IRA Distributions

IRA Distributions - How they are calculated

So you've been working and saving making contributions to your IRA for years. Now you're coming to the age where the government rules say you must begin taking distributions. How does that work?

Once you reach the age 70+1/2 you are required to take distributions, also known as Required Minimum Distributions or RMD's. You may have IRA accounts at several different banks and investment firms. Each of those institutions are unaware of the accounts you have at the others. Only you know your total IRA savings so only you will be able to calculate your total required distribution.

At the beginning of the year you are going to turn 70+1/2, each institution should send you notification of an amount you are required to take as your distribution that year. It's important to communicate with each institution what you plan on doing. You have several options.

You could let each institution mail you a check for the distribution they calculate. But the smart thing to do would be to look at the interest you’re earning in each of your accounts. Let’s say you’re earning 3% interest on a 2 year IRA CD you have in a local bank and they have mailed you paperwork explaining you are required to withdraw 2,000.00 this year from the account. Then let’s say you have savings in an account at an investment firm earning 5% interest, and you receive a letter saying you must take a distribution this year of $4,000.00. Now you could let each institution mail you the above mentioned distributions. But the smart thing to do would be to tell the investment firm to NOT mail you any money, and tell them in writing you plan on taking your distribution from monies you have elsewhere. Then tell the local bank you would like a 6,000.00 distribution as you have monies elsewhere you are taking into consideration when calculating your amount. This way you leave your savings earning the highest interest rate alone, and you take from the place where your money isn’t working so hard for you.

Both institutions are fine with this as long as you communicate ahead of time, well before they mail out ‘automatic payments’ of your distribution. This is usually done at the end of the year. And truth be told, if they mail you a payment you didn’t want, even if you neglected to communicate to them, you can send the check back with written instructions to reverse the transaction, or redeposit it as you’re already met your RMD elsewhere.

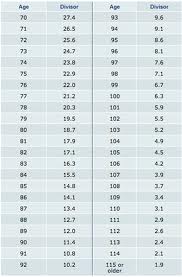

Exactly how do the institutions calculate your RMD? The government has created a Uniform Lifetime Table. It assumes you’re going to live as long as 115 years! Isn’t that good news?!! Once you reach required distribution age, you can no longer make contributions. So, according to the chart below, based on your accumulated IRA funds (actually the value of the fund as of December 31 of the previous year) is divided by the percentage for that age. The first year would be your IRA value divided by 27.4% and that is the aggregate or total amount of your RMD the year you turn 70+1/2. The following year, again, calculations for RMD are based on the value of the fund as of December 31 of the previous year, and this time the dividing percentage is 26.5%. Your fund will slowly be decreasing in size over time, as will the percentage that is required for your RMD.

Basically you are spreading out your retirement fund to last throughout the rest of your life and be a steady source of income for you.

You can actually take the first year distribution anytime before April 1 of the year following the year you turn 70+1/2 should you want to delay that increase in your income. However you will be required to take that ‘following year’s distribution’ sometime before December 31. If you do that you’ll be taking two the second year.

For example, if you turn 70½ on July 25, 2012. You must take your first RMD, for 2012, by April 1, 2013. You are still required to take your second RMD, for the year 2013, by December 31, 2013, and your next RMD for 2014 by December 31, 2014 and so on.