Indian Credit Cards Review

The Indian credit card market is red hot at the moment. With the market predicted to grow at 25% until 2012, and just 25 million adults having credit cards (out of a billion population) every single bank on the planet wants a piece of the pie. The consumers in India enjoy a huge number of choices of cards. Sides, the banks and the consumers see a lot of problem between each other. India does not yet have a unique nationalized id like social security number in US, or Tax File Number in Australia for all of their citizens. The problem for the banks with this is that there is a huge risk to give out these credit cards that can never be traced if the holder changes his or her address. The consumer on the other hand complains about exorbitant hidden fees, fines and non-existent customer service. There are still not a lot of regulations for the credit card industry. Any one on the road is given a credit card (even by non-bank employees who work as sale sub-vendors to banks) with out any proper checks or verification (a la US sub-prime mortgages). Well but India is one market that any bank cannot ignore, so as time goes by proper regulations will be put in place to get things in order. The idea of this article is to give a list of credit cards out there for the consumers in India and their features.

The article reviews card of the top banks operating in India like Citibank, HSBC, Barclays, ICICI, HDFC and a few others.

Availability of Information and ease of use of the bank websites

The information in this article is directly from the banks websites (as of 14th May 2009).

Here are some comments about the website itself.

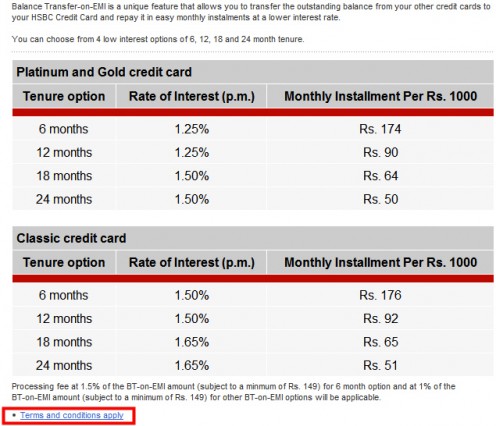

HSBC

The HSBC site was very easy to use and had the information like interest rates and fees easily accessible. They were just a 3-4 clicks away. The entire website was laid out in simple direct format with nice little examples. They had a 7 page “Terms and Conditions” page hidden behind a small font link. There were some unpredictable links to some important pages that worked on and off.

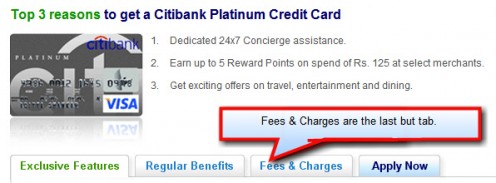

Citibank

The Citibank website was a little sluggish and little more complicated. Getting the interest rate information required 5 or more clicks. The website’s credit card looked more like a marketing flyer rather than information brochure. The website was trying to make you special while all you needed was the interest rate on a card. Links to some important pages when clicked took for ever to show up. All the rates and fees for every single card were listed on the same page.

ICICI

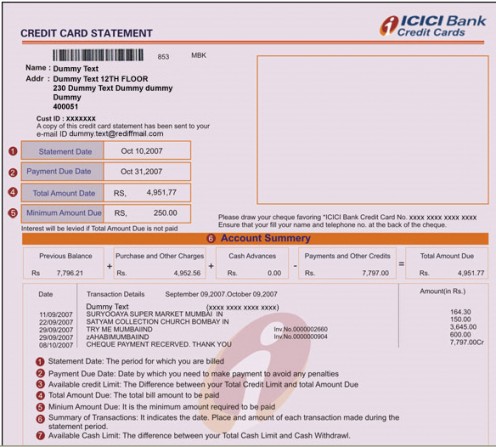

This site was easy to use and had the information like interest rates and fees easily accessible. They were just a 3-4 clicks away and were organized on the same page for all Credit cards offered. The site offers you a usage guide, even though the idea was right the execution was all wrong. Take a look at this, the title says “How to read the Monthly Credit Card Statement” but has nothing other than a screen shot of mock statement and a few 2 liners. They have explained the obvious and not described complex items. There are so many numbers on the screen and it’s hard to tell what is what.

