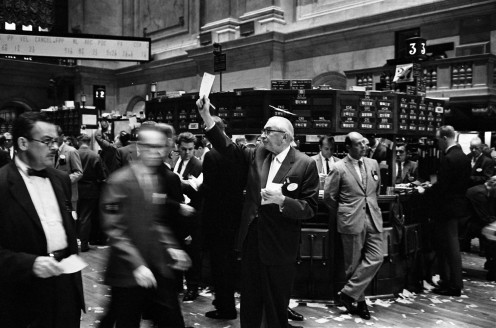

Is It Safe to Invest in Stocks?

N.Y. Stock Exchange Traders

Is a Bull Market in the Cards?

When the Dow Jones Industrial average ticked above 8,000 recently the talk of the town was: Will it soar above 10,000?

Even The Hour newspaper broached the subject in one of its weekend polls, and most respondents thought the optimistic barrier would be reached. But instead of rising, the Dow Jones made a hasty retreat toward 7,600 before returning to the wide swings that have characterized stocks lately.

The volatility, however, should not be surprising. The stock market, by design, is enigmatic at best.

The Contrarian View

That's why there's a segment of market players called "contrarians." Whenever any market opinion becomes popular, the theory goes, the wise thing to do is to take the opposite, or contrary, position.

Because the market goes up and down in a never ending cycle, contrarians always end up looking like geniuses.

Financial pundits can tick off dozens of strategies for winning in the market. Such advice ranges from the astrological alignment of the stars to environmentally correct stocks or mutual funds.

When the man on the street (Main Street, not Wall Street) begins touting the stock market as a good place to make a buck, most professional investors become extraordinarily wary. It reminds me of the story about the big time investor who was given a stock tip by a man who was shining his shoes; he wasted no time in dumping his substantial stock holdings on the market. To him, that was a clear sell signal.

Buy Low, Sell High

Like the discount brokerage house that advises "buy low" in its advertising, so-called momentum investors advise: Never buy a stock that's going down; never sell a stock that's going up.

Probably the most common advice offered to the average investor, however, is: Don't put all your eggs in one basket. Depending on one's financial position and investment goals, advisers often recommend balanced mutual funds that include U.S. bonds, corporate bonds, U.S. stocks, a mix of large and small caps, and a small percentage of an international fund.

But, after all is said and done, is it safe to invest in stocks?

That's the question in the minds of many people today -- people who have seen a meteoric rise in the Dow Jones average. They're not wealthy people, and they're not market followers. But, perhaps they have a few dollars tucked away in a bank or have some loose change in a 401-K or Individual Retirement Account (IRA.)

The Short Answer: No

The short answer to the question posed above is "No." But, there's another, longer, answer: Who can afford to be concerned about safety when the stock market is where the money is? And, unless you want to settle for generally lower fixed-income instruments like bonds, CDs or money markets, where else can you put your money to work and hope to see significant long-term growth?

Everyone knows that, on average, the stock market performs better than the "safer" bond market -- as well as most other places the average investor can tuck away his meager savings.

If I were a qualified financial consultant, which I'm not, I'd say: If you have a few bucks left over after you've paid all your bills, covered yourself with adequate insurance and put away a little for a rainy day fund, take the plunge into the market and, if you're thinking long-term, take your chances!

I wrote this column as a "My View" for The Hour newspaper of Norwalk, Conn., on Sept. 27, 1997. The stock market isn't looking too good today, but often that's exactly the time to take the plunge. I now write my views on a wide variety of topics on HubPages.