Income Tax Questions - Last Minute Tax Tips

Do you need help with your taxes?

Have you filed your taxes yet for this year? For 2012, the normal April 15th deadline has been extended to April 17th. If you haven’t yet done your taxes, there is still time, but you must make some quick decisions to meet the deadline. If you need assistance with your taxes, there is help available.

Do you need an extension on your taxes?

If you need an extension because you can’t get your taxes done on time, file with an accountant or file yourself. Remember, though, that filing an extension doesn’t mean that any money you owe won’t be penalized. The extension is for the tax return, not the amount you must pay. To avoid large penalties on the money you owe, consider sending in an estimated amount of what you think your tax amount will be. However, if you think you can finish your taxes on time, then there are other decisions to make.

Should you do your taxes yourself?

If you don’t plan to claim deductions, such as home mortgage and charitable contributions, then you might consider filing a basic EZ form yourself. If easy enough, it might be worth it to you to save an accountant’s fee, which is usually around $200 or more, and just fill out your tax return form yourself.

Should you get an accountant?

If you have deductions, it might be worth your while—and your money, as you might make up for any fee spent for an accountant. Over the years, I have learned a lot about tax deductions and those that I would have missed if doing my taxes on my own. Do you have mortgage interest? Any interest on college loans you’re paying back? What about work expenses that weren’t reimbursed? Medical expenses, while deductible, must reach 7.5% of your income. Have you contributed to churches or other charitable organizations? Have you taken loads of goods to the local Salvation Army or other thrift store? Do you have rental property? What have you spent on it for repairs and improvements? Have you installed energy-saving appliances, insulation, or windows in your home? Some of these energy-saving improvements may be deductible. Do you work from home? If so, you may be able to deduct a portion of your home for office space, and even part of your utilities. You may be able to deduct part or all of your phone bill, computer expenses, and anything else you use for your home business.

- What to do with Your Tax Return -Fun and Responsible...

What should you do with your tax refund? Be responsible or do something fun? Here are some practical ideas that could also be considered fun as they make your life easier and more enjoyable.

Will a tax software program work for you?