HDFC

This site was having quiet a bit of information on its site. The key information like interest rates and fees were accessible in 3-4 clicks. The website had detailed, separate fees and rates section for each card. They had a FAQ and Credit Card Usage Guide section. FAQ had 6 question and answers but the Usage Guide did have a lot of information on there. It explained by text alone (no screen shots) the terms in the statement.

Barclays

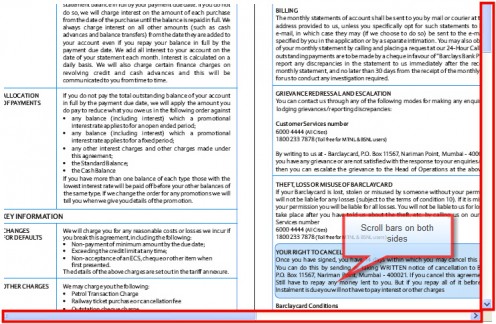

Have to give it to them they had the shiniest site among all, but couldn’t find the rates and fee even after fiddling around the site for sometime. The information on the website looked more like marketing flyer rather than plain simple information. The terms and conditions were listed in a malformed PDF file that had to be downloaded. The rates and fees information could not be found any where on the site.

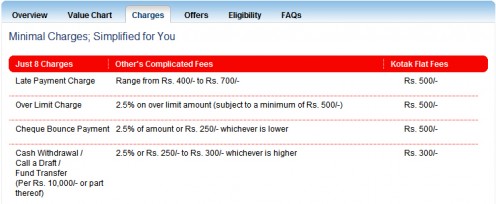

Kotak

This one website there is nothing to complain about. The website is created beautifully and all the required information is carefully organized. Information related to rates, fees, benefits, FAQ and examples illustrating scenarios are built around the credit card. Finally found a website that satisfies all the criteria.

Enough on the websites, now for the credit cards themselves.

Basic Credit Card Guidelines

- Having too much plastic is not good for your financial health. As much as you can try to avoid having too many credit cards.

- Carefully monitor all the credit cards you have through online banking (Paper statements are a pain).

- Register for SMS or email alerts if your bank offers them.

- Try to avoid taking cash advance they charge you very high interest for cash advances. If need some money, try to apply for a personal loan that are offered at a much lower rate.

- Always pay off the minimum balance for every statement cycle.

- Try to pay off more, even if it a very small amount you would save a lot of money in the end.

- Try to get add-on cards for family members rather than having separate cards, so it is easier to monitor your credit cards.

Info: Recommended credit card below are for low credit spending individuals, who do not tend to spend too much using credit cards and follow the above guidelines.

The conditions for recommending these credit cards are a combination of the rules below,

- Low Interest Rates - Your card might have any amount of sugar coated features but this is what counts the most.

- Low Fees or No Fees - Some banks might give you a low interest rate but for a high annual fee, so watch out.

- Benefits - Anything else does not matter than the above two (1&2), but if you get added benefits why not? But you should never pay higher fees or interest rate for the benefits. The benefits might be cash back, fuel surcharge, air miles, shopping discount,...

