It's Time Kenya maintains her Debt-to-GDP ratio in a Manageable Level

Its time the Government check its ballooning public debt before it explodes

As of 2016, the Kenyan Government Debt equivalent to the Gross Domestic Product was 55.20%, up from 38.2% in 2012, representing a 17% increment over the 4 year period. Debt-to-GDP ratio is a country’s government debt (amount) and its Gross Domestic Product (years), with 60% being the accepted barometer (E.U standard criteria), meaning a country’s National debt beyond it is viewed as unsustainable. With Government assurances that our Public Debt is still manageable but its increase over the years points that we’re on track in surpassing the 60% mark.

But what prompted the increase over the years, from 38.2% (2012) to 55.2 %( 2016), what underlying factors contributed to the rise of the Ratio, has the Government deliberately encouraged the steady increase of the Ratio, has there been a positive or negative impact in the economy, can the Government manage the rising public debt, can practicing unlimited total monetary sovereignty like the U.S.A or U.K help in taming the rising Public debt.

What is Public Debt

Public Debt is how much a country owes to lenders outside of itself, and is categorized as internal debt (owed to lenders within a country), and external debt (owed to foreign lenders), or in terms of duration; Short (1 to 2 years), mid (in between long & short), or long term (10 years or more).

As of September 2016, Kenya’s public debt was Ksh 3.6 trillion, up from Ksh 1.5 trillion (2012), of which the external debt was Ksh 1.7 trillion, and internal debt was Ksh 1.85 trillion according to theCentral Bank of Kenya which meant that for every Ksh 100 collected by the Kenya Revenue Authority, Ksh 32 was spent on servicing our national debts.

With our National Budget increasing yearly, and K.R.A (Kenya Revenue Authority) constantly missing her revenue collection target, we are continuously faced with Budget deficits, forcing the Government to borrow funds either externally or internally and hence perpetuating a vicious cycle where the only outcome is the steady increase of our National Debt.

