Learning about Trading Stocks for a Living!

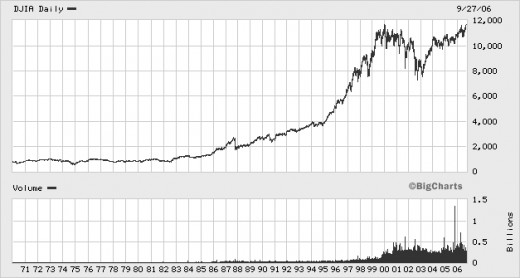

Long Term Chart of the Dow Industrial Average; the Dow

The Search

I have always been the entrepreneurial type. I knew that I would never retire from any one company. I knew I would never have a "pension." One of the problems that loomed on the horizon was that, even though I don't mind working, I couldn't work forever.

I owned a medium sized independent pharmacy in Western Michigan. It provided my family with a nice income, but didn't seem like it would be the answer to my retirement dilemma.

I tried investing in real estate and found out that I am too soft-hearted to evict people who are down on their luck. It took a few years and lots of my personal time and money to discover that.

In addition to the pharmacy, I tried a couple of other small businesses; an auto tune-up shop and a video store. They were good businesses, the kind that make good money with a good manager, but I couldn't find good managers. More wasted money and time.

I finally decided to take a look at investing in stocks. I started out by putting a few dollars a month into some popular mutual funds. This was in the early eighties before personal computers became the norm. The only way I could track their progress was to wait for quarterly reports. I was too impatient for that. I wanted to see how my money was doing. I found out that some daily newspapers would have the closing prices from the day before. I would write the prices down and chart them on graph paper. I could see that they would go up and down a lot -- generally up most of the time.

Starting To Make Sense

I began to read books about investing in the library and the local bookstores. I read everything that was available on the subject. It seemed like everything I read indicated that there seemed to be no rhyme or reason to the movement of stock and stock option and futures and commodities prices. They would go up and they would go down, apparently as a result of mysterious forces. I finally found a book that made a difference. Martin Zweig's Amazon.com: Winning On Wall Street: Books: Martin Zweig showed me that stocks were part of a larger animal, the trend. You want to own stocks when the trend is up. He also taught me that the interest rate decisions that the Fed makes were very instrumental in determining the direction of the trend. When interest rates rise the market tends to suffer. When interest rates go down the market tends to do better. Also, in the mix is the idea that the stocks of companies that make money do better than the stocks of companies that are losing money. This is all simple stuff now, but it was revolutionary at the time.

With this new knowledge in hand I gave a local stock broker some money and started picking some cheap stocks to experiment with. I would buy one or two hundred shares of a three or four dollar stock. My only criteria was that they were profitable and cheap. They are hard to find, but the information is there. It's much easier to find nowadays on just about any search engine.

My picks would usually do very well. My stock broker kept trying to change my mind, I guess it was so that he would feel he was earning his commission. The only problem was that his picks were almost always duds. About that time Charles Schwab came on the scene. Charles Schwab: Investment and Financial Management Services I moved my accounts over there. His brokers would not try to talk me out of my investing decisions -- nor would they try to talk me into using their suggestions.

Investor's Business Daily began publishing data about just about every stock there was on most of the markets. You can find them now at www.investors.com/. They even rated them against all other stocks. What a find. All I had to do was find the Friday edition and pick the best of the best of their selections, throw in a couple of my own preferences and I managed to increase the value of my holdings almost five times in just two or three years.

Keeping track of daily charts had become quite a chore. I found out that the Worden Brothers in North Carolina had a stock charting program called Telecharts that would provide complete daily stock charts for pennies a day. I jumped all over that. I have been with them for more than ten years now.TeleChart Software: Worden Brothers, Inc.

Putting It All Together

About five years ago I received a serious injury and couldn't work for over six months. I remember lying on the couch and looking at my computer. I had been experimenting with short term trading, but I hadn't really taken the plunge. Schwab had given me a copy of their new StreetSmart program. Schwab Active Trading: StreetSmart.com I decided to try it out.

I lost money the first month, broke even the second month and then never looked back. I am what is termed a swing trader. My trades generally last from one day to three or four weeks, depending on what is happening. I would like to say that I got rich quick, but that's not what happened. What has happened though, is that I can make a fairly good income doing what I enjoy.

I have learned a lot about shorter term trading from a web site at Day Trading / Online Trading - Trade The MarketsThey have a free daily update that I believe is the best thing going. I also learned a lot from John Carter's book .Amazon.com: Mastering the Trade (McGraw-Hill Trader's Edge): Books: John F. Carter.

Here is a site that I use to monitor the markets. Briefing.com: Stock Market Update. There is a fifteen or twenty minute delay in the information, but that's not a problem. I'm just looking to see how the market itself is doing, if there is some good or bad news that might be affecting the short-term trend.

Spend some time learning about the Turtle Trading Rules at www.turtletrader.com/. There is a lot of good stuff there to teach you how to keep your money where it belongs -- in your own brokerage account. They have a lot of good rules about keeping your risk under control. You don't want to become a victim of your own greed or fear.

Summary

I traded futures on stocks and commodities. I also traded stock options. When all was said and done, I enjoy trading stocks without the benefit of any derivatives. it's fairly straight forward that way. It easier to to tell what you've made or lost. It's also easier to get in or out of positions when the time comes to make a move.

If you have never traded stocks, or have been having bad luck trying to trade, I would suggest that you get the FREE DVD that's available at www.technitrader.com Just log into their web site and ask them to send it to you. It will usually get to you in less than a week from the time of your request. They teach that you should only buy stocks when they are going up -- that you should never buy one on the way down for any reason. My philosophy exactly!

All I can say for now is that I am still doing very well, thank you, doing what I love to do -- trading stocks.

* Remember, I am not giving you any trading advice. You can lose your shirt in short order, whether you get cocky or not. Always use protective stops and never risk more than you can afford to lose.

.................

Related articles:

- How I find good stocks for free

- An easy way to calculate "daily" risk in dollars for owning a stock or index

- I use FreeStockCharts.com’s free charts and investment tracking tools to monitor my stock and ETF trades