Investment Strategies and Mistakes

Investment Strategy

When you get ready to start investing you need to devise a strategy, or better yet a method in which you make your investments. Think of investing like gambling. When I gamble I will only use a predetermined amount of money, money that I can afford to lose. This is also how you should conduct your investment transactions; it is also called a strategy.

There are many facets that are involved with investments. Just like stores have thousands of products to choose from, so does the market. There are thousands of companies you can invest in, and there are many ways to invest in those same companies. The best advice I can give you is to research everything about investing. Failing to do your homework on a stock usually ends in catastrophe.

Like I said earlier, research is so important that without it you can quickly become confused and disoriented. There are countless websites that talk specifically about stocks, there are sites that show you charts. There are even websites out there that will teach you how to read those charts. Patience will take you a long way with investing. If you jump too soon into the market you can quickly become lost. So take your time, do your research, do your homework, find a stock that fits you just right and that you are comfortable with, then figure out how much you’ll put into it. All the different investments out there to choose from will be your strategy, coupled with how much your risk tolerance is.

Now, I would never tell a young Soldier to go fix a vehicle he or she has never worked on before and expect them to be successful. I would be there with them, teaching as we worked together so that one day that Soldier can do it all alone. This same principle should be applied to investments. If you’ve never done it before, work with a professional until you feel like you could do it on your own, which is the desired result. Doing this will provide you with a learning curve that will teach you what your strategy is and what your risk tolerance is.

Furthermore, you must never invest money without a clear cut goal and a strategy on how to reach that goal. Those two items are of the utmost importance because I feel without them you cannot have success. The same way you would give your money away without knowing where and what it will be doing so should investing be. In your goal you should also have an end time for getting your money back, plus all the dividends you received.

In conclusion, we discussed what the most important thing to investing is and why it is important.

Investing Mistakes to Avoid

People make mistakes; we are after all, human. To err is human to forgive is divine. Well, yes this is true but the stock market is not divine, and it will eat your hard earned money if you’re not careful. Some mistakes are recoverable, but then there are some that are unrecoverable. Those big mistakes should be avoided at all costs if you are to become a success in the markets. One mistake that is probably the biggest one of all is to never invest, or to put it off until you’re older. When you are young it is a heck of a lot easier to recover from financial losses than when you’re older. So do not let your fear of the stock market leave you wondering. It is better to try than to not try at all. If you don’t try you will definitely fail, but if you try you may succeed. 50% is better than 0% right?

How much money do you need in order to invest? A measly 20 bucks is more than enough to get you started, and if you lose it what are you out?

Investing Literature

There is another mistake that could be costly as well, that is investing before you are in a position to do so. That goes right along the lines of investing only what you can afford to lose. Making sure your financial situation is squared away first will ensure you have money freed up for investing. You may be asking what exactly defines a perfect time to invest. Personally, I believe you should have a clean credit report, your higher interest credit cards should be paid off, and you should have a couple months worth of living expenses saved up. Now then, the above would be a perfect scenario, but we do not live in a perfect world. So, I think you should do what feels right to you. If you are scared to lose 20 bucks, the time is not yet right. When you have no fear of losing 100 dollars that is the right time. When you reach this juncture, go for it. By that time you should have already been doing tons of research and investigations of stocks and you’ve probably been watching them closely.

Another mistake people make, and end up leaving the market permanently is investing to get rich quick. Some people can do it with ease—like Warren Buffet, while the vast majority of us only end up losing. High Yield = High Risk, remember that always and be your own bull. Some rapid earning investments might be necessary at times but should be entered into with extreme caution. Invest for the long term and allow that precious money to grow. Pulling out too soon is another investment mistake to avoid. There is going to be ups and downs that is just the nature of the game. In fact I don’t know of a single stock that has never gone down.

