- HubPages»

- Personal Finance»

- Tax & Taxes»

- Income Tax

Income Tax Slab Rates for Assessment Year (AY) 2014-15

Income Tax Slab Rate for Assessment Year (AY) 2013-2014

- Income Tax Slab Rate for Assessment Year (AY) 2013-2014

Income Tax are charged at fixed rate for the year by the annual Finance Act. This Hub deals with the Tax (slab) rate for the Assessmen Year 2013-2014. This rate may change for each Assessment year.

Income Tax Slab Rate - Overview

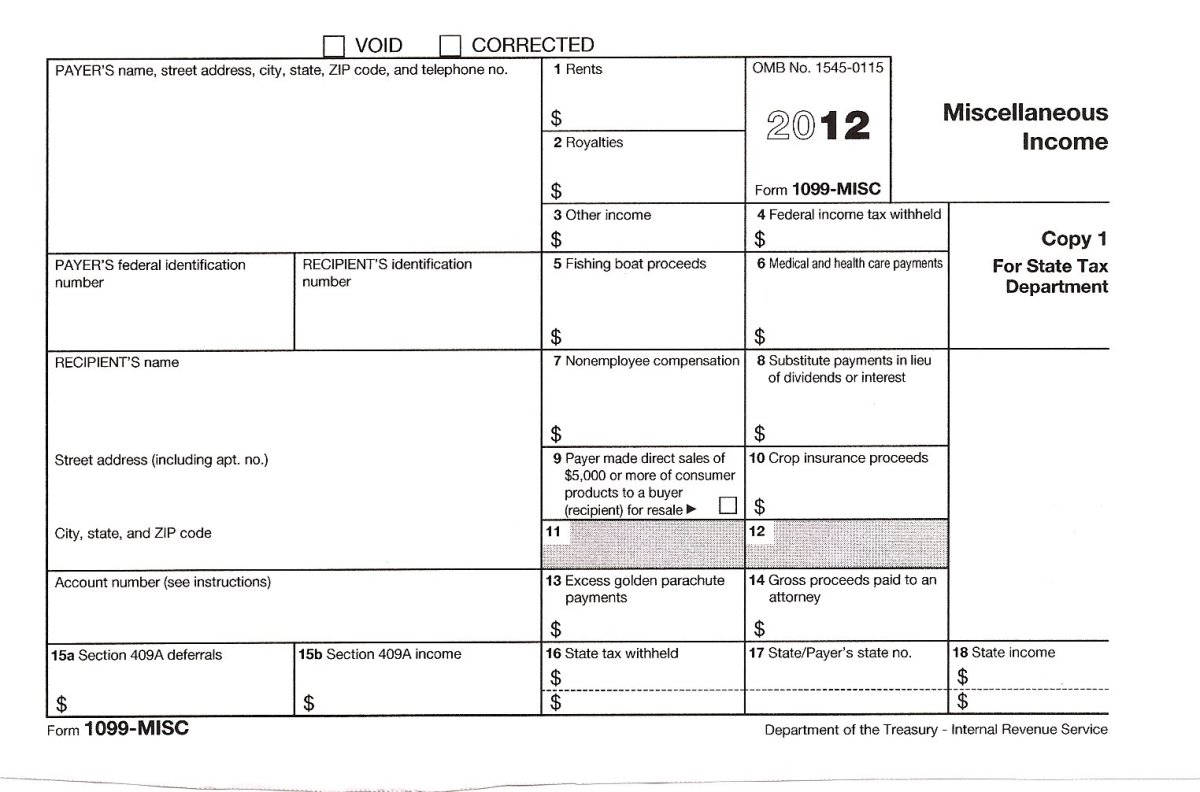

Every year Income Tax Slab Rates will be revised in Budget by the Finance Minister of India. Income Tax Slab Rate for the Assessment Year 2014-15 has been announced in Budget 2013. These will be applicable for the financial Year (FY) 2013-14. The Slab Rate has not been revised for the AY 2014-15, but a new rebate has been Introduced for the Slab Rate between Rs. 2,00,000 and Rs. 5,00,000. this Tax Credit hass been for Rs. 2,000. Apart from this, Surcharge of 10% will be on taxable income above 1 Crore Rupees.

Let's see the Income Tax Slab Rates for the Assessment Year (AY) 2014-15 in detail.

Individuals / HUF

Individuals here include women assesses but does not include assesses who are above 60 years of age. Tax exemption limit is Rs. 2,00,000.

