How to Properly Prepare for Financial Independence for Starters

You Are Doing it Wrong!

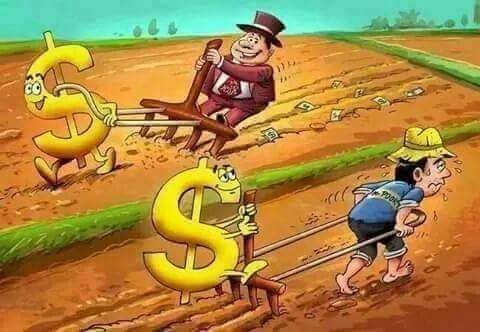

As you grow up, you can see your parents and other adults doing the Adulting 101. They get a job, work 40 hours a week, earn money, spend that money, and work again. As a kid, you admired what they were doing and wished to be like them when you grow up. You studied a lot, went to college, had your first job and spent your first salary as a reward for your hardworks. But its been years since you've started and you looked back on all the progress you have made, except, you didnt. You just saw yourself in the mirror so stressed out. Your savings is practically empty, and you're still dependent on you parents. You tried to figure out where it went wrong but couldn't come up with good excuse and just retorted to self justifications. "Im still young. It's ok." and "I will start saving up today". But unfortunately, years has passed and you still barely have anything but accumulated debt. You tried to pay the money you borrowed from your friend with the money you loaned from the bank. Bad move.

Since you could not figure out what was the problem, let me help you by pointing it out loud and clear - YOURE DOING IT WRONG. You technically got yourself stuck in a loop that basically you've inherited from the people around you. But don't you worry, it may be hard, but it is not unbreakable. You can still get out and start your very own journey to financial freedom.

But if you think you already know these basics, you may want to click this :Financial Freedom - Choosing the Perfect Mutual Fund

Financial Freedom

Before we go deep in the topic, first we must understand what "financial freedom" really means.

Financial freedom means that you get to live your life to the fullest possible and make decisions without being financially stressed because you are "prepared". You control your finances instead of being controlled by them. Financial freedom is something more personal than general.

There are many strategies to achieve financial independence, each with their own benefits and drawbacks. To achieve financial independence, you have to have a clear view of your current incomes and expenses, and identify and choose appropriate strategies to move towards your financial goals.

Step #1 - Understanding How Money works

Most people think that financial knowledge is only for rich people. But it is not. Investing in proper and complete knowledge on how the money works should be the first and top priority of anyone who pursues financial independence.

Most people work and earn money. They spend what they need and save what is left.

Wealthy people save money first and spend what is left. They let the money work for them.

By spending some TIME to learn about money, you will have a proper understanding on the basic building blocks of a strong financial foundation.

MAKE - SAVE - GROW - PROTECT

Also, thinking negatively about money is an obstacle to achieve financial freedom. You must eliminate the thoughts that having money leads to evil or that money can’t buy you happiness. In short, just think positive.

Step # 2 - Improve Your Cash Flow and Save

Improving your cash flow doesn't necessarily mean that you have to quit your current job and find another with better pay, or finding a second job to increase your inputs. Improving cash flown means improving the way you handle your money by proper and correct planning and allocation.

You always have to remember that the first thing you have to do is to SAVE. It's like paying yourself first, but instead of buying leisurely things you barely need, you keep your money in a bank or somewhere safe.

Once you have secured your saving, the next thing you got to do is PAY your DEBT. If you have borrowed money from a friend or bank, you should take in mind that paying them off as soon as possible is the best thing to do. Otherwise, they will serve as a great obstacle in pursuing financial freedom.

Saving takes more discipline and courage than it sounds and seems. Working and earning money will never suffice if you have unhealthy and improper lifestyle. Afterall, financial freedom will only be accessible to people who knows control. Before buying something, think of your dreams and things you really want to have in the future.

Step # 3 - Grow Your Money

Saving is good. But improper saving will not give us the freedom we are dreaming of. We have to make our money work for us and let it grow. Instead of keeping your money in your closet and let the molds grow in it, putting it somewhere that puts interest in it is a far better idea.

One way to consider is putting it inside a bank. Interest rates range from 0.5% to 1.125%. The higher the amount and the longer the terms of placement, the higher the interest rate. Though the interest rate may be small, the money grows in a steady nature. It also does not involve any risk and may be left with ease of mind. The only problem with Time Deposit is the inflation that keeps on fluctuating every year.

