Instant Gratification is a Dangerous Myth

Spiral I by Robert A. Sloan

Instant Gratification and other insulting myths

"American consumers just want instant gratification."

That's a statement repeated so many times in so many editorials, sermons, media that people take it for granted as fact and feel vaguely ashamed of themselves every time they get a cup of coffee at Starbucks, eat out because they worked late and are too tired to eat dinner or at the end of a pay period, wind up doing anything besides paying the bills. I don't think it's accurate.

I think it's a mislabel for a common bad attitude -- and insulting to working people everywhere, who have deferred gratification a long time and put up with hard work, often with added humiliation, emotional abuse and unreasonable levels of stress who have spent an entire pay period looking forward to what they can finally do on payday. That's not "instant gratification."

It's a natural human desire to gain a real reward after putting in a lot of effort and deferring gratification. So why does it get so many people into trouble?

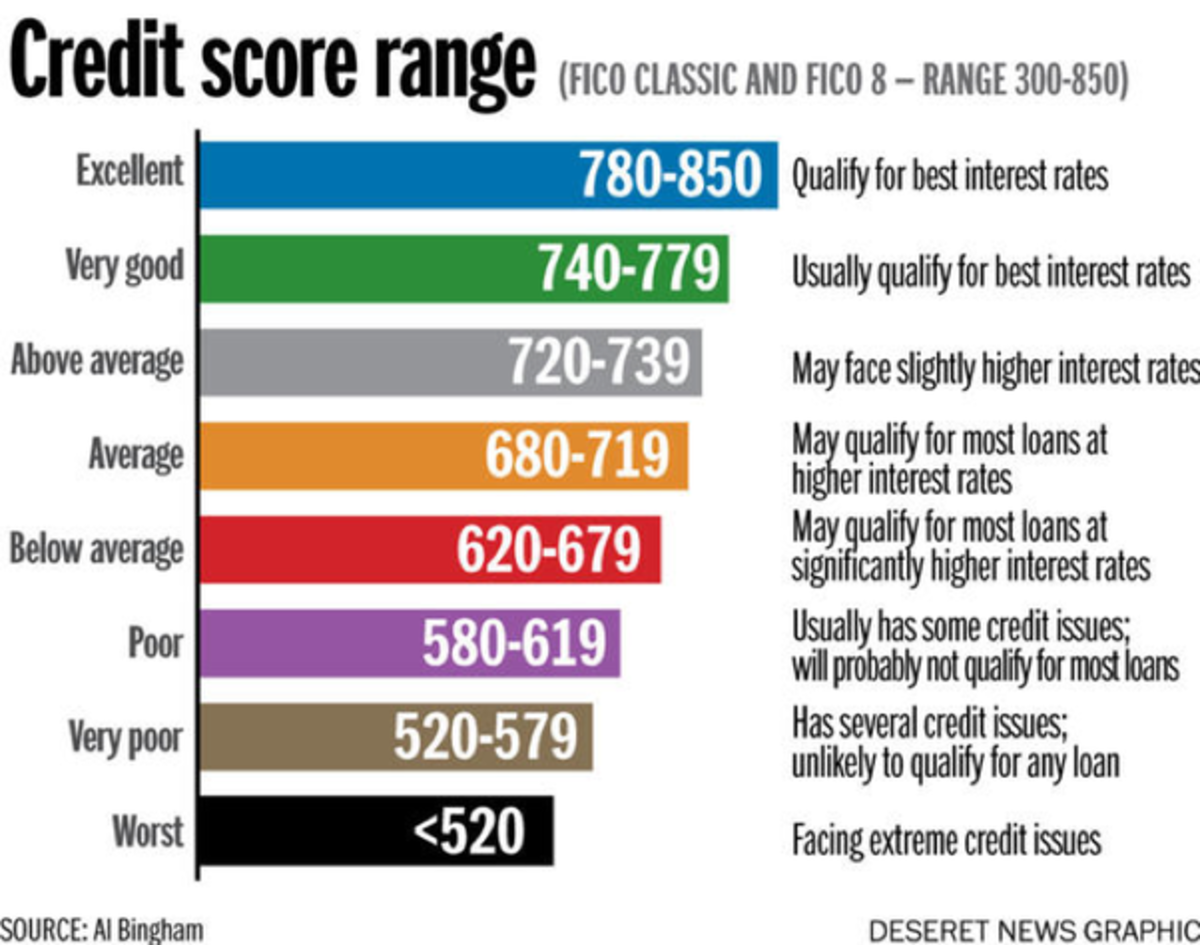

The sentence that comes right after "American consumers want instant gratification" usually leads into "that's why they run themselves into debt for luxuries they can't afford." The problem is real. Debt is spiraling. People do buy a lot of things they don't want and don't need at inflated prices and often on the worst terms.

