IRS Cracks Down on Offshore Accounts

IRS

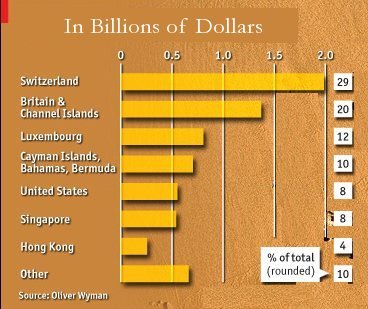

The current (Obama) administration is taking a hard look at unreported offshore accounts, as indicated by its aggressive prosecution of Zurich, Switzerland-based UBS AG. As a result of the law suit access to 52,000 offshore accounts has been given to the Internal Revenue Service (IRS) which has vowed this month to “crack down on the abuse of tax havens by individuals.”

Harsh Penalties & Jail Time

Offshore account holders who previously did not report these accounts, and now voluntarily report their

income, face harsh penalties, including paying up to twenty (20%) percent of the amount of tax

that was underpaid for the past six years plus twenty (20%) percent of the highest value

of the account over the past six years. This is on top of the unpaid taxes and interest due on those taxes. Account holders also face a possible $100,000 fine or up to fifty percent of the total foreign account balance. This is what foreign bank account holders face for not reporting offshore bank accounts, but voluntarily coming forward to report that account before the IRS contacts them.

Should the IRS make the first move, the account holder could be looking much stiffer penalties including prison time.

John Doe Summons

To find "tax cheats" the IRS has issued summons to foreign banks demanding to know the names of American citizens with offshore accounts. With this "John Doe Summons" the IRS does not need to know the names of the account holder; the banks are required to provide them.

Working hand in hand with the U.S. Justice Department these banks are starting to comply with the demands. UBS, in particular, paid a seven hundred eighty million ($780,000,000) dollar fine and began making amends by giving the IRS the names of three hundred (300) American individuals with account holdings.

The IRS Simply Wants the Money Owed

As of now the IRS is only interested in payment of back taxes and penalties. They are not out to ruin reputations or send people to jail. This means that the tax evader's identity will be kept confidential as a civil matter. But this could change if account holders don't come clean and broker a deal with the IRS.

Carrot and Stick

As an example of just how far the IRS is willing to go the Justice Department singled out Igor Olenicoff, a California property developer. Mr. Olenicoff had not paid taxes on two hundred million dollars ($200,000,000) that was banked offshore. He only avoided a jail term because he agreed to pay fifty-two million dollars ($52,000,000) in penalties and interest. As it is Mr. Olenicoff is on two years probation and is currently performing one-hundred twenty hours of community service. The fifty two million dollar fine and back taxes is seven times what he would have owed had he reported the account and paid taxes when due.

“Today’s guilty plea serves as a reminder to individuals who have an interest or ownership of foreign financial and securities accounts, that they must accurately report their foreign financial accounts to the IRS. IRS Special Agents possess unique financial skills and expertise that enable them to actively and aggressively investigate leads, whether domestic or international, and expose potential criminal tax violations.” - Catherine D. Tucker, Acting Special Agent in Charge, Los Angeles Field Office

(see Igor Olenicoff link above for details)

Olenicoff originally faced up to three years of imprisonment for filing false tax returns.

This serves as an example of what will happen if people ignore the current opportunity (to come forward) and the IRS tracks them down. Lawyer's and tax advisers are telling their clients that the best thing to do is step forward and volunteer to take care of these tax matters before the IRS contacts them.