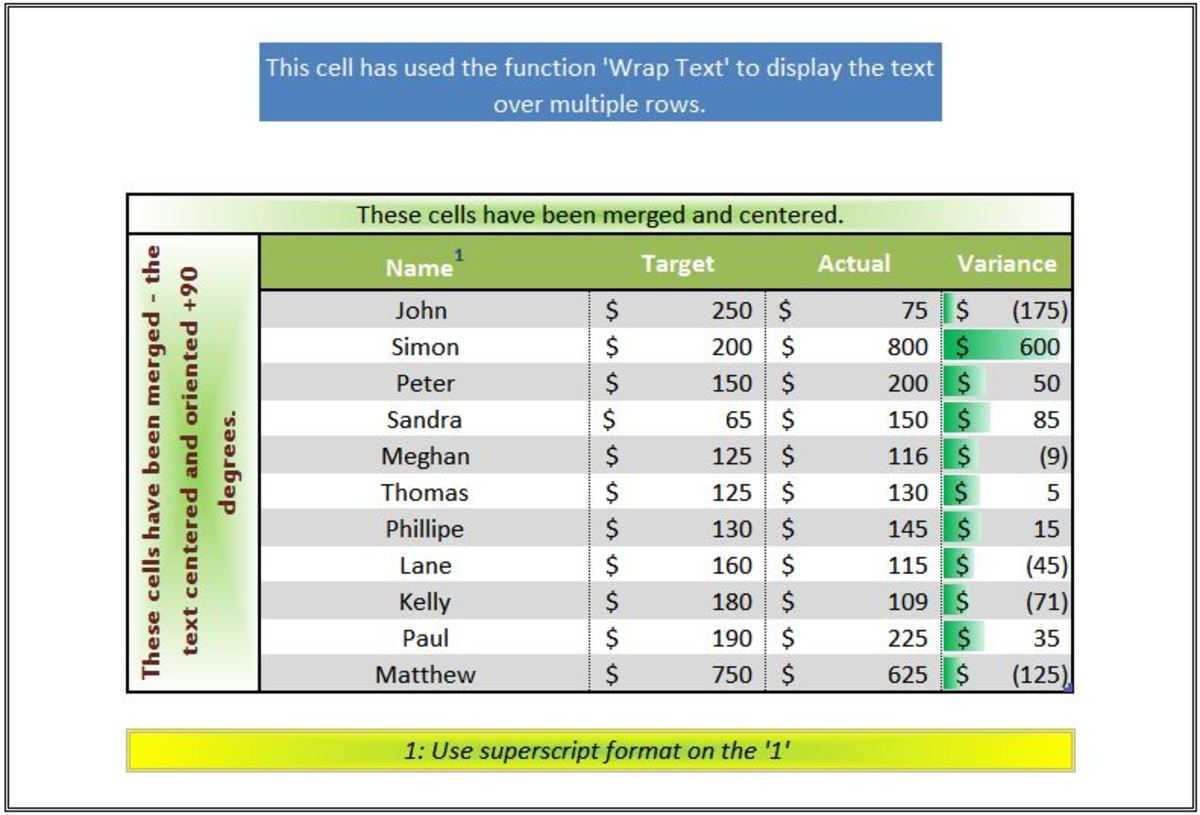

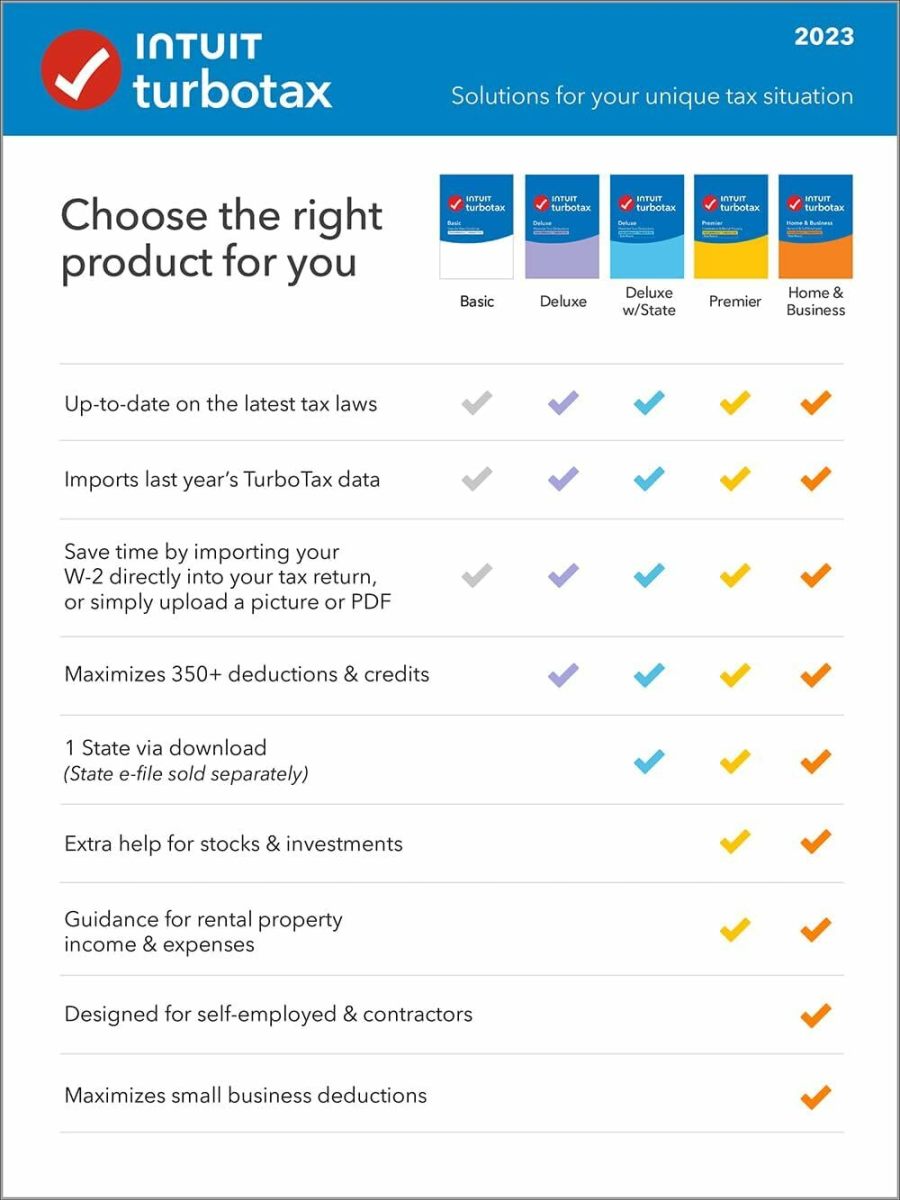

Deductions can be complicated, and an expert can help. If you don’t want to pay a certified public accountant, you might consider a software program that guides you through filling out your taxes, prompting you for the information it needs as you answer questions. Turbo Tax software can range from around $29.95 to near $100, offering a substantial savings over the fees of an accountant. If your tax return is relatively simple, consider purchasing a basic tax software program—or you may even be able to get a free version. For numerous deductions and a potentially complicated tax return, look for the more deluxe TurboTax software.

Save more on TurboTax and other tax software programs

Save even more by looking at these TurboTax deals that offer a variety of software programs for your tax needs, from a free download to up to 40% off. Tax-Software Coupons also gives you options of other software, ranging from free to 60% off. Decide first on whether or not you need an extension for this year. Then, if you’re ready to file your taxes, save money by checking out these discounts on TurboTax and other income tax software—and get those taxes done!