Using a credit card without paying the entire bill immediately is borrowing money on terms that approach Mafia loan sharks. You can wind up paying for the same purchase four or five times over by the time the bill gets retired or you go bankrupt, which is why the companies haven't complained so much about the bankruptcies. Interest will kill you.

The simplest discipline is to just live thriftier -- don't spend more than you have, spend the actual cash you have left after necessities and save up for anything that costs more than you can do on a paycheck. Like those two big necessities, a House and a Car.

Foreclosures reached an unbelievable level because people are falling off the treadmill left and right when any unexpected medical or other emergency breaks their month-to-month barely-balanced budgets. Savings, if they had any, got eaten up in debt or emergencies. It's cheaper to buy down the debt and treat credit cards like debit cards than to save money, beyond having a sensible emergency fund that'd cover everything basic if something happened.

But I have known way too many people who don't go craving Instant Gratification and still wind up in trouble -- because it's not instant gratification. Expectations get raised by a pay period of hard work in stressful, often abusive conditions and whatever deprivation the person's managed to put themselves through in order to make it to the next pay period.

They arrive at that paycheck in a tired, stressed, emotionally vulnerable state where they've run themselves into the ground and what they are looking for at that point is a tangible reward for all that hard work. Easy credit and advertising wave false promises at them and their judgment is skewed by stress and fatigue. It's easy to forget that you do have to pay the card on your next check.

So that isn't "Instant Gratification." But saying so is a way to misdirect people from the real problem -- which is that all that overwork does create real emotional needs for a reward, one that is truly satisfying in a way that's social and emotional. It has nothing to do with what you paid for it and everything to do with how you feel about it.

I'm an ex-spendaholic. In the 1980s when I earned more than I ever have again in my life and worked 90 hour weeks, I went bankrupt on exactly that cycle. I didn't even have that many credit cards, just a Sears card and some payments on some furniture that turned out to be shoddier than the thrift store furniture I replaced it with. I grew to loathe that $750 couch the faster it broke down and was still paying on it long after it degraded to unusable trash.

I changed my expectations when I became a self employed street artist and knew I was living on the cheap. I didn't borrow anything. I found an inexpensive apartment and worked the hours I wanted to pay for necessities and then as much as I wanted in order to get the things I wanted -- and those things started mounting up as I started to see how well I could live on less if I looked for bargains and understood my emotional needs.

I shifted my balance and hit a plateau between work and spending where I only bought what I could afford, and since I leaned toward physical things that would still be good a month or year later bought as cheap as I could get them, I wound up living pretty high on the hog. I wasn't struggling to pay the cable bill.

What I bought with that lifestyle change was the luxury of sleeping in on Monday mornings and taking off if I felt like it and the day was going slow. So I became very frugal in order to keep this privilege of not having a yelling boss or working to someone else's schedule, and until my health failed I lived well on an income that was under $5,000 a year. I now live well on a low fixed income with disability and still have a perk to look forward to every month.

Years ago, a sermon by a Unitarian minister on the radio made me think about this. It was in the holiday season and most of the preachers were thundering against another myth: "Christmas is Too Commercial." Instead he talked about why people go shopping and what they're really buying when they do.

At work you get told what to do all the time. In the family you have to weigh what you want against everyone else's needs and there's endless discussion or fiery arguments about every single purchase. But when you go shopping it is the one point in life when you are in charge. You're making decisions without anyone else second guessing them. You get to just do what you want, and sales people are going to treat you with more respect than the people at work (or often the people at home) do.

Shopping is a way to reduce stress by having a break from constant petty harassment and having all your decisions second-guessed.

I listened and realized he was right. That the emotional reward of getting to go shopping was being able to decide for myself exactly what to do with my money, while being treated respectfully by sales people.

I looked at my 1980s habits and realized that putting my paycheck in my pocket and heading for trendy stores and malls was asking for a ripoff. I could have the same fun stopping by the French Market with a five or a ten, or going to a used bookstore and coming out with a big stack of favorites.

In the bankruptcy, a financial counselor put an entertainment budget into my budget. That surprised me because like most people I believed if you were tightening the budget you had to treat it like All or Nothing dieting. Financial counselors know better. People try that and binge and bust like dieters, with the shaming "You just want instant gratification" ringing in their ears to put a damper on the pleasure they got from the purchase just like dieters are shamed and guilt tripped if they have one piece of chocolate.