Inflation is the rate at which the general level of prices for goods and services is rising and, consequently, the purchasing power of currency is falling. Meaning, your money that you deposit in the bank today may not have the same value next year. And that is not a good thing. For you to be able to actually save, you have to beat the inflation. But inflation rate is often higher than what the bank can offer as an interest.

Another method of making our money grow is to tackle a more aggressive investment. Few of the most popular investment nowadays are stocks, bonds, and real states. In these kind of investments, risk is present. Yes, you may lose money along the way before you gain but the interest rate is higher than the bank offers. These kind of investments usually got an interest rate ranging from 10% - 15%. It may sound scary and intimidating, but with proper knowledge and preparation, this may be your highway to financial freedom. You just have to remember the rule - the higher the risk, the higher the returns.

Bank

| Investment

| |

|---|---|---|

Interest Rate

| 1% average

| Depends on stock but usually range from 10% - 15%

|

Guarantee

| Interest rates are guaranteed on time deposits. However, these usually provide modest returns.

| Risk is present so there is no guarantee of returns. Fund value may fluctuate depending on market conditions. This is why mutual funds should be held long-term

|

Starting Fee

| 10$ and above

| 100$ and above

|

Mutual Funds

If you think stock market is too scary for you and real state is also a no-no, you don't have to worry and mope at the corner. You can still invest in what we call Mutual Funds.

A mutual fund is a company that pools money from many investors and invests the money in securities such as stocks, bonds, and short-term debt. Investors buy shares in mutual funds. Each share represents an investor’s part ownership in the fund and the income it generates. These funds are managed by experienced and seasoned managers that spent most of their time studying and analyzing stock market behavior. This kind of investment is perfect for the people who wants their money to grow but doesn't have enough knowledge about the market or doesn't have enough time to manage their own money.

Investing in mutual funds allow investors to diversify their money. “Don’t put all your eggs in one basket.” Mutual funds typically invest in a range of companies and industries. This helps to lower their risk if one company fails.

Also, in mutual funds, investors can adjust the risk that suits their risk appetite. They can be conservative and minimize the risk with minimal but steady return or aggressive and increase the risk for a higher return.

Advantages and Disadvantages

Advantages

| Disadvantages

|

|---|---|

Professional management. Mutual Fund managers are professionally trained and experienced, constantly watching and managing their fund.

| Management Fees. Since your fund is being managed y professionals, they deduct a portion from the sales of your shares as their salary.

|

Diversification. If one stock or asset goes down, there will be others that compensate for it. This just means that the potential for losses is spread out conservatively.

| The risk is present and may cause the investors to lose their money. Even though diversified, there is no 100% guarantee that the stocks bought will generate positive return.

|

Liquidity. If you ever want to get out of a mutual fund, all you have to do is instruct your broker or financial advisor. They can sell it immediately.

| Mutual Fund Charges. Mutual funds charge fees when you redeem your money. There are also “operating expense” fees.

|

Basic Types of Mutual Funds

1. Money market funds

These funds invest in short-term fixed income securities such as government bonds, treasury bills, commercial paper and certificates of deposit. They are generally a safer investment, but with a lower potential return.

2. Fixed income funds

These funds buy investments that pay a fixed rate of return like government bonds, investment-grade corporate bonds and high-yield corporate bonds. They aim to have money coming into the fund on a regular basis, mostly through interest that the fund earns. High-yield corporate bond funds are generally riskier than funds that hold government and investment-grade bonds.

3. Equity funds

These funds invest in stocks. These funds aim to grow faster than money market or fixed income funds, so there is usually a higher risk that you could lose money. You can choose from different types of equity funds.

4. Balanced funds

These funds invest in a mix of equities and fixed income securities. They try to balance the aim of achieving higher returns against the risk of losing money. Most of these funds follow a formula to split money among the different types of investments. They tend to have more risk than fixed income funds, but less risk than pure equity funds. Aggressive funds hold more equities and fewer bonds, while conservative funds hold fewer equities relative to bonds.

5. Index funds

These funds aim to track the performance of a specific index. The value of the mutual fund will go up or down as the index goes up or down. Index funds typically have lower costs than actively managed mutual funds because the portfolio manager doesn’t have to do as much research or make as many investment decisions.

6. Specialty Funds

Specialty funds focus on specialized mandates such as real estate, commodities or socially responsible investing. These types of mutual funds forgo broad diversification to concentrate on a certain segment of the economy or a targeted strategy.

Financial Freedom - Choosing the Perfect Mutual Fund

If you are interested in learning more about the mutual funds, click here.