Overpayment Mortgage Calculator- how to overpay your mortgage quicker

Overpaying your mortgage

Are you looking for information on an overpayment mortgage calculator? An overpayment mortgage calculator may be of use to you if you are trying to predict when you will finish paying your mortgage.

If you are buying a new home or moving house you may need a mortgage. A mortgage is a home loan tailored to your individual needs. Many people cannot afford to buy a house without a mortgage. However mortgages are very expensive and take a great deal of time to repay. Many people are spending hundreds if not thousands of dollars each month on their mortgage interest payment alone. It is for this reason that it is beneficial to overpay your mortgage home loan and become debt free as soon as possible. If you are overpaying your mortgage you may be curious to know how much longer you have left to pay and how much interest you are saving each month by overpaying. Personally I love finding out how many years are left on my mortgage and how much interest I am saving by overpaying. The best way to check these two things is by using an overpayment mortgage calculator.

This page will provide information on where to find the best overpayment mortgage calculator, and why this type of calculator may be useful.

Mortgage Home Loan Information

What is an overpayment mortgage calculator

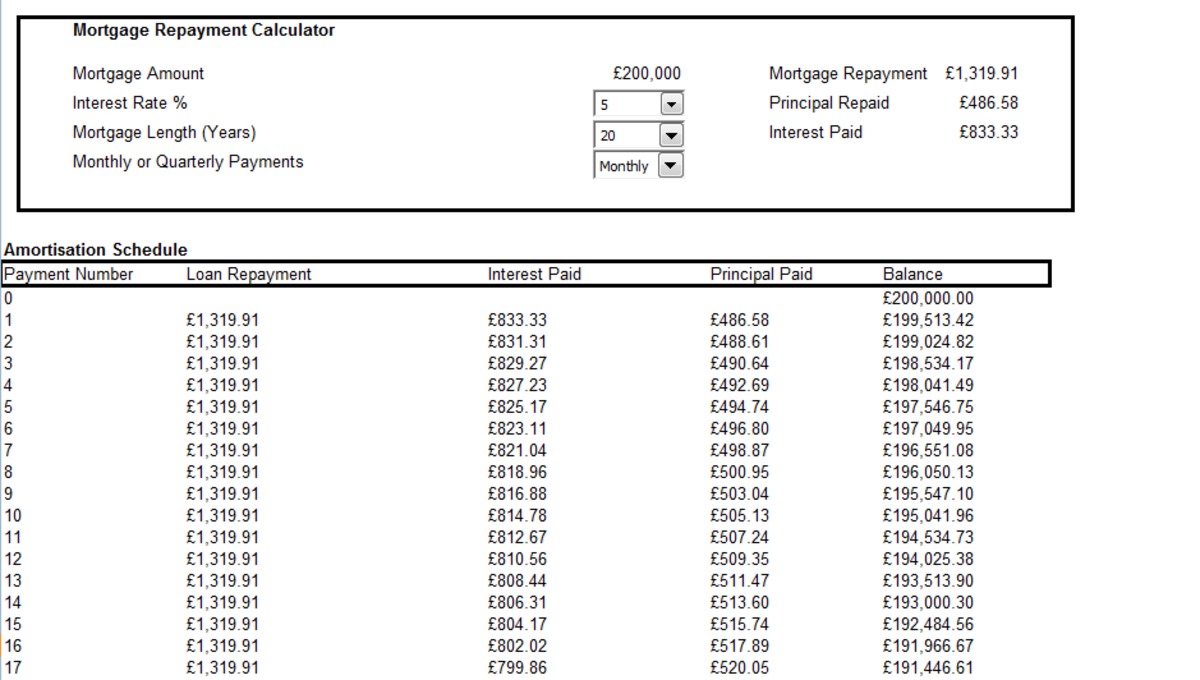

An overpayment mortgage calculator is a tool which lets you see how many years you owe on your mortgage without overpaying, how many years you can cut the term down by overpaying by a certain amount and the amount of money you can save on interest payments by overpaying a set amount each month.

An overpayment mortgage calculator is very useful for those overpaying their mortgage on a monthly basis. It can help motivate you to continue overpaying your mortgage and it can also help you plan for future events. I mean imagine the satisfaction gained by seeing that you can half your mortgage term by overpaying a small amount per month.

The good news is that even a small contribution each month will help you pay off your mortgage quicker. The table below will provide an example using an overpayment mortgage calculator calculation.

Pay your mortgage quicker

No Overpayment

| $50 Overpayment

| $100 Overpayment

| |

|---|---|---|---|

Mortgage owing

| 120 000

| 120 000

| 120 000

|

Monthly payment

| 695

| 745

| 795

|

Mortgage Term

| 25 years

| 22 years

| 19 years 7 months

|

Interest Paid

| 87 777

| 75 656

| 66 617

|

Example of the use of an overpayment mortgage calculator

Okay so you