Inflation: A Significant Economic Indicator

Rise and Fall of Stock Market

If only you can understand the factors that cause the stock market to rise and fall, then you can be a very good stock trader. Unfortunately, there are thousands of factors which only add up to create more confusion to millions of investors. Corporate earnings, corporate news, political news, and general market sentiment will all move the market. From these, the factors to do with economics are the most significant influence on long-term market performance.

Significant Economic Indicators

The three most significant economic indicators to stock market investors are inflation, gross domestic product, and labor market data.

Profits

Low inflation means things are good. Low inflation means the cost of doing business is low and keeps a company’s profits high.

What causes inflation?

The US Can Print More Dollars without Any Negative Consequence

The US economy is the finest in the world. The US has quality goods at high prices. They have everything money can buy. The demand for US dollars overseas is high. Unlike the economies of other countries, the US is the only country that can just print more dollars out of thin air without any negative consequence related to exchange rate just because there is a high demand for US dollars overseas.

Buying Stocks

If you buy a stock and it manages to go up by say 5% in one year and at the same time the inflation rises by say 5%, then in the final analysis you have done nothing. In order to take on that market risk, then you need a risk premium above and beyond the 5% inflation rate. When you buy stocks you expect that the returns will be higher than the inflation rate. If inflation rates are getting higher, then you have fewer investors buying stocks

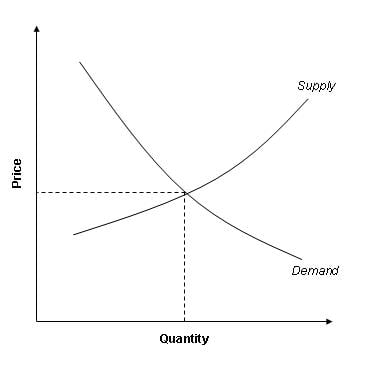

Supply and Demand

What causes inflation? It all depends on supply and demand. It can be from increased demand for a particular product. It can be from increased prices of supplies. It can be from limited supplies. It can be from fear that supplies might be limited at some point in the future.

Output Gap

The balance between supply and demand in the economy is called output gap. The output gap measures the difference between the economy’s potential (where all capital and labor resources are in use) and the actual level of output. To get the actual level of output is easy because it’s measured by GDP, but to get the potential output is not easy and can only be estimated.

Measure of Inflation

Consumer Price Index (CPI) is a measure of inflation and is widely followed by many investors. Consumer Price Index is issued every month by Labor Department. Consumer Price Index measures the increase in the price of a given "basket" of goods and services purchased by the average consumer. The percentage increase in the price for these goods in one year is the inflation rate. If the percentage increase is negative, then it’s called deflation rate.

Growth Domestic Product

When the Growth Domestic Product increases, the output gap decreases. This translates to a greater risk of inflation to the economy.

High Demand for US Dollars

The US economy is the finest in the world. The US has quality goods at high prices. They have everything money can buy. The demand for US dollars overseas is high. Unlike the economies of other countries, the US is the only country that can just print more dollars out of thin air without any negative consequence related to exchange rate just because there is a high demand for US dollars overseas.

The Party Is Over

But the party is soon coming to an end. Unless the US gets back to the drawing board, they may not have any more cards under the table.

The hubber's website is designed to help beginners and average readers make money online to supplement the few dollars they may be earning from their online trading – details of which you can find in my profile here, if you will.