Diversity is not an old, old wooden ship from the civil war like Ron Burgundy said in Anchorman. Just like the news stations of the 70’s you must also be diverse in your investments. Never sink all of your money in one medium for investment. Spread that money out in different forms of investments. You should invest in everything from a savings account to mutual funds and certificates of deposits, and bonds, to the actual stock market. The reason for this is if one asset takes a huge hit, your other money will be fine, heck it may even be going up. When you reach a low in the market know that a solid stock will usually go back up.

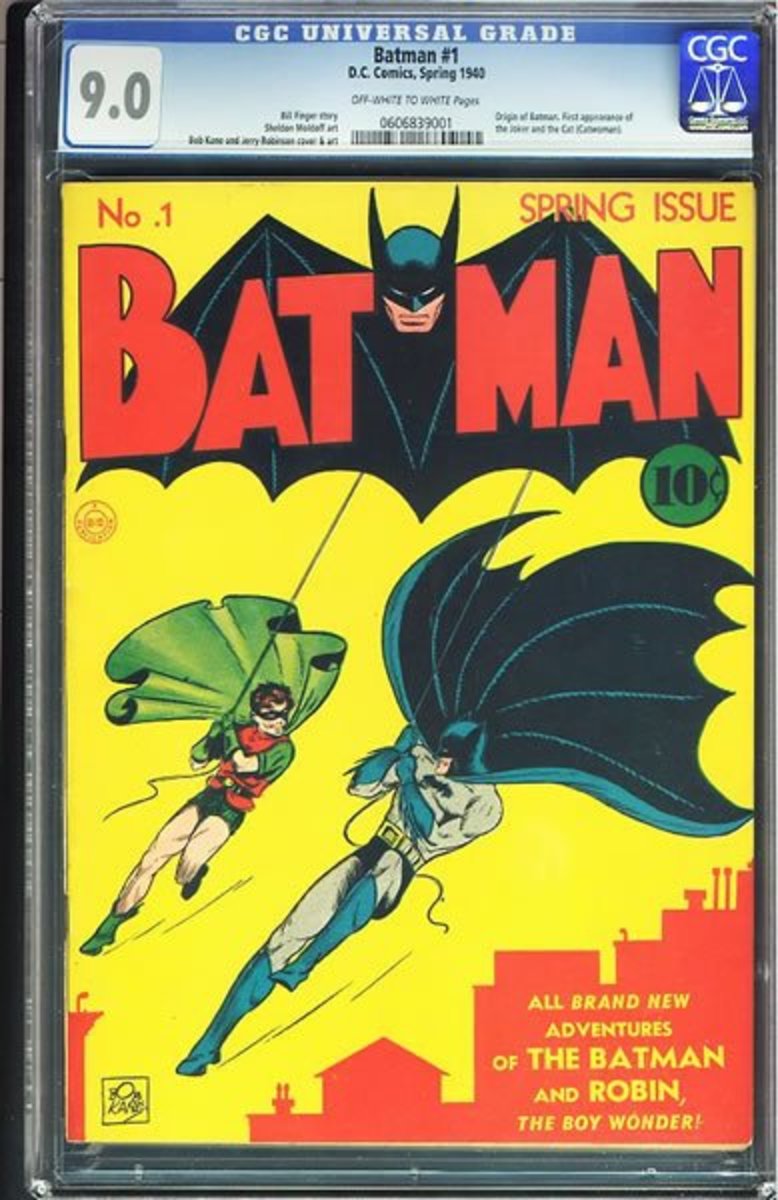

I know of a lot of people that have all kinds of bizarre collections. Coke bottles, baseball cards, civil war pennies, stamps; all these things are worth some money but I seriously doubt anyone could retire off their baseball card collections. Enjoy your time investing and avoid these mistakes at all costs. Remember that a financial goal coupled with a strong strategy and the avoidance of detrimental mistakes will cause you to enjoy financial success.

© 2010 by Wesley Cox. All rights reserved. Copying without permission is illegal and will be prosecuted.