Is College Education Worth It?

A college degree has been regarded as a golden ticket to success for many years. However, with personal income averages increasing much more slowly than the cost of education compounded by the current condition of the economy, many people are asking if going back to school for a degree is really worth the trouble. If you don't have money saved up for school, and you don't necessarily qualify for any scholarships or grants, this could mean thousands upon thousands of dollars in student loans - sometimes as high as $100,000.

There are no clear-cut answers. Every action in life is a gamble. Maybe you will graduate and land that perfect job days later. Maybe the school has a placement program to find you that job, that would be the best outcome, though it is a rarity. Do your research before making the leap.

Many new graduates will leave college with a degree, a ton of debt, and no job to show for it. Some will find employment right away, but most will go months, possibly years unemployed before finding a career in their chosen field. Meanwhile, they still must make payments on their accrued debts from schooling.

If you would imagine, having $100,000 in debt, right out of school, and no job to help you with it. The only job you can land in the mean time is at your local general merchandise store with a rate of $9.50 per hour. The management won't allow you to work more than 40 hours a week, if you even get scheduled that much - trust me, this is extremely realistic. You're looking at about 1500 dollars in income per month, prior to taxes and deductions. That would barely cover your student loans, if it did at all! Where would you live, what would you eat?

Believe it or not, the total amount of student loan related debt now far exceeds the amount of credit card debt in the United States. This is actually a very alarming instance as total U.S. student loan debts have exceeded expectations when they crossed the 1.2 trillion dollar mark in late 2013.

Unfortunately it is becoming harder and harder for college graduates to get jobs in the field they studied for. Which results in not enough income to pay off their student debts. Take a moment and consider these facts:

1) The unemployment rate for college graduates younger than 25 years old was 9.1% in 2013.

2) Over one third of college graduates end up taking jobs that don't even require college degrees. - 36% as of 2013

3) Over 18,000 parking attendants have college degrees.

4) 317,000 waiters and waitresses have college degrees.

5) Approximately 365,000 cashiers have college degrees.

6) 24.5% of all retail salespersons have a college degree.

Now, I'm not trying to scare anyone away from college, not in the slightest! I'm just hoping to inform readers. If one person, one person at all, gets information from this and uses it to prepare themselves and hopefully prevent the situation, I will be happy.

According to recent Pew Research Center polling, 75% of Americans believe that college tuition is too expensive for the majority of Americans to afford.

But why? Is it the increasing costs of education materials, such as text books and computers? It can't be, computer costs have been plummeting and the students pay for their own text books as well, which are also extremely over priced. So then why is it? What makes the cost of college tuition so ridiculously high?

As with anything in the world, it is greed in business, combined with rising operation costs. If the cost of electricity rises, they have to compensate for it from somewhere.

If the school is prestigious and well known, they will charge more. Granted, they will pay their staff more, as to keep the best possible faculty, but where do the rest of the millions in tuitions and fees go? Even with smaller, less prestigious schools, there is a lot of money going places that do not increase the value of education, but rather impede on it.

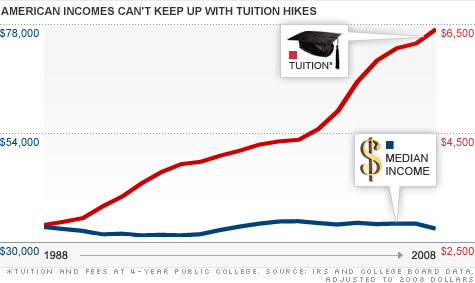

Income vs Student Debt

Over the past 25 years tuition costs have consistently risen at an average rate approximately 6% higher than the general rate of inflation. Since 1978 the cost of tuition on average has risen over 900 percent! Compound this with the insane rate of inflation on college text books, which has more than tripled in the last 10 years.

According to some sources, the average American income is no better now than it was 10 years ago, many stating the national average was actually higher then than it is now. Reports show general inflation at around 3% for the last 10 years, resulting in heavy debts and many more people struggling to afford putting dinner on the table.

With the rate of inflation, the current rate of income expansion, and the extreme rate of tution inflation, does it turn out being worth it?

How do I Avoid the Debt?

There is no real way to avoid the debt, outside of scholarships or grants. The easiest solution is to pay for as much of your schooling as you can from your own pocket. This means intense savings plans, and extended time in college. Most schools have a payment plan where you can take a few classes at a time and pay as you go. For instance, a friend of mine is currently doing two courses per semester and paying almost 200 dollars per month, but at least its affordable. This won't work for all colleges or even all programs, as many specialized programs you need to take it all on their schedule just to maintain your status in the program.

Wait, So College Isn't Worth it!?

I never said that. College is a gamble. If you pick a high demand field you'll have a much better chance for success. I've noticed many of my friends choose the super high-paying fields that really aren't in demand for that exact reason - everyone is trying to get into that field. Many of these fields are the ones you hear about as being high paying all too often. Think about it, if everyone wants to be a doctor or a lawyer, how many jobs are open on the market for these people?

There are many jobs in the market that do not require a full on degree, that still pay very good money. A friend of mine is an electrical lineman with the power company, for instance. He brings in on average $150,000 per year, and the only requirement was a little time at a technical trade school - which, might I add, is majorly less expensive than a full time college per semester.

So if you want that stereotypical high paying job from your college experience, take a minute to examine it and think it all through - you may be more financially well-off in the long run spending a few semesters at a trade school, or even just working your way up the chain in a career that requires little more than a certificate.