My Experience of Peer-to-Peer Lending in Britain/UK

Peer-to-Peer Lending

Peer to peer lending websites, which appeared in Britain during the last decade, harness the power of individual lenders bringing them together with individual borrowers. This allows saving and borrowing while avoiding the banking system. Both parties benefit from this system. The lenders receive a higher rate of interest than they would using saving accounts with the bank; the borrowers receive a lower rate of interest than they would on a bank loan.

A quick internet search can return the current savings rates. For example, at the time of writing, Sainsbury’s Bank is offering 0.85% and RCI Bank a higher 1.10%. With Paragon Bank, one can achieve a savings rate of 1.60% but with a downside of committing the saved money for five years. These rates are abysmal.

When comparing lenders and borrowers, the crucial difference is for savers. Unlike traditional saving accounts, which in Britain are protected by the Financial Services Compensation Scheme (FSCS), peer-to-peer investment is not covered. This means the initial deposit is at risk of not being returned. This risk explains the higher rate of interest available.

As for borrowers, there is no blatant distinction. Borrowers simply choose the lender that can offer them the lowest level of interest, making the loan as cheap as possible.

A rapid internet search for peer-to-peer lending reveals the savings rates offered by these alternative companies. Funding Circle is advertising 7%, QuidCycle 6.1% and Assetz Capital a lower 4.40%. Clearly, these interest rates are far more attractive than those being offered by the bank.

As a reminder, then, the higher rates for savers is achieved by removing the ‘middle-man’ – the bank – allowing these peer-to-peer operators to reduce the costs. The healthy interest rates, then, have driven the curiosity in these unorthodox investments.

Of course, there are some risks associated with peer-to-peer lending. The higher risk reflects the interest rates offered. The majority of the companies have in place protection schemes – with fancy names – but said safeguarding systems are only good as long as there are not many defaults all at once.

With all this in mind, I wish to share my experience of three peer to peer companies I have invested with. I will include information such as company name, the number of active lenders, the amount lent and so on. Perhaps my experience will enable you to decide if peer to peer lending is suitable for you.

I have invested with the following three peer to peer lenders: Funding Circle, Landbay and Wellesley & Co..

I introduce these companies to you in ascending order of my investment amount.

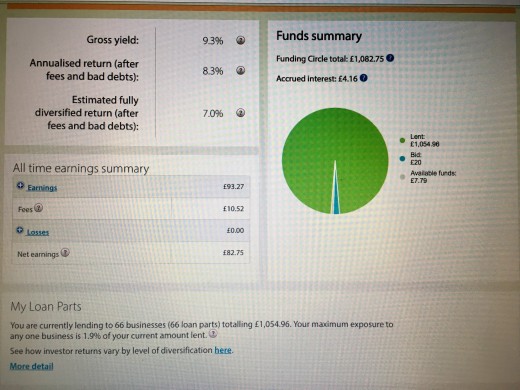

Funding Circle

- Launched: 2010

- Amount lent to date: In excess of GBP 1.4 billion

- Number of active lenders: More than 50,000

- Money withdrawal: Loan repayments are made monthly into the holding account which can be withdrawn within at any time. If you wish to withdraw before the end of the term you have to wait until the loan amount can be sold to another investor.

- Interest rate: 7%

My Experience

On the advice of my friend, I started to invest with Funding Circle in January 2016. This company is extremely popular, even securing GBP 40 million from the government to support small businesses.

Funding Circle has an automatic system for reinvesting the interest earned from the loans or you can choose the loans yourself. The benefit of using the automatic system is that you needn’t check the account each month and the interest will compound.

I only invested GBP 1000 into Funding Circle because getting access to the money results in fees to the account. As the loan parts you’re invested in may have many months, or years, to go before they are repaid, you must sell these loan parts to other users to reclaim your money. Funding Circle has a system for this but charges 0.25% for the luxury.

To avoid this charge, remember to turn off the automatic reinvestment tool. This way you can withdraw loan amounts as they are repaid to your holding account.

Given the difficulty in accessing one’s money with Funding Circle, I do not recommend this platform unless you are happy to invest and forget for many years.

