Jim Rogers and China Agriculture Commodities Index Fund

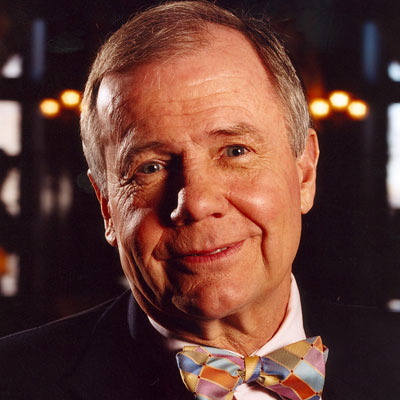

Introduction to Jim Rogers

The international commodity investment vehicle recently started by Jim Rogers named the "Macquarie and Rogers™ China Agriculture Index," focuses on agricultural commodities in China, and was formed based on Rogers' belief that China will be the bellwhether for agriculture for a long time into the future.

Macquarie is a large funds group based in Australia, and has gladly partnered with Rogers in what they perceive as a potentially highly profitable venture.

Jim Rogers is of course one of the most highly regarded investors in the commodity sector, and made a fortune when he co-founded the Quantum Fund with George Soros. Over a 10-year period, the fund enjoyed returns of over 4,000 percent. Just a $1,000 invested would have turned into $1 million after only a decade.

Anyway, after Rogers enjoyed that period of success, he basically retired and travelled around the world, about which he wrote a book called "Adventure capitalist," where he describes his journey and adventures during that time.

Reasoning Behind Macquarie and Rogers China Agriculture Index

There are several reasons why Macquarie and Rogers are providing this index.

The primary reason is the large, emerging middle class in China, which is growing significantly, and wants to eat better along with consuming more goods and services.

The Rogers' fund targets those people by focusing on the most predictable aspect of Chinese behavior - eating. No matter what happens with anything else economically over the years, the Chinese people will have to eat no matter what.

Now they have the capital to demand more and better food, which will have a significant impact on food demand and prices.

What is the Macquarie and Rogers China Agriculture Index?

The unique factor concerning Jim Rogers commodity index is in what it tracks.

