How to Spend Smart and Live Rich

Whether you are happy with the amount of money you have or want more money now or in the future, it makes sense to use what you have wisely. That includes water and electricity at home. Reduce, reuse, and recycle applies to money, too. You would be surprised at how much you can save, just by focusing on those three concepts. You would also be surprised at how much richer and more relaxed you feel when you're not hooked on spending.

Smart Tip 1 - Reduce, reuse, recycle.

Reducing means cutting back on your perceived needs. It means making decisions that match your priorities, and deciding against spending just to spend or just because there's a sale. It means not going with your friends to Las Vegas, if you really prefer camping; installing efficient water and electrical fixtures to cut down on monthly bills; or buying two apples instead of a whole bag on sale, if you know you won't eat them before they spoil. Doing what you love to do in itself is an enriching feeling.

Reusing requires taking care of what you have, so you can keep it for a long time. It means that when you get tired of a thing, instead of throwing it away, fix it up to look nicer or fit better, or break it apart and use the pieces for something else.

I had a long-sleeved blouse that I really loved. One day one of the elbows wore through. Instead of throwing it away, I cut both sleeves off above the elbow and hemmed them to make it a short-sleeved blouse that I could wear in summer.

Recycling means that when you are through with a thing, you find a way to get rid of it without sending it to the landfill. If it's still good quality, you can offer it to your friends to trade for something. Or you can donate it to a second-hand store and browse through their offerings at the same time. (I found two of my favorite blouses this way. Took them apart, made a pattern, and sewed up new ones from the pattern.) Or put it up on eBay or Amazon.com and sell it. Or post it on Freecycle.org and give it away free.

These are general guidelines, but they give you an idea of how the three R's can apply to money. Meanwhile, here is the way I went about cutting back on my own expenses.

Smart Tip 2 - Set spending priorities.

At some point I realized that the more money I had, the more time it would take to care for it. Since I don't want to spend my life thinking primarily about money, I decided not to get rich. But that meant I needed to get clear on what I did want, so I started looking for my actual priorities.

"The economy is a wholly owned subsidiary of the environment, not the other way around." - Sen. Gaylord Nelson

I looked at the spending choices I'd been making and what I did with my time, and made a list of them, assuming that they reflected the real goals in my life, rather than those I thought I "should" have. I looked at which results I liked and which I didn't and why. Then I compared them: If I had to take action here or there - move to a nicer house in a better location or fix this one to lower monthly bills - which would I choose? That helped me put them in order of preference.

Surprisingly (or not so), I discovered that health came first. There is no sense in having a life, I reasoned, if you're too sick to enjoy it. Money turned out to be pretty far down the list and I found I didn't want to give up any of the priorities above it, so there it stayed. At the same time, I realized that it meant I needed to take care of the things I already had, including money, and keep good records.

Smart Tip 3 - Keep track of your money.

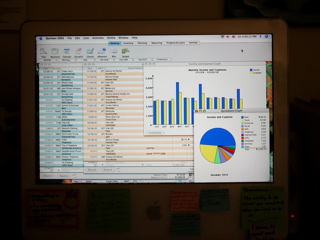

Eight years ago I installed an easy-to-use financial software called Quicken, which has been fun to explore and essential to getting control of spending. I set up my checking and savings accounts in Quicken, then started entering income and expenses.

From the resulting charts and graphs, I quickly discovered that I was slightly overspending almost every month. The reports showed what I was spending for what, so I could see what to cut back on. It took me awhile to balance expenses with monthly income, but I did it and it felt great.

I also found that I could cut back on my food expenses by making shopping lists. That was as effective as eating before shopping. (If you food shop when hungry, you spend a LOT more on food than you need to.) I now keep a list on my refrigerator to write down necessities and limit myself to that list when shopping. It has saved me a LOT of money and wasted food, and has trained me to buy only what I need.

Because I shop online a lot, the third thing I keep track of is my favorite stores and my blacklisted stores. I know the clothes stores, for example, that have clothes of high quality, made of natural fibers, have decent prices, and get good reviews. And I know the stores whose clothes look good on the screen, but don't fit right or are made from cheap fabric. These lists save me from searching for and/or purchasing from a store whose products I will have to return or which won't last, wasting money on shipping charges and sometimes restocking fees. (Don't buy underwear from Hanes, but do buy it from Lands End.)

Smart Tip 4 - Good health saves money.

More bankruptcies are caused by excessive medical bills than any other cause. This shows how essential it is to take good physical care of yourself, and also how much money you can save by doing so. If you keep yourself in good physical, emotional, and spiritual health you will live longer, enjoy life more, and spend much less.

I took the time to figure out what kinds of foods agreed with my body and which made me sick. I now eat organic as often as possible and as much raw food as possible, since raw food is much healthier than cooked food, and I've started going to potlucks. (I once had a friend who subsisted on potlucks when she was broke. She would host one a week and feast on the leftovers for the rest of the week.)

Some people I know grow their own food at home. Even if you live in the city in a small apartment or condo, you can grow food hydroponically in your living room window. It doesn't cost much to set up a system. If you take care of it, you can save a lot of money on food, and help the environment as well (reducing food transportation costs).

I've completely cut out carbonated drinks - they're just sugar, water, and carbonation, which is harmful to the body. I didn't need to cut down on alcohol, because I don't drink much. I'd already noticed that over-drinking caused embarrassing behaviors and was dangerous for your brain and body. (I once had a neighbor who drank so much that alcohol had replaced all the water in his body. He couldn't function and was terribly paranoid.)

