How to trade low volume stocks using stock screeners

Are you a seasoned trader, or a newbie?

Trading low volume stocks

Making money from trading low volume stocks is a difficult task, of course your goal is to move out of the low volume range someday. If your brand new to stock trading, or if your trying to setup your first stock trading account, check out this article for help, today we are going to work specifically on setting up and sticking to a trade system using screens. It should be noted that I am not a financial analyst and any investments that you undertake are done wholly at your own risk; in investment you can lose everything you put into the system, so be careful and move at your own risk.

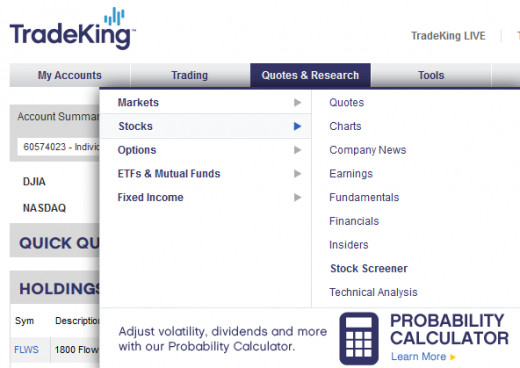

First off, we will be using the TradeKing platform, and focusing specifically today on how to manipulate the stock screener. The screener is a powerful tool that will help us sort through all of the stocks available for trade using a filter system that the user is able to define. You can save your screens, lets talk a bit about what some of the filter settings in the TradeKing system do, and what it might potentially mean.

- Industry: Industry allows you to search related companies, its useful if you think a particular sector of business is going to perform well, or if you want to compare similar companies when you can't decide which one of a list to purchase.

- Sector: Similar to industry but more specific

- Percentages Below/Above 52 Week High: filters for stocks that are a user defined percentage above or below the yearly high. This can be useful when your trying to find stocks that are doing much worse or much better than they have in the past.

- Price Change: Allows you to set a user defined percentage price change over a user defined period

- Quick Ratio: The acid test will help you know how financially stable a company is. If this is a large number it means the company is able to pay its financial obligations out of pocket or with other liquid assets; which theoretically makes it less likely to go out of business.

There are a number of predefined screens on the TradeKing platform that you can chose to use, the first step in using the screener is to decide on your own trade system so that you can setup your screener appropriately.

Since we are looking at trading low volume, your also generally going to be looking at trading low cost stocks. No matter how much volume you trade in, you have a flat commission fee with TradeKing; this means the more stocks you trade at a time the easier it is to take advantage of smaller price changes(discussed in this article). I generally start every screen with a price range that ensures I can buy at least 20 shares, and then I move from there; the cheapest I am comfortable trading is four dollars, and when your trading stocks that low it's a good idea to also include the Quick Ratio in the screen. Each time you launch a screen you can adjust the user defined variables, so if your still not seeing numbers you like, go back to the screen and readjust your values.

Manipulating the screener

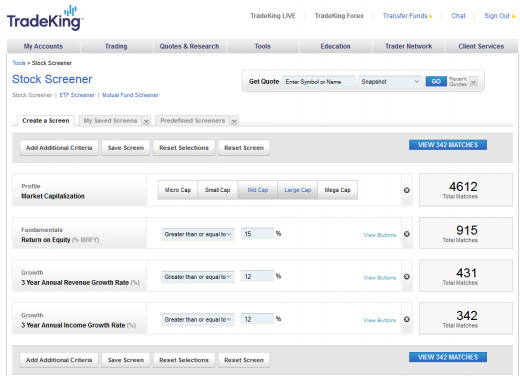

The black circles beside the total matchbox are how you remove screen filter boxes, you can always add them later by clicking the "Add Additional Criteria" button at the top left. Each box has variables that can be entered and changed each time you run the screen. Its useful to play with these variables sometimes to see how the result changes the types of stocks you see within your acceptable range. The screener starts at the top of your list and works its way down. The total match box shows you how many stocks match that criteria, and each criteria above it so that the final box you add will show you how many stocks match all of your criteria.

Start at the top with your most important criteria, for most of us trading low volume this is going to be price. After price you need to include any general information your strategy revolves around. An industry or sector criteria may be important to you, and you can get really good information on the performance of each sector by googling "Stock performance in _______" Research is the single most important tool in your arsenal, don't forget to do it when your designing your own strategy.

After that you may want to include the acid test, when your trading low cost stocks you are regularly trading less stable companies, by including the quick ratio you are giving yourself an easy method of selecting stocks from your chosen strategy that are more able to pay the bills if things go south.

From this point there will be several hundred different strategies; If your looking for high returns quickly your going to want to filter for highly volatile stocks. You can do this by setting the price change percentage to a fairly high number and a fairly short period. It often takes some tweaking to find stocks that meet your screen strategy when your going for short period changes, but highly volatile stocks will allow you to purchase on low dips, and ostensibly sell on a high dip later on; whereas more stable stocks will change slowly; and remember the key to low volume trading: quick turnarounds and small gains add up quickly. But of course, volatile stocks are also more likely to tank.

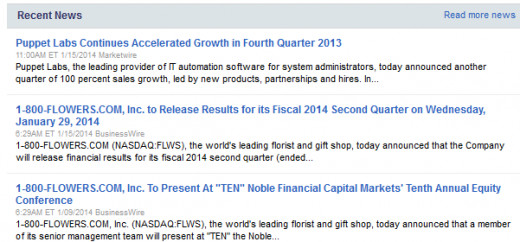

Recent News

How to chose a stock from the screener list

There are some handy research tools that TradeKing has seen fit to give us. Chose a stock that looks appealing to you for whatever reason after you've run your screener and you will be shown several useful bits of information, you should focus on a few different ones to make your choice.

First your going to want to look at the headlines box, called recent news. This will tell you how that particular stock has been doing as far as the news is concerned. You will find lawsuits and earnings announcements, as well as government grants, lost contracts, and anything else. If there's bad news on the doorstep you might want to avoid the stock, but there is a recently good earnings report, or a contract signing coming up it may well be a sign for good prospects. Of course not all signs can be reliable, trade at your own risk; but the headlines are the most important thing to check when your making sure your prospective stock isn't hiding any dirt behind the ears.

Historical Data

Leave a comment and start a conversation?

The next thing you'll want to look at will look more familiar, the historical data charts. You can select the duration your interested in, I normally chose a year when I'm shopping for a stock. If the company has been around for a few years its probably going to be around for a few more. If your strategy revolves around buying stocks that are on the way up then you probably want to look for stocks that are near their 52 week high; if your strategy revolves around buying stocks that are down you should probably buy a stock that is priced noticeably below the 52 week high.

The five year view can also show you yearly trends, and the window directly below the historical data window will show you the performance of major competitors overlapped with the performance of your chosen stock, an excellent comparison tool to catch up and coming competitors. If there is a competitor who's business is growing while your chosen stock is falling, you might want to look into that competitor as well.

Hope you enjoyed the basics of the TradeKing stock screener. Feel free to leave a comment and a thumbs up, and don't forget to share it with your friends!