DEUTSCHE BANK SMART GOLD CREDIT CARD

Best Features

Fees: No fees forever

Interest Rate: 2.95%

Fuel Surchage: Waived in any fuel outlet

Other Benefits: Choose from 4 options Shopping - For shoppers,Travel - Frequent Flyers,Party - For consumers frequenting restaurants, bars, pubs, Theatres,Home-Utility Bills Groceries,

Free Security Insurance - Protection against unauthorised transaction and fraud

SBI GOLD CREDIT CARD

Best Features

Fees: No fees forever

Interest Rate: 3.1%

Fuel Surchage: Waived in any fuel outlet

Other Benefits: Cash Back 2% on all purchases,Balance Transfer-Low Interest options available

SBI SILVER CREDIT CARD

Best Features

Fees: No fees forever

Interest Rate: 3.1%

Fuel Surchage: Waived in any fuel outlet

Other Benefits:Cash Back 2% on all purchases, Balance Transfer-options available

BOBCARD EXCLUSIVE YOUTH CREDIT CARD

Best Features

Fees: Joining Fee of Rs 750/-, No renewal Fee for next year

Interest Rate: 1.99%

Fuel Surchage: Waived in any fuel outlet

Other Benefits: Personal accident insurance free, Medical Emergency withdrawal allowed

BOBCARD EXCLUSIVE WOMEN CREDIT CARD

Best Features

Fees: Joining Fee of Rs 750/-, No renewal Fee for next year

Interest Rate: 1.99%

Fuel Surchage: Waived in any fuel outlet

Other Benefits: Personal accident insurance free

Con: Only for women.

BARCLAYS BANK SMART BUDGET CREDIT CARD

Best Features

Fees: No fees forever

Interest Rate: 2.95%

Fuel Surcharge: Waived in all outlets

Other Benefits: Free Cash Advance for a limited time,

0% Balance Transfer, consolidate transaction over Rs 5000 and pay them as EMI

Cons: Available only in metros and for businessmen.

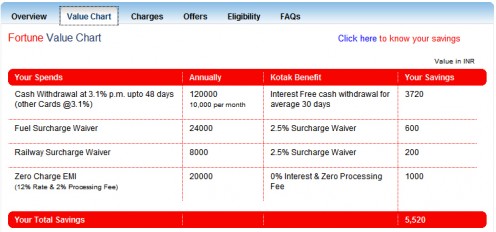

KOTAK MAHINDRA FORTUNE CREDIT CARD

Best Features

Fees: No fees forever

Interest Rate: 3.1%

Fuel Surcharge: Waived in all outlets

Other Benefits: Interest free cash withdrawal for 48 days (flat fee 149 for 10000 applies),

Railway surcharge 1.8% waiver for online or in person ticket booking,

Discounts in select flights and hotels,

Consolidate transaction over Rs 5000 and pay them as EMI-no fee no interest for 3 months,

No fee transaction on any VISA ATMs.

Cons: Available only in metros and for business.

KOTAK MAHINDRA TRUMP CREDIT CARD

Best Features

Fees: No fees forever

Interest Rate: 3.1%

Fuel Surcharge: Waived in all outlets

Other Benefits: Interest free cash withdrawal for 48 days (flat fee 149 for 10000 applies),

Railway surcharge 1.8% waiver for online or in person ticket booking,

Discounts in select flights and hotels,

Consolidate transaction over Rs 5000 and pay them as EMI-no fee no interest for 3 months,

No fee transaction on any VISA ATMs.

Cons: Available only in metros and for businessmen.

BOBCARD VISA/MASTERCARD CREDIT CARD

Best Features

Fees: No Joining Fee, Renewal Fee of Rs1000/-

Interest Rate: 1.99%

Fuel Surchage: Waived in any fuel outlet

Other Benefits: Personal accident insurance free

NEXTGEN BOBCARD GOLD CREDIT CARD

Best Features

Fees: No fee forever

Interest Rate: 2.5%

Fuel Surchage: Waived in any fuel outlet

Con: Only for students.

Disclaimer: The author is not a financial advisor and the information in this article for educational purposes only. The author does not guarantee and makes no representations as to the accuracy, quality, validity or authenticity of any rates or terms posted by credit card issuers. All information is subject to change without notice.

Info: The author does not work for any of these banks or receive monetary benefits for recommending one of the credit cards from the banks. This is an independent honest review of the credits cards offered by the banks. This article lays out the features it is up to you to choose the credit card that is right for you.