Managing a family budget

Mum used to say when we were kids, “save for a rainy day”. Well it applies to all of us and during all our lives. Everybody in their right mind out there is trying to live a good life and trying to manage a job, a home, a family, expectations, wishes and demands!

Not all of us are born with a silver spoon in our mouth. Talk about an average household and we all plan in some way or the other to make sure bills are paid and there is some set aside to indulge with.

Here are a few easy to –dos that can help you strike a balance with what you earn and what you spend and save if any!

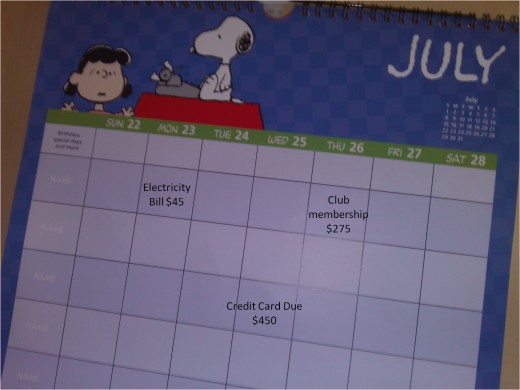

A simple time frame to manage is Monthly. Some of us get paid weekly, some twice a month and some just once at the end of the month. Nevertheless, a monthly calendar plan is probably the simplest to adhere to.

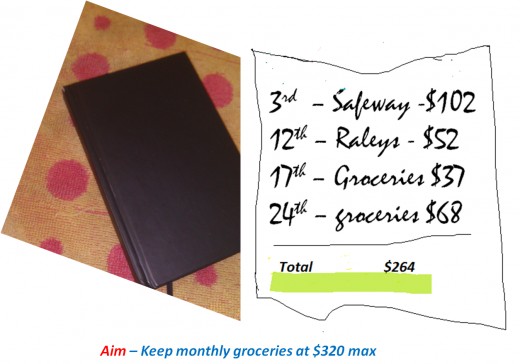

1. First things first- groceries. Of course we need to have three meals a day and then some more. Yet, it is a good habit to keep tab on your monthly grocery spending. You’ll notice when you do, you cut on over indulgence and buying those extra cookies or cream puffs which is anyways not good for your waistline. I am not saying you keep track at a line item level, just give yourself as a family an approximate monthly target and stick to it and around. Maintain a note of monthly totals and make sure you are spending up to that acceptable average month on month. That is it. Keep it simple.

2. Plan to keep some amount aside for your monthly movies, dinners, social get together, invites etc. Unless you have a very erratic and expensive social life, you should be able to plan for these well in advance too. Hopefully birthdays, anniversaries, kids events etc are not surprises that hit your budget out of the blue! One can easily make sure they do not.

3. Have a rolling investment in the works? Building a house and you know when the next instalment is due? – plan for it in advance. Know when the due dates are and maybe you have to restrict those social gatherings or have a secondary source to fund the upcoming installment. Once paid, you can breathe easy till it is time to plan for the next! It is awesome if you can fund your investments without taking a loan!

4. Have a bright calendar up in the kitchen for all to see. Mark your monthly bills and expenses there on their due dates. Things like rent, utility, electricity, credit card bills,Trash, Phone, club membership etc should all go up on your calendar. If you prefer mention the amounts too. This way you have an idea of what all is the outflow in the month and when. Helps you plan better, yet again. The more the visibility to all your household expenditure, the better you plan for it. That is the key to successfully managing your home budget.

5. Aiming to make that vacation abroad this year? Plan. Keep aside every month to your ‘vacation budget’. Make sure your vacation and big number outflows (like investments, insurance) don’t fall in the same month. Look for off season packages.

The key habit that you need to inculcate is knowing your expected income and spend accordingly. Monthly Income is X and your bills, sundry expenses, outings add up to Y. The moment the Y starts approaching the X, have caution bells on in your head.

Being in debt is never a great place to be in. A conservative spender cuts his cloth as much as he requires. Use your credit card being fully cognizant of your bank balance, never head towards an overdraft.

Spend only if you have some to, else don't.

Illustrative Example

If you are a household that enjoys a fixed monthly income, it is very easy to manage your finances. Foresight and updated information on outflows and inflows as mentioned above can help you gauge how much you can save approximately every month or every few months. All you need is to get down to doing it.

A good friend of mine says –if you’re not able to do all the things you want to- then you’re not earning enough. He obviously is not big on planning his finances so diligently and is fortunate to land well paying jobs!