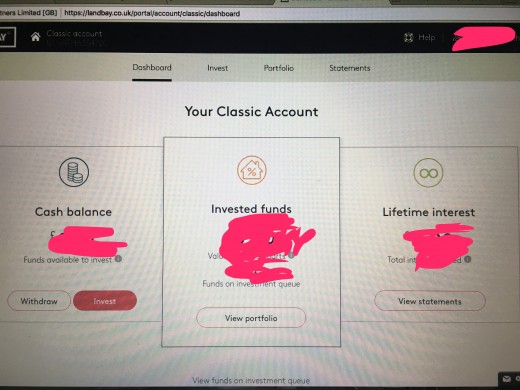

LandBay

- Launched: 2014

- Amount lent to date: In excess of GBP 50 million

- Number of active lenders: More than 5,000

- Money withdrawal: You can withdraw money at any time as long as there are new investments to cover the amount. There is no fee for this service.

- Interest rate: up to 3.75%

My Experience

I started to invest with LandBay in December 2016. I signed up for their tracker rate hence with variable interest. This is currently the LIBOR (London Interbank Offered Rate) + 3%. The current interest rate for the tracker rate is 3.43%.

The money you invest with the tracker rate will begin earning interest immediately. Interestingly, the money I invested in December remains in an investment queue. Even so, LandBay continued to pay interest for the total amount in my account.

The online platform is very clear, detailing the invested funds, cash balance and lifetime interest.

The disadvantage for LandBay is the relatively low interest rate on offer but unlike Funding Circle you needn’t worry about selling loan parts should you wish to gain access to your capital – simply withdraw.

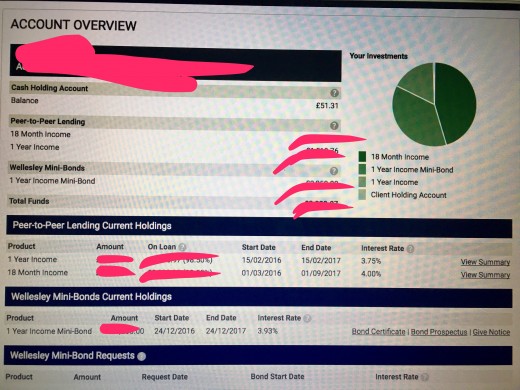

Wellesley & Co.

- Launched: 2014

- Amount lent to date: In excess of GBP 417 million

- Number of active lenders: More than 5,000

- Money withdrawal: You can withdraw money at any time but this is done on a discretionary basis. Wellesley & Co. will help you to sell the loan amount to other users if this is possible.

- Interest rate: 2.35%

My Experience

I started investing with Wellesley & Co back in the winter of 2015. I invested GBP 3000 for one year with an interest rate of 4%. As the company has become more popular over the past year, the interest rates on offer have plummeted.

Wellesley & Co. always pay the interest on time into the holding account. From here you can easily request a withdrawal to the bank account you last financed the holding account with.

The investment process is simple. Just top-up your account then choose the product wanted. From here you don’t need to do anything until the term on the product is completed. At this time, you can withdraw easily or sign-up for another product.

I am currently invested in another product with Wellesley & Co. – the one-year mini-bond. This is unlike the other investment as you are investing directly in the company. For this, you can receive an interest rate of 3.93% for the income product or 4% for the interest on completion product.

Overall, I am happy with the experience I have had with Wellesley & Co.. However, there have been a few negative articles in the press recently about the company. In the business of peer to peer lending, however, one must hold steady to reap the greatest reward. That said, I will likely withdraw all the money from my holding account on completion of the current agreements.

Peer-to-Peer Financing

Have you invested in peer-to-peer lending?

Overall, I am content with my peer-to -eer lending returns. The basic fact you have to accept is that the money you invest might never be repaid. The same could be said of the stock market. Therefore, the key to all investment strategies is division. Never forget the moral of spreading your eggs among many baskets.

Peer-to-peer lending is one method for avoiding the painfully low interest rates of the banks. I hope my experience has given you some food for thought.

This article is accurate and true to the best of the author’s knowledge. Content is for informational or entertainment purposes only and does not substitute for personal counsel or professional advice in business, financial, legal, or technical matters.