My Tax Filing Experience 2018

Introduction

With the new tax reform laws passed by Congress last year, this is the first year of tax filing that took effect. I want to document my experience here. Hopefully, this will give others an idea of this new law and its impact on a typical middle class family.

- April 2019

Background

Income taxes in general is a complicated topic. It has many components which the average person may not be aware of. This new reform law, proposed by President Trump, was to address some long standing issues and complexity of our tax code. It is also meant to reduce the complexity and reduce some tax liability for the majority of the public. The sweeping changes are significant. It has several components which should reduce our taxes and also help businesses be more competitive with their overseas market.

My article focuses on my personal experience in filing my taxes for 2018. It took me approximately 3 hours to complete online. I used the HR Block tax filing software which I have been using for the past 10 years or so. It was simple and easy and cost $120.

Last year, at the completion of my tax filing, the program provided an estimate for me. They informed me that assuming everything stays the same, my taxes would be reduced by $1500 under the new tax laws. That is the projected savings under the revised tax code.

Of course, nothing stays the same...

My Own Case...

I am not going into specifics but just a description of some of the changes that affected my taxes this year.

- I had a full year of Social Security income whereas last year was only a partial year since I just turned 66 in Sept. of 2017.

- My wife sold some FB stock with some extra ordinary Capital gains.

- I purchased a new Minivan with cash...paid a sales tax of $2300.

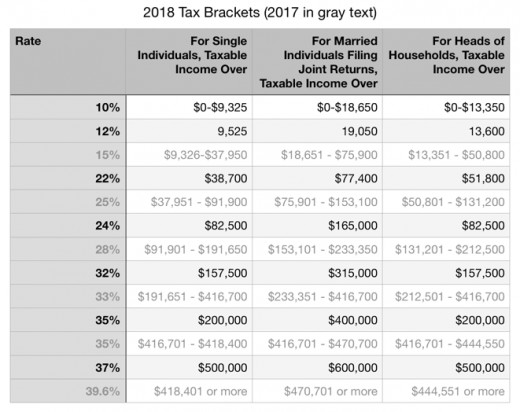

The net effect is our income was higher this year compared to last year. We expected our taxes to increase as well. However, due to the tax code change in rates, our overall taxes should be reduced from last year’s tax table, by about 2%.

See the table below comparing the two rates, from 25% in 2017 down to 23% for 2018. The 23% is the average between 22% and 24%.

Details

In terms of simplicity, it definitely helped me. I was able to take the standard deduction which had doubled from 13K to 26K. However, the personal exemptions went away which reduced it by 8K.

I did not have to worry about itemizing all my local taxes, and donations and misc...deductions as in the past.

This has mixed results for me. I was not able to deduct the $2300 extra sales tax I paid as a result of the new car purchase.

My estimation is that the end result is a wash. If the laws did not change, my taxable income would be approx. the same.

My taxes did go up due to the extra social security income and the capital gains.

Another unexpected result was the reduced withholdings. My wife, who still works and collects a paycheck, saw a reduction of her tax withholdings. This was done by the IRS, in anticipation of the tax saving as a result of the code changes. The idea is to provide the money to the wage earner right away instead of waiting till the end of the year when filing.

A Sidebar on Economic Theory

Taxes are an integral part of our economy. The policies will influence how people and businesses conduct themselves. Our government functions based on revenues collected by the IRS.

During the Reagan years, An economist, Art Laffer came up with the Laffer curve. It is a simple concept that illustrate the ideal tax rate. There is an optimum tax rate that will being in the most money into the treasury. The question or debate is what is this “optimum” rate?

Luckily, we have some history to draw upon. During the 1980s, when Reagan cut the top tax rate from 70% down to 37%, revenues soared.

It is also good to point out that we have a progressive tax structure. That is to say, the tax rate increases depending on the level of income. So the effective tax rate is some where lower than the highest tax bracket. The highest tax rate does has a psychological effect on the part of the people. If the rate is too high, the people may decide to just stop working or relocate or hire accountants to find loop holes.

Another way to think about this is to avoid focusing on the actual tax rate but examine what revenues are generated. If it turns out, the Treasury can collect the most amount of dollars overall, who cares if the top tax rate is 70% or 30%?

The Laffer Curve

Another Observation

One other element of the change in tax code is significant and it applies not equally across our country. The $10,000 deduction cap for State and Local taxes has an effect of leveling the field across States. What it does is favor the States with lower taxes. It penalize those States that have high local property taxes.

The idea is over time, it will change the behavior of State legislatures and force them to lower their taxes to be more in line with the rest of the country. There is no reason why States like NY, NJ, CA to have taxes that are 3-5 times higher than States like Texas and Florida...

Summary

My tax filing for 2018 went smoothly. I was surprised when I was told I have a small refund from the State. In my state of NY, which is a fairly high tax state, in past years, I either broke even or had to pay a small amount.

The big surprise was having a much larger federal tax bill due. In past years, I usually end up owing about $2K.

The increases is due to several components as I analyzed, a bigger income and less withholdings. My total savings is estimated to be $1400. That is to say, if the tax law had remained the same, I would have end up paying $1400 more in my total federal income tax.

I look at it this way, uncle Sam is paying for my fencing membership at the Fencers Club and then some...

Thanks to President Trump and the Republican Congress.

A Simple Poll

What is your experience with tax filing 2018?

This content is accurate and true to the best of the author’s knowledge and is not meant to substitute for formal and individualized advice from a qualified professional.

© 2019 Jack Lee