How Can I Apply For An Online Payday loans?

Pay Day Loans

What are payday loans?

Are small sums given to individuals who have proven records of receiving payments through banking systems or thereof. More often, such loans are usually aimed at assisting the borrowers to caters for daily expenses before the following pay day.

As has been the norm, the loans are repaid on an agreed date failure to which large fees may be levied for not observing the pay day. In addition, the loans attract a higher rate of interest.

The need for cash

Do you always have enough cash at your disposal for use before next the pay day? Chances are few people do. In fact, with a rising cost of living, more and more people are finding their monthly earnings scarce relative to expenses incurred duration between consecutive pay days. Emergencies, financial requirements and occurrence of unforeseen expenditures present difficulties to individuals. At some point, individuals will have to seek alternative sources to supplement their scarce finances and increase their odds of surviving to the next pay day. Payday loans is among the options individuals can turn to cater for the occurrences.

How payday loans work?

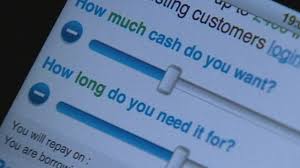

An individual seeking a payday loan pays a visit to a facility that offers the loan facilities. This may include applying online for the loan processing. One may also access the facilities from physical offices of financial corporate and fill in the necessary details. The basic requirements include membership for a predefined period in which there are regular payments.

In order to access an online payday loan, you need to authorize your bank to deduct a specified amount of money at the next

payday.

Are pay day loans any different from normal corporate loan facilities?

There are distinct variations between the normal bank loans and cash advances which are payable on the next pay day. Most notable is the high percentage levied as interest on the loans. This charge also varies with time. For example, a person who exceeds the indicated payday pays a high bigger interest than if the loan was settled on agreed date. Another striking difference is that pay day loans are loaned out for short period of one month and in rare cases, an extension of two months, which more often, are occasioned inability to settle it in the first. Another common distinction is that few legal and collateral requirements are asked off in a payday request. This, perhaps, can be attributed to the low amounts given out, a shorter period of payment and also the fact that the debtors ought to have a proven record of membership for predefined duration.

How do payday loans work

Economic effect of pay day loans

Do you think opting for payday loans can a have a negative effect on an individuals economic well being

What do you need to qualify for some of the best payday loans?

How hard, or easy it is to qualify for a cash advance is dependent on guidelines from regulatory authorities. However,

regulations in most of states and countries are in tandem in reference to limits of interests levied on such loans,

requirements for qualifying for such a loan as well as terms of payments of such loans. In United States, for example, many

states have put a ceiling level of 28% on higher end for interest charged.

What are the advantages associated with pay day loans?

Certainly, payday loans give a respite, especially where unforeseen occurrences require financial commitments. Another

important aspect of pay day loan is that they require few to no collateral to secure. They can, as such be available to

households which could otherwise not qualify mainstream credit facilities.

Payday loans are convenient and time saving. They can be obtained almost at an instant taking at most two days to process.

Applying for best payday loans online

An online payday loan is payable within a duration that may not exceed two weeks. There many companies offering payday loans facilities online at your disposal. Before applying for a pay day loan, however, you need to be familiar with requirements and regulations guidelines.

Generally, the following should always be put into consideration when you are seeking to a apply for a payday online.

1. The legal guidelines in which the payday providers are operating.

2. Charges levied, including processing fees and interest as well as the expected duration to paying back the loan.

3. Ease of accessing the funds once they have been proceed.

Imminent failure to pay your loan

What should you do in case you miss pay deadlines?

Sometimes, things may not go as planned out. If such is imminent, its no brainer to first contact the lenders. This acts to

keep trust and at times avoid spiraling interests being levied as punishment. This should then be complimented with efforts to repay the settle the loan with accrued interest on or before the second payday. A successive breach of payday agreement almost always leads to listing the account as defaulter with possibilities of penalties and exclusions from further loaning

facilities.

Point of thought

Ninety percent of of individuals who seek out payday loans are compelled either by emergencies or to cater for daily expenses. However, charges in form of interest or levies due to missed deadlines overrides the short term benefits gained. With informed budgeting, as well as setting a small amount on regular basis will help to avoid constant visits to money stores.