How to Pick Your Own Stocks

Some Stockpicking Info From My Husband

My husband wanted to use my HubPages account again to write a hub about how you can pick your own profitable stocks. I thought I would let him because it helps me get that much closer to reaching my 30 Hubs in 30 Days goal - only 3 more to go, but only 1 full day to publish them all! So here is his advice, based on years of stock market research.

Open Your Own Trading Account

First, you need your own trading account. My husband recommends TD Ameritrade as an online broker. They have one price for online trading. It costs less than $10 for each trade, compared to other online brokers that either charge much more or seem to charge less upfront but cost more overall because of hidden fees.

TD Ameritrade has treated him very well over the years. Great customer service - someone’s available to answer questions and help you with other issues you might have 24/7.

They also have an excellent research platform, although this is not the only place you should do your research.

StockCharts.com

Second, you go to StockCharts.com. This web site provides excellent charting for beginners and experts alike. There is a paid membership you can join, but my husband just uses the free service.

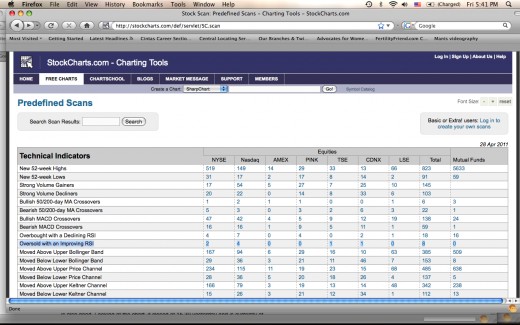

At the homepage of this web site, look at the right side and click on “predefined scan results.” On that page, you will see a table with a line under the column heading “technical indicators” that says “oversold with an improving RSI.” This will give you an indication of the number of stocks available in various exchanges that are potentially good to purchase. You can use any of the exchanges with which you are set up to trade, although the Nasdaq and NYSE tend to be the most commonly used.

Once you choose which exchange you want, click on that number and then begin looking at the closing price of each stock. This is important if you have limited funds. You want to pick one that you can afford but will also give you a good return on investment.

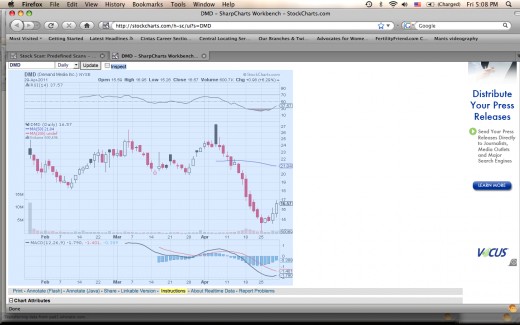

For practical purposes, we will use the Nasdaq as an example here. At the time of writing, there are two stocks showing available in the “oversold with an improving RSI” condition. By clicking on the first we get a chart of DMD Demand Media Inc. It shows an RSI just over 30, which is good for buying.

It also shows a MACD that could make a bullish crossover in the near future, which is also good. Looking at the chart, it closed at 15.39 yesterday and is currently at 16.57, showing that if we had done this research last night, we would have been making money today.

Terms You Need to Know

- Oversold: When a stock is classified as oversold, it means that, due to market panic, its price has been driven way down. This makes it cheaper to buy, although it might not actually be an indication that the value will go back up.

- Overbought: A stock that is overbought is at a price that is too high to maintain given its number of outstanding shares, price, PE Ratio, and other stock fundamentals.

- PE Ratio: Price/Earnings Ratio. You find this number by dividing a stock's market value per share by its earnings per share.

- Improving RSI: RSI stands for Relative Strength Index. This is a way to tell how the stock compares to itself due to both its overbought and oversold statuses.

- MACD: Moving Average Convergence/Divergence. Average price of a stock over a set number of days. Common intervals include 10-day, 50-day, and 200-day. It is a lagging indicator of what has just happened and what is expected to happen with any given stock.

- Buy price (or bid price): How much an investor is willing to purchase for a given number of stocks.

- Sell price (or ask price): This is the market value and established exchange rate that is guaranteed to buy a specific amount of any stock.

- Stop loss: Setting a stop loss will limit the hit you will take if a trade suddenly turns negative. You will not lose more than the difference between this amount and your purchase price.

- Sell order: You will work with your broker to issue a sell order when you want to get out of a certain stock.

Study the Stock Charts Closely

Next look closely at the chart of each stock listed. See how much the stock fluctuates each day and what its trend is.

If the stock is trending upwards, you might be able to make more than if it is trending downward. You can still make money if it is trending downward. It just won't be as much and must be traded faster.

The stock tends to fluctuate up and down at least two dollars, so that is the amount you want to try to get from this stock. This stock has already risen over one dollar, which takes away from how much you can make with it at this time.

Now look at the volume. You need to purchase enough shares to make a worthwhile profit. The volume traded needs to be at least twice as much as you intend to buy. Not having enough volume traded could cause you to not be able to sell the stock when you want to.

Before buying, you need to get a buy price and sell price set for the stock. That way you know before you buy how much you should make. Also, set a stop loss if you find it appropriate. Sometimes it is not worth it to set a stop loss. It depends on the individual trade at the time and the individual making it.

Once you have bought the stock, go ahead and put in your sell order. This keeps you from having to constantly watch to see when the stock reaches your sale price. If you do not put in your sell order, then watch the RSI and sell once it goes above 50. That is when you should be selling a stock and not buying it. Sometimes the RSI goes on up even over 90, but it is very risky to buy in that range. These trades can take anywhere from a few hours to several months to complete, so patience is important. If you find the trade does not get completed on the same day, just check it each trading day to ensure it is not dropping too much for you.

Want Some More Expert Advice? Check These Out!

This Should Get You Started

There are other things to do for research, but this is the fast and easy way to get started. My husband uses many resources online and offline to ensure each trade will be profitable.

Keep watching for updates and new information.

And remember: If you have any doubts at all, let the trade pass. Always do your own due diligence and be as thorough as necessary.

IMPORTANT!!!

The Fed held its first press conference in its 97-year existence Wednesday and let out that they will be controlling the market by making commodities prices go down and that there would be large fluctuations in prices both up and down for a while throughout the markets. This means you may have to endure much larger wilder swings during your trading. Do not be alarmed at that. Just make sure your research is more thorough and solid.

It should also be noted that you should do all your chart research outside of market hours. That way the prices you see will not be fluctuating, and your research will be more solid and accurate.