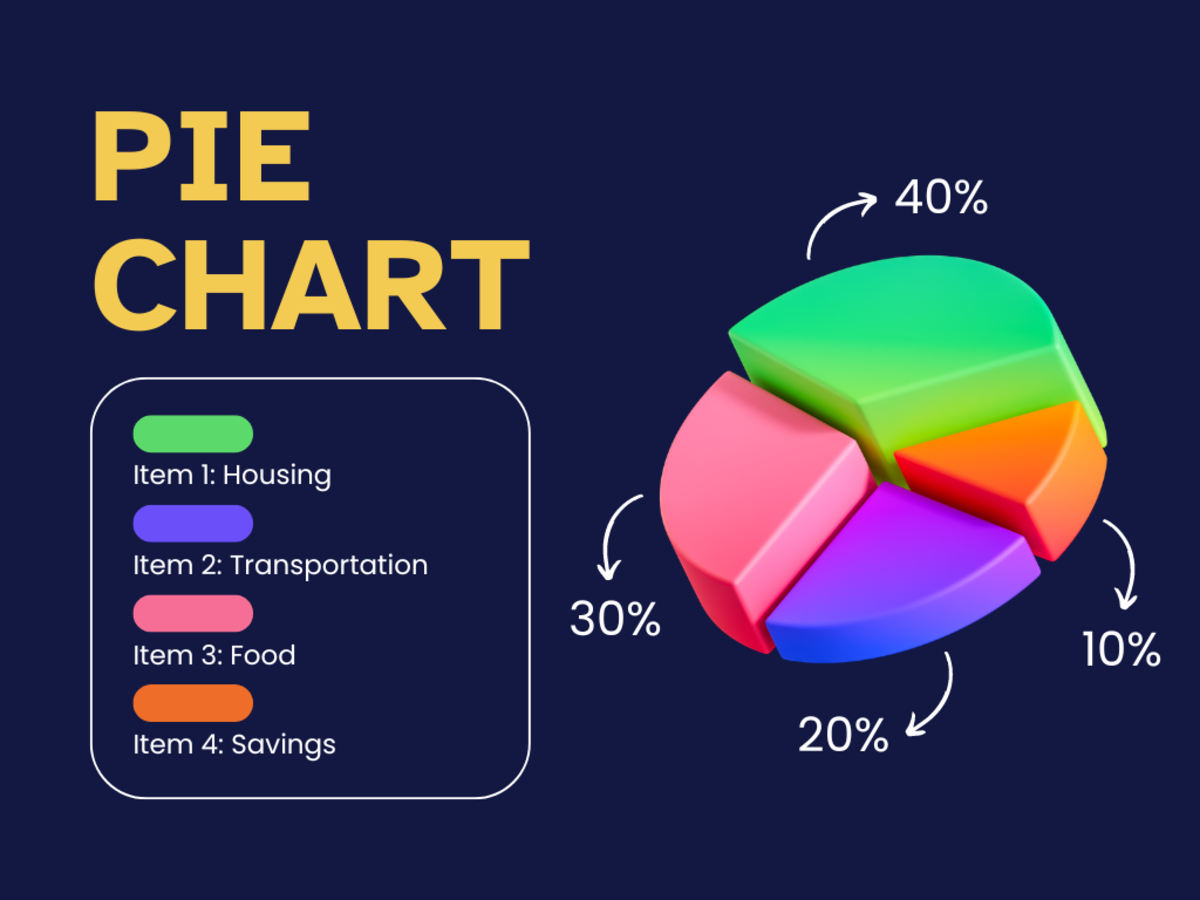

Have we forgot the story of the tortoise and the hare. Slow and steady wins the race. The average American spends hundreds of dollars on interest each month. How much more could we have if banks and credit card companies were non existent. This thought seems ridiculous to most, hence the core of the problem prevails. Why not pay as you go? But we couldn't possibly do this. We must have it now,before our friends do. Why not wait a week before taking that shopping trip and pay in cash? Let's take a look at this in greater detail.

Bob grew up in a large town and was and the only child of middle class, hard working parents. As a child, Bob got anything he wanted, his parents wanting him to have a better life than they had. Because of this he never developed patience. While attending college, Bob's parents could not afford to sustain his wants, so he applied for a credit card. Bob used this new tool to maintain this lifestyle. He had the best clothes, all the latest tech toys, and splurged on his friends every weekend. This was the way he had always been accepted.

After college, Bob applied for several upper management jobs with no success, all the while accumulating debt. This went on for years until Bob, at the age of 40, with a credit card debt of 30,000, living in a rental property his parents owned, and working a mediocre job not really suited for his stature, met Tim.

Tim, ten years older than Bob, grew up in a small rural community. His parents had little money but always managed to give their son what he needed. Tim didn't always have the latest fashions and didn't drive the best car, When Tim was 12 his parents started a bank account for him and taught him the importance of saving money. At the age of 16, Tim bought his first car at a local auction for 1,000 dollars. It was a good running car and got him back and forth to his job on the weekends.

During college, still driving the same car, and never forgetting the lessons his parents taught him, Tim continued to work and save. Because of his hard work in high-school, Tim received scholarships and had little expenses other than the bare necessities.

At the age of 22, Tim graduated college and took a position in the mail room of a large company. He had managed to save 5,000 dollars during college and purchased another car. His rent was cheap and he never spent above his budget. He paid for everything with cash and always managed to save at least one check per month. When ever he bought something he didn't need he would simply take from his savings and pay it back with interest.

At the age of 30 Tim using the money he had saved not using credit cards, and the added income of paying interest to himself was able to purchase his first home. It wasn't the quality estate his friends had, but it suited his family's needs and allowed for him to keep saving. Tim continues to pay interest on his home to himself. After 10 years he is able to pay himself back and has added about 300,000 to his checking account. At the age of 50 Tim a retired millionaire teaches personal finance in his spare time where he meets Bob.

A rich old man wants told me " a man who won't take care of a penny, won't take care of a million dollars". We must be responsible with our money. We must budget, save, and never over-extend. Poor decision making concerning our personal finance is the reason for the rise in foreclosures.

By changing the way we view ourselves, developing patience and being more responsible we can save thousands.