Income

| Tax Rate

|

|---|---|

Where the total income does not exceed Rs. 2,00,000/-

| NIL

|

Where the total income exceeds Rs. 2,00,000/- but does not exceed Rs. 5,00,000/-.

| 10% of amount by which the total income exceeds Rs. 2,00,000/-

|

Where the total income exceeds Rs. 5,00,000/- but does not exceed Rs. 10,00,000/-.

| Rs. 30,000/- + 20% of the amount by which the total income exceeds Rs. 5,00,000/-.

|

Where the total income exceeds Rs. 10,00,000/-.

| Rs. 130,000/- + 30% of the amount by which the total income exceeds Rs. 10,00,000/-.

|

Illustration :

Mr. A has a total Income of Rs. 11,00,000. He is of 45 years of age. Computation of his Tax Liability is as follows:

Income

| Tax

|

|---|---|

First Rs. 2,00,000

| NIL

|

Rs. 2,00,000 to Rs. 5,00,000

| Rs. 30,000 (10%)

|

Rs. 5,00,000 to Rs. 10,00,000

| Rs. 1,00,000 (20%)

|

Above Rs. 10,00,000

| Rs. 30,000 (30%)

|

Total

| Rs. 1,60,000

|

The total Tax liability for Mr. A is Rs. 1,60,000. This computation can be done in another way which is a simple one.

As his income exceeds Rs. 10,00,000, it can be computed as follows :

Rs. 1,30,000 + 30% on balance (Rs. 1,00,000 in this case) which comes to Rs. 1,60,000.

Hope you understand how to compute Tax Liability. Let's move on to the next head under Individuals.

Individual resident above 60 years and below 80 years

The Income Tax Slab rate for Individual resident who is of the age of 60 years or more but below the age of 80 years at any time during the previous year. The Tax exemption limit under this head is Rs. 2,50,000.

Income

| Tax rate

|

|---|---|

Where the total income does not exceed Rs. 2,50,000/-.

| NIL

|

Where the total income exceeds Rs. 2,50,000/- but does not exceed Rs. 5,00,000/-

| 10% of the amount by which the total income exceeds Rs. 2,50,000/-.

|

Where the total income exceeds Rs. 5,00,000/- but does not exceed Rs. 10,00,000/-

| Rs. 25,000/- + 20% of the amount by which the total income exceeds Rs. 5,00,000/-.

|

Where the total income exceeds Rs. 10,00,000/-

| Rs. 125,000/- + 30% of the amount by which the total income exceeds Rs. 10,00,000/-.

|

Illustration :

Let's take the same example above assuming that Mr.A is of 65 years of age. The Tax Liability will be :

Rs. 1,25,000 + 30% on Balance ( Rs. 1,00,000*30%) which will be Rs. 1,55,000.

Individual Residents above 80 years of age

Individual resident who is of the age of 80 years or more at any time during the previous year will get exemption limit up to Rs. 5,00,000.

Income

| Tax Rate

|

|---|---|

Where the total income does not exceed Rs. 5,00,000/-.

| NIL

|

Where the total income exceeds Rs. 5,00,000/- but does not exceed Rs. 10,00,000/-

| 20% of the amount by which the total income exceeds Rs. 5,00,000/-.

|

Where the total income exceeds Rs. 10,00,000/-

| Rs. 100,000/- + 30% of the amount by which the total income exceeds Rs. 10,00,000/-

|

Illustration :

Once again taking the same example assuming that Mr. A is of 85 years of age, the Tax Liability will be

Rs. 1,00,000 + 30% on Balance ( Rs. 1,00,000*30$) will be Rs. 1,30,000.

Comparison of above:

To make it clear, let's compare the results arrived on the above. By comparing one can get a clear understanding about the Tax Liability.

Basis

| Basic Exemption Limit

| Tax Liability

|

|---|---|---|

Individuals (Below 60 years of age)

| Rs. 2,00,000

| Rs. 1,90,000

|

Individuals above 60 years of age but below 80 years of age

| Rs. 2,50,000

| Rs. 1,55,000

|

Individuals above 80 years of age

| Rs. 5,00,000

| Rs. 1,30,000

|

You can see the difference above. And this difference is due to the exemption limit.

Tax Rates for firm, Co-operative Society, Company

The Tax Rates for firm, Co-operative Society, Company has also not changed and remains the same.

These are the slab rates applicable for the Assessment Year 2014-15. Hope this Hub is useful to you. If you have any doubt, just make a comment below.

Take a small Quiz.