COUNTRY

| DEBT-TO- GDP RATIO

| YEAR

|

|---|---|---|

U.S.A

| 103.8 %

| 2017

|

JAPAN

| 243.2 %

| 2013

|

CHINA

| 22.4 %

| 2013

|

UNITED KINGDOM

| 89.1 %

| 2016

|

GERMANY

| 70.1 %

| 2016

|

FRANCE

| 98.2%

| 2016

|

A table showing countries with various Debt-to- GDP ratio

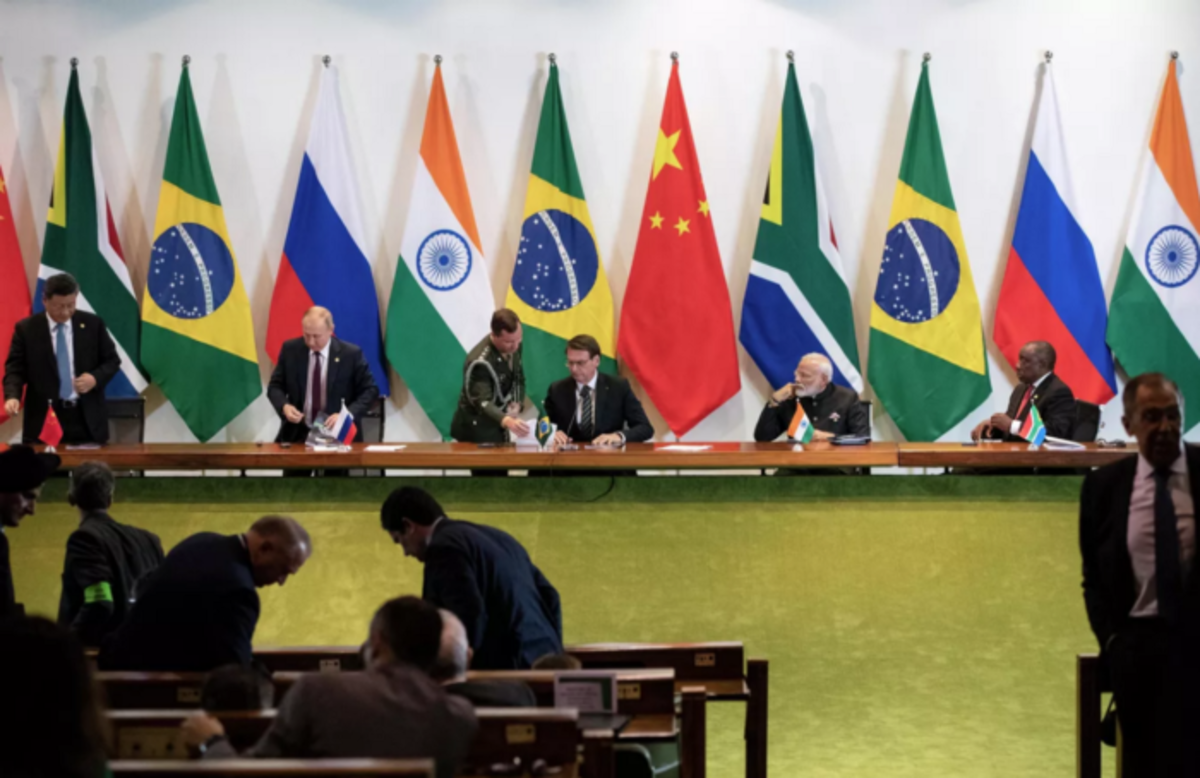

Comparison between Kenya Debt-to-GDP ratio vs Other Countries

If we compare our Debt-to-GDP ratio with other countries for example; Japan- 250.40 %( 2016), U.S.A- 106 %( 2016), & United Kingdom- 89.3 %( 2016), we presume our Debt-to GDP ratio is lower hence sustainable & on the right trajectory, but in contrast with our ratio set to increase, it will become untenable, and likely we’re headed in the opposite direction as warned by World Bank and the I.M.F (International Monetary Fund). Then why are countries with a higher Debt-to-GDP ratio than ours are said to have a sustainable national debt? What mechanisms are they using in managing their National Debt? Can our Government constrained with its limited options use those same mechanisms, instead of heavily taxing & borrowing, and the effects passed on citizens?

Unlimited Monetary Sovereignty

Having an Unlimited Monetary Sovereignty shows how countries like Japan, U.S.A & U.K are able to sustain their National Debt. Monetarily Sovereign Government means; they have the exclusive& unlimited power or ability in creating their own sovereign currency i.e. they have total & absolute control over their currency.

Which means they can do as they wish with their own currency, i.e. (i)they can equal their currency to any unit or amount (1 USD = 10 Euros or 1 USD = 5 Ounces of Gold), (ii) as creators of their own currency they have absolute ownership, (iii) hence have other reliable options in sealing budgetary deficits other than taxing or borrowing, or (iv) and can pay any invoice of any size, at any time.

In contrast, Non-Monetary Sovereign Nations like those in the E.U, have surrendered their exclusive unlimited power in creating their own currency, hence use one currency; the Euro. Limited in creating them, these states ability in creating or obtaining money is pegged on the existing laws guiding on borrowing & taxing.

Kenya is a Monetary Sovereign Country, but in reality does it have Unlimited power or control over its own currency, can it be used in settling of debts or payments to another country, and is it able to stand on its own without the backing of another currency or commodity like Gold.

Limited Monetary Sovereignty

Despite being a Monetary Sovereign Nation, Kenya has limited control over its own currency; it only creates, issues & controls its circulation in the country, and accepts in payment of taxes and other obligations. But it will be difficult or impossible to pay other countries using Ksh. instead a generally acceptable Currency like U.S.D. will be used for payment.

Our currency is backed by other Currencies like the U.S.D, British Pound, Euros, or Commodities like Gold and the Central Bank has created Cash Reserves for such currencies to meet the Country’s obligation in payment of external debts and for Imports.

, (ii) as creators of their own currency they have absolute ownership, (iii) hence have other reliable options in sealing budgetary deficits other than taxing or borrowing, or (iv) and can pay any invoice of any size, at any time.

In contrast, Non-Monetary Sovereign Nations like those in the E.U, have surrendered their exclusive unlimited power in creating their own currency, hence use one currency; the Euro. Limited in creating them, these states ability in creating or obtaining money is pegged on the existing laws guiding on borrowing & taxing.

Kenya is a Monetary Sovereign Country, but in reality does it have Unlimited power or control over its own currency, can it be used in settling of debts or payments to another country, and is it able to stand on its own without the backing of another currency or commodity like Gold.

Maintain Our Debt-to-GDP ratio to a manageable level

Hence in equating our Debt-to-GDP ratio to the likes of U.S, Japan, Germany, and U.K who practice Unlimited Monetary Sovereignty & have a free reign in printing more money in meeting their obligations and use it in payment of external debts is impractical.

Thus we have to sustain our Debt-to- GDP ratio in a manageable level by; creating good fiscal policies, reducing or eliminating institutional corruption, promoting local industries, maintaining favorable balance of payment position, reducing recurring expenditure, creating employment opportunities and engaging in developmental projects.With limited options in raising revenues in meeting our obligations other than taxes, borrowing (internally or externally), or selling of bonds etc. the Government should find other ingenious ways of sealing our Deficits without unnecessarily burdening the citizens and sustain our Debt-to-GDP ratio to an acceptable level.

© 2018 Van Nchogu