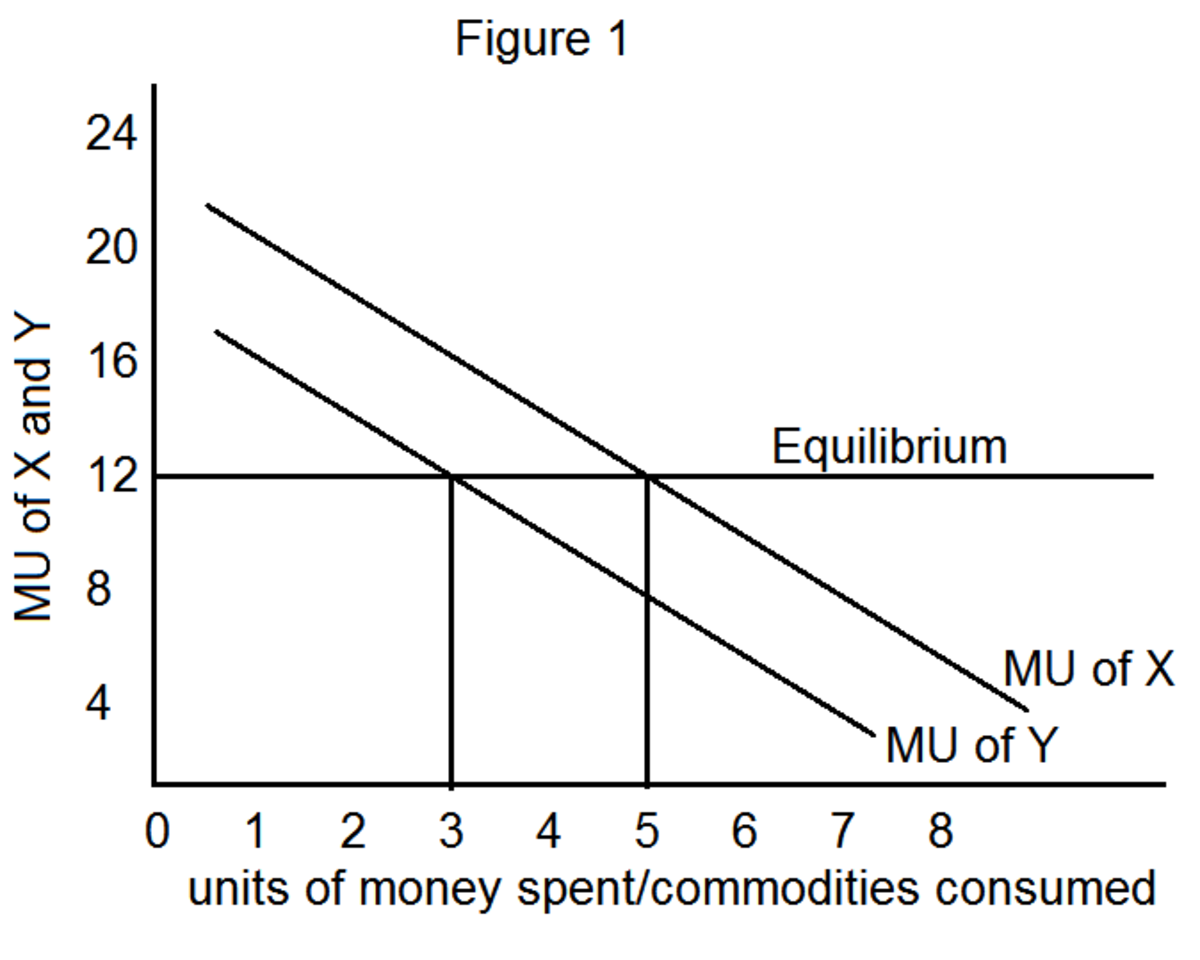

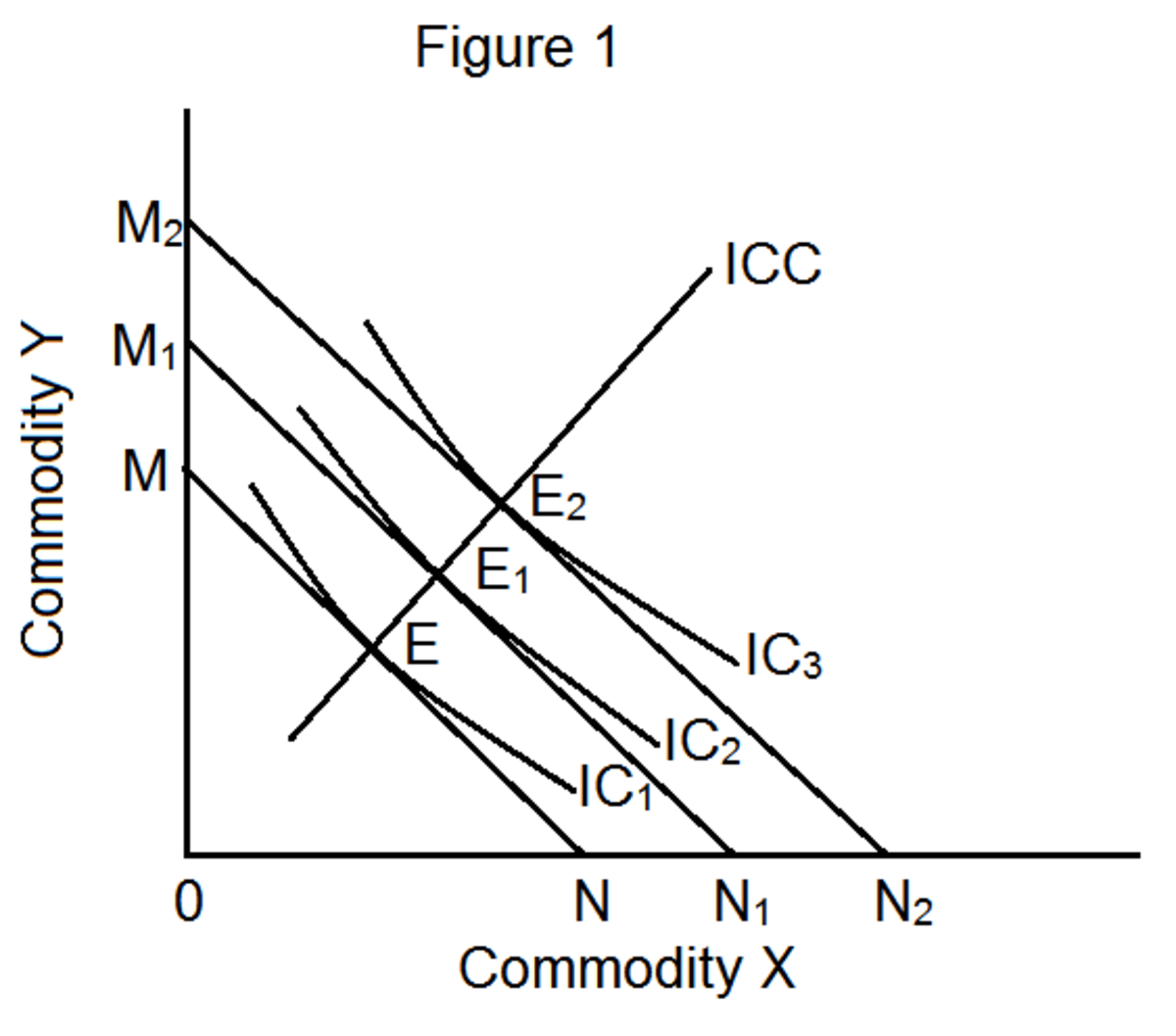

Most commodity index funds will focus on supply side or the production factor as the what they measure or base the index on. The performance of the commodity index fund will be determined by that.

That's a way of saying they measure what is being grown, not what is being consumed.

With the Jim Rogers index, it takes into account actual and projected Chinese food consumption, rather than if it is in the field or not. This should result in much more targeted and accurate price indicator, which should also be a better performing index.

Here's how it's described on the official Macquarie and Rogers website:

"The Index incorporates the spot return of the underlying commodity contracts plus the discount or premium obtained by rolling over the contracts as they approach delivery. The roll period is a period of three business days from the day prior to the last business day of the month to the first business day of the following month.

"The Index is calculated on both an excess return and total return basis. The excess return index reflects the return of the underlying commodity futures price movements, whereas the total return index reflects the return on fully collateralised futures positions."

Jim Rogers on Who will be the True Wealthy in the Future

Jim Rogers has been evangelizing for some time now that it is no longer going to be the bankers and financial industry that will be the future wealthy, but rather those that invest in or or become farmers.

Obviously he's not talking about riding a tractor, but owning the operations; although I guess if you enjoy it you can do both.

What he's saying is there will be an increasing demand for agricultural products, and that will be the way it is for a long time into the future.

Those who wisely see and respond to that reality will truly ride a commodity bull market that is only taking a breather because of the global recession.

What the economic slowdown has really done has extended the commodity bull market, not ended it.

Conclusion on Investing in China Via Rogers' Index

Asia is definitely the growth region of the future, and providing agricultural products to the growing population and growing middle class will provide large fortunes to those investing in the sector.

China is obviously the largest of all countries in the region, and that, coupled with being more predictable and stable than India, makes it the surest bet available to invest in, as far as Asia goes.

The Macquarie and Rogers China Agriculture Index should be an excellent way for investors to partake in the coming and ongoing agricultural bull market.