People I've known who really changed their habits, lost weight and kept it off are very fond of enjoying one good truffle instead of a half pound bag of M&Ms. If what I'm buying when I shop is being treated well, seeking out places where everything is cheap and the service is good gets me more of what I really want -- a pleasurable shopping trip with an added little luxury or two for my life -- than going to a mall and paying extra at ruinous interest for what I liked best out of what they had, which was never what I really wanted anyway.

That worked. Ever since I made that lifestyle shift, I reached an even balance. I didn't spend more money than I had because cutting up the credit cards taught me not to borrow money. But while I defined my shopping trips as "impulse shopping," my daughter has corrected me on that.

It's not impulse shopping when I spend all month planning what I'm going to do with my spending money, even if my ultimate decision is to budget $25 to $30 for books at Amazon and decide which books in the moment. I put a lot of forethought into my purchases before even deciding where to go -- do I want books or art supplies? But to me it feels like impulse shopping because I didn't decide exactly what to get before I place the order.

I started shopping online when I realized how much cheaper it was, that it had no lines but because it's essentially mail-order, it has much lower overhead. Usually the savings get passed on in terms of big proportions between Retail List Price and the online company's price. I pay for it in a wait of between two days and two weeks depending on who's shipping and how -- and that becomes more anticipation, like a kid waiting for Christmas morning.

The problem with Apparent Instant Gratification is that after working long and hard and doing without any luxury, then being stressed and tired, it's too easy to lose all judgment. The first ad for anything you wanted for a long time is going to grab your attention and the credit card companies do their best to get you to ignore the fine print. They make their money by all the people who don't pay it off within 30 days and borrow money in short term loans at ruinous interest.

They might go out of business if everyone started just treating them as debit cards and ignored their line of credit, just spending what they actually have at the end of a pay period.

So knowing what it is you want at the end of a pay period -- what your personal wish list is, what individual things are high or low in priority on it and what your resources really are -- it's possible to break the cycle of Instant Gratification by recognizing that yes, you do need an emotional reward.

It's old hackneyed advice, but set aside a reasonable sum of money for "Reward." If you work hard and put up with difficult conditions, you do deserve some reward.

I broke my habit of not saving in a weird and creative way recently. I could not manage to save up for anything, because I missed being able to decide what to do with my spending money when I have some. I felt deprived if I had to set aside some of it and not get everything I wanted.

So I decided arbitrarily that every time I put $50 or more into savings I would buy myself a Terry Pratchett book. He's a prolific author and one of my favorites -- and I won't buy one of his books if I haven't done savings that month. This is working. The second month, I automatically put savings in before going to place a Blick order for art supplies and didn't feel like the Blick order was shrimpy.

The trick to an effective reward system like that is to find something inexpensive but deeply personal that you enjoy that much. Then stick to the rule.

Instant Gratification and Impulse Shopping are the result of tired, stressed, distracted people who have worked hard without reward getting overpriced rewards waved in their face by dedicated professional advertisers. Think of how many ads talk about Rewarding Yourself -- with very expensive things like new cars or high priced clothing, entertainment, that sort of thing. The advertisers know what's really going on behind it and they are all competing for your attention at a time when your judgment is lowest -- for good sensible reasons.

So decide the Reward at the top of the cycle. "I get to go to a good movie," or "I get a new CD" or "I get a Terry Pratchett book." Set the price range for the reward. You're you. I don't know what really thrills you. It might be getting a used Matchbox car on eBay, new music, something to wear, going dancing, sports equipment -- it's your own thing.

But if you make the general decision first, then go ahead and decide the specifics in that tired needing-reward state, your personal rewards for sticking to the savings plan won't have that shame and guilt attached to them. You can actually enjoy the reward for savings without any aftershock stress of "oh why did I do that?" and "what is this going to do to my bills?"

If you are already in deep debt, I'd suggest trying to knock down the credit card bills steadily. That'd take a long time but it can reach a point where you're looking at having more left every month because a bill is gone -- just gone, doesn't need paying any more. Knocking them out one at a time is a good way to make it easier to knock out the rest, because the lower bills would let you put more into paying off the next one.

But always leave yourself a planned reward -- just plan ahead what the amount is and then enjoy it in the way you most want it. The only real solution to this economic problem is an individual one -- to go against the tide and not buy into knee-jerk consumerism. It's amazing how good it feels to make progress and not beat yourself up too, that kicks another stress right out the window.