I started drinking plenty of water, so my body could stay lubricated. It's the water in blood vessels, capillaries, and flesh that moves food to where it's needed and takes toxins out to be eliminated. Water in your joints lets them move smoothly. And it's water in your brain that nourishes brain cells and provides the medium for electrical charges that tell your brain and body what to do. Drinking good, clean water (NOT bottled water, if you have another choice) can do wonders for your health and budget.

I found many ways to exercise naturally, rather than going to a gym. This helps reduce stress, which is a big health-destroyer. Why spend the money for a gym if you can walk places instead of drive, climb stairs instead of using the elevator, swim in the local pool or go hiking, and do yoga or another type of exercise at home with a book or a video? You could buy a bicycle and go riding with friends. All of these practices are cheaper than a gym and more fun too.

Smart Tip 5 - Make what you can.

I taught myself how to make stuff. Nearly everything I make saves money, especially with the things I'm good at. I have made furniture from kits, clothes from patterns, decorations like wall photos and dream catchers, and gifts for friends and family. Some people knit sweaters or crochet blankets. My grandfather used to make jewelry.

You can also make your own food from scratch, instead of buying expensive TV dinners. And you can host parties or other entertainments at home, instead of going out drinking. You'll save a LOT of money that way, especially if your guests bring their own booze (BYOB). And you can turn a good skill into income, if you want to.

Smart Tip 6 - Buy smart when you spend money.

When you do purchase goods, look to see how much you really need. If you are buying equipment or supplies to make things with, buy high quality equipment that will last awhile, and buy raw materials as much in bulk as you can, to get discounts. Look for equipment that has a long-term warranty.

I once had a giant golf umbrella with a lifetime warranty. After several years a part wore out and I sent it back. They sent me another one free. Then I was careless and scraped the fabric raw. They sent me another one. Warrantees show higher quality and make it worth spending more to save in the long run.

I also buy in advance, whenever possible. This allows for purchases in bulk and saves both time and money. It lets me time purchases to take advantage of sales and coupons. I buy my toilet paper, paper towels, napkins, and sandwich bags in bulk. I also buy granola and nuts in bulk, and I grind my own peanut butter at Whole Foods.

With utilities I now use only as much as needed. I installed CFL or LED light bulbs to conserve electricity, dress warmly and comfortably during winter, and leave the heater off (I've only used it twice this winter). I use fans during summer, instead of the air conditioner, take short showers only when needed, and I've installed faucet aerators and a water-savings shower head. I use the dishwasher only when full and rinse my dishes before putting them in. That's so I don't have to use the pre-rinse cycle.

Smart Tip 7 - Maintain and fix what breaks.

It's important to take care of your things, if you want them to last. Oil them, polish them, wash and dry them sensibly. Fix them when broken. Some people throw a thing away the minute it breaks or tears, and run out to buy a new one. These people are spending at least three times more than they need to. Much better is to become skilled at fixing something your friends can't fix, then trade off services.

Here are some things I fix myself: Clothes, furniture, minor household breakdowns (like a closet door not closing right). I also revamp clothes I don't like anymore or that don't fit right. You could do the same: Change the buttons, cut the legs shorter, or add a different color to make them longer, then match the color with a patch or decoration elsewhere on the outfit.

What you can't do yourself, give to your friends to do or take them to a shop to be repaired. My friends can provide transportation and electrical repairs when I need them. Another friend sells stuff on eBay. I have a shoemaker down the way who re-heels my boots. My apartment manager takes care of leaks and appliance breakdowns.

Smart Tip 8 - Give away what's no longer wanted.

In addition to trading services, another way to repay friends is to offer them something you've finished with, that's still in good condition. I gave my transportation friend a long skirt I never wore, which she loved, and my eBay friend a couple of how-to books for his health.

All the other things I don't want anymore I sometimes sell at garage sales or on eBay to bring in extra income, but usually give to a thrift shop or advertise on The Freecycle Network (see link at right). I've given LOTS of things away on Freecycle. You can get stuff free there, too, as long as you pick it up.

Living a Rich Life

The upshot is that if you value and care for the things you buy - food, clothes, furniture, water, electricity - the world will care for you. You won't need to spend all your money or go into debt. You might even be able to afford a more fun job that pays less. You can make closer friends and have more fun with them. You can become more talented and skilled, healthier, and better fulfilled in life. You'll be known as someone smart, experienced, and practical when you change your life to one that is thrifty and efficient.

What is "living rich"? According to the dictionary, it means having a great deal of assets (including money); a plentiful, abundant, and interesting life full of diversity or complexity. We can all achieve that, as long as we spend less than we earn, and value and share what we have.

More information on living smart:

- How to Water & Decorate with House Plants

Many first time renters are uncomfortable with houseplants, because they don't know how to take care of them. Their biggest worry is usually about how to water properly which, yes, is key to optimal health. - Drinking Water Filters & Purifiers for the Home

Drinking water filters can net you many years of healthy and good-tasting drinking water, if you choose carefully. This article can help you decide what kind of filter would work best for your home. - Man and Nature: Why We Need the Natural World

Without regular interaction with nature we starve ourselves, both emotionally and intellectually. With it, we learn about ourselves and how life works, and where we fit in. - How to Practice Water Conservation

One of the threats most common to much of the world is the drying up of water. Without water we cannot live. Here are ways individuals can use water efficiently, so there is enough for everyone.