Option Trading and Record Keeping - How its done

Record Keeping and Option Trading

What is the best reason to keep good records of all trades when you trade stock and options like I do all day? The reasoning is, if you don't record all your trades how can you ever know how you are really doing per day, per stock, per month?

I keep careful records of my trading using no less than 3 methods. The first is using a spreadsheet for all current holdings. Method 2 is another spreadsheet which acts as a database to keep a record of all my monthly expenses and the 3rd method is the most important and I use MS Access to keep a database record of all trades. Using MS Access I can calculate using SQL (structured query language) totals for all profits and losses for all stocks and and period of time. This also allows me to calculate the totals of all the fees I incur using my discount broker for any period of time.

Database Calculations for Option Trading

Using a database is a perfect way of recording each stock or option trade. I have columns in the table that represent the number of contracts for each option trade and one contract represents 100 shares of stock. A calculation for any option trade would be (100*price*contract) - Trade fee. SQL (Structured Query Language) has allowed me to get a snapshot at any point of time to tell me how I am doing per day, month, year and for any specific stock or option trade type.

There is really no way to know how you are really doing unless you keep careful trading records. This is the main reason why I do this and over time I am turning option trading into a real profession and ultimately a business.

Rolling Options

One of my other strategies with options is to roll them out to a later date once I have made a good profit, generally about 100 dollars. This way I can lock in some gains as I buy them back and then sell them again at a higher strike price or a later month. I do this for both the PUTS and CALLS that I sell.

I also do this in reverse with PUTS, when I ROLL down the PUTS I have bought for insurance to protect my downside and I sure did this in a big way in October 2015 because of the market insanity over the EBOLA crisis and then again during the big drop in OIL and GAS stocks. All this is part of the BULL PUT CREDIT strategy I have been using almost exclusively during the last two years. It has not been easy to say the least.

During the times when I get a stock PUT to me at a higher price I have just sold the stock and then rolled out a new PUT option and in some cases I can generate more income and offset the loss of the stock. This does not happen in ever case however. I definitely prefer SELLING PUTS as opposed to selling covered calls against stocks.

Option Trading Poll

What are the most difficult challenges of option trading?

Handling the tough times in the stock market

Option Trading is a tough profession. There are times where the stock market or the movement of an individual stock makes no sense at all. A great example of this was last October 2014 when the Ebola virus destroyed the stock market and created a major correction, all because of the irrational fear that the exposure of this virus to two people at a hospital in Houston was going to mean that the whole world was going to die of Ebola. As an option trader I was able to make many profits all the way down with many of my PUT options that I bought as insurance to protect myself from this very contingency. For the most part this worked out, but the overall value of my account was hurt by the massive downturn.

This happened again a few months later after the Ebola crisis abated with the Oil and Gas stocks went down in a huge way. Once again I made money on the downside, selling for profits and then re-buying PUTS all the way down. The volatility of this stock market has been at times very difficult during the last 6 months after I reached the peak of the overall value of my brokerage account.

Option Trading is in fact a profession, but its also a very challenging profession. It takes a great deal of skill and courage at times and most of all accurate record keeping.

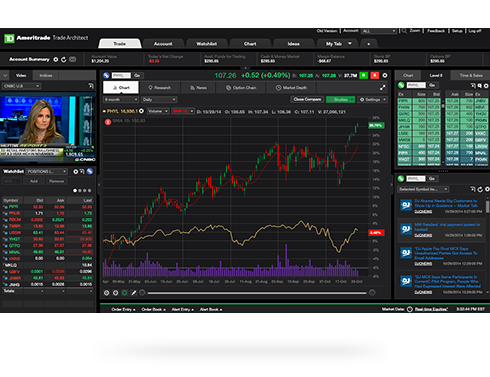

Trade Architect