Moving In Together? Make Sure You're on the Same Page, Finance-Wise

Moving in with your significant other can be equal parts exciting, amazing, daunting and scary. Being single is an expensive business, especially when it comes to your living situation, so living with someone else can relieve a bit of that burden. Having another person to split rent, bills and tax with makes a big difference.

Bingham Self Storage have put together this detailed infographic on the common pitfalls of cohabiting and things to bear in mind, and we think they offer some very sound advice.

There’s lots to consider here, including things you may have blocked out through virtue of being so loved-up, which is no bad thing! But there is one thing that cannot be ignored, and that's your newly-shared finances. Here are some tips to avoid financial pitfalls when you move in together.

Are You Both Ready?

Before you heed any kind of advice about cohabiting, you both need to be absolutely sure about your decision, and make sure you're moving in for the right reasons. On the plus side, this is a good opportunity to go on a long holiday together if you haven’t already, just to check you really can spend all that time together. You should also make sure you have shared goals for the future and that you aren’t moving in together just to save money on rent and bills.

Cohabiting Financial Advice

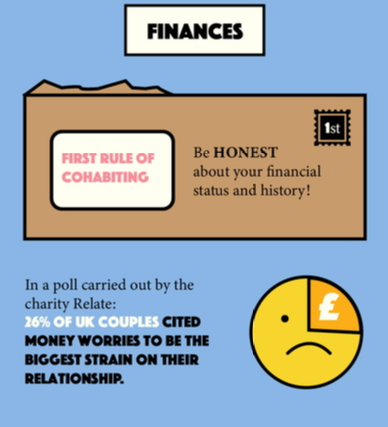

This is the most important part of cohabiting to dissect as financial woes are the biggest cause of arguments in a relationship. Our lives are all centred around money and it will naturally become a point of tension if you don't both foster an honest, transparent approach to it.

If you’re going to live together, Bingham recommend what they call a ‘cohabitation prenup’. The term ‘prenup’ has negative connotations around it, so having this shouldn’t be seen as an absence of trust or faith in the other but rather just ensuring you’re both on the same page. A cohabitation prenup is simply where you both know exactly what each other’s financial assets and liabilities are, what your joint costs are going to be and what is expected from each person.

This way, you both know exactly what you’re signing up for. And honesty is so important here. Not everyone has a perfect financial track record and there might be things that you want to cover up, but this can only lead to disaster down the line. By placing all your cards on the table, everyone is aware of any problems that could arise, and you’re both positioned to deal with that in the best way.

Work Together But Keep Your Finances Separate

Bingham advise that you should not combine the following:

- Credit

-

Bank Accounts

-

Investments

Especially not to begin with. If you've got a happy and healthy marriage and there are years of cohabitation already under your belts, combining finances makes sense if that will make things easier for you. But if you’re just thinking about moving in together for the first time as a couple, don’t combine anything.

If things don’t go as planned and there is a breakup, then trying to un-share your shared finances will be an almighty task and, considering the nature of breakups, can lead to a very bitter situation indeed.

Keeping finances separate gives you autonomy. If there is disparity in your incomes too, then sharing finances can cause friction. No matter how much you love someone, your salary is your salary and if you feel like you’re shouldering most of the financial burden then this can fester into something negative for your relationship.

That being said, it can be useful to create a joint "house" account which you both pay into, for bills, groceries and the like.

Be Frank About Your Financial Delegation

If you both earn a similar income, dividing up financial responsibility should be easy. You can split your expenses down the middle and everyone’s happy. If, as just mentioned, there is a disparity in incomes, you need to give this task a bit more time and thought.

Consider splitting expenses as a percentage based on the difference in your respective incomes. If the higher earner isn’t comfortable or happy about paying more of the expenses, they must accept that they can’t force a higher cost of living onto the lower earner. This is a partnership, after all.

If you’re happy to take more of the financial weight then make that (and the extent that you’re willing to take on) clear, and don’t lord it over your significant other.

Tackle Debts Together

One (or even both) of you may have debts. If that's the case, be entirely forthcoming about how much there is. This doesn’t have to stop you moving in together. If you tackle your debts together, it will pay off for both of you in the long term. Having one of you struggle in debt whilst the other doesn’t will create a wider gulf between you two financially and can lead to problems. Once those debts are cleared, you'll be able to focus more on saving for the future.

Audit Your Spending Habits

When moving in together, it’s always good to give your spending habits a bit of an audit. A spreadsheet where you can track your individual and joint expenses makes it easy to visualise where you’re spending your money and therefore easier to see what needs cutting back and toning down.

There are also new app-based banks that make this very easy. Banks like Monzo, Starling and Monese make it easier than ever to track spending. Monzo, for example, will divide all your spending into categories and produce monthly reports. You can set yourself limits for each aspect of your spending and you can even set up different saving pots within the app.

This is advisable for many reasons. Not the least of which is, when you actually see the amount of money that you spend on, let’s say, takeaways in a month as opposed to smaller increments when you buy them, it really puts it into perspective!

If you can both find some common ground in your spending habits, this will make your whole cohabitation easier. Organising finances into spreadsheets or tracking your spending makes this plain to see and easy to resolve. You can still spend your money on things that make you happy and that add value to your life, but you also need to show that you're putting effort into your relationship and living situation.

Think about how you can save money in the places that you spend money together. For example, your energy bills and the weekly food shop. Are you checking out deals and offers? Do you have a meal plan to help avoid food waste and use your money wisely? Did you get the best deal for your bills?

Honesty is the Best Policy

It’s an old saying, but it absolutely holds true in this case. Living together is a very exciting step to take but the financial aspect of cohabitation can’t be ignored. If you take this advice, you’re giving yourself the best chance. Finances have the power to break apart the strongest of relationships and it’s imperative that you’re both on the same page.

It's easy to sit and say that financial woes mean nothing because you’re so in love and everything is amazing, but you’ll be surprised at how much of a toll it can take, especially when avoidable situations arise. Be frank, be honest and be forgiving. Any financial problems that may occur are also very likely to be fixable. And if you get your finances right, it frees you up to spend more time and energy focusing on your future as a couple!