Loan Modification Hardship Letter

Example Loan Modification Hardship Letter

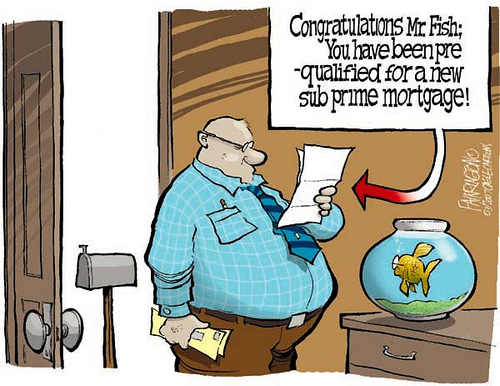

I've been coming across so many homeowners trying to contact the loss mitigation department with their lender to negotiate a loan modification. One of the first things a lender asks for is a hardship letter showing why the homeowner has been late with mortgage payments.

A good loan modification hardship letter shows valid reasons for example, been laid off, hospitalized, unable to work, or mortgage loan adjusted, was deceived into a loan (loan fraud) etc.

When putting together your hardship letter, be sure to point out everything you can. It's OK to cry out so someone hears you.

Hardship Letter Example...

To Whom It May Concern:

I have had problems making my monthly payments due to financial difficulties created by my negative amortization loan and my high interest rate. I was sold this loan by a mortgage broker who assured me the quoted payment of $1,748.94 was my full principal and interest payment. Needless to say he was totally wrong and misled me. I was only paying a deferred interest payment which was going to increase my loan balance each month. I have been paying my interest only payment and been struggling due to the high rate of 7.375%

My wife and I are barely making ends meat and we have been dipping into our savings to cover our mortgage payment along with the taxes and insurance. My wife and I were told we could refinance out of this loan but that is obviously not possible since the home is worth less than we owe on our mortgage and the property values keep on dropping in our area.

In order to avoid a future possible foreclosure, I'm requesting a lower interest rate (30 year fixed rate with lower monthly payment) on my current mortgage to Countrywide.

As a long time customer, I'd prefer that the you remain my primary mortgage lender, but without a reduction in the interest rate, I simply can't afford higher monthly mortgage payments.

Our (me and my wife) total annual income amounts to $75,000.00. That income should certainly sufficient just to pay the decent principal and interest monthly payment. We have always paid our bills on time and have an excellent credit rating but cannot afford to pay the minimum payment and have the loan recast; we need help badly and want to retire in this home. We are scared of our current loan and we were completely misled and had no idea about the negative effects of paying the minimum payment. Please help us.

Thank you for your consideration,

Your Signature

Also, it is extremely important that you have a copy of your credit report to compare with your lender for errors. A lot of people say that there are mistakes with the lender's credit report. This is a problem because their decision on approving your loan modification is dependent on certain variables on your credit report. A lender looking at your debt to income ratio to make there final decision could mean the difference in approval and the final payment program they offer you in the process. So, if you have your own copy of your credit report you can disarm any false information they are hitting you with and forward a copy to your attorney if you wish.

Remember, be brief and to the point in your loan modification hardship letter but don't leave anything out. Good Luck! Be sure to get the a loan modification help and strategy Ebook to get you on the right track. Loss mitigation can be tricky if you don't have the right tools.

Did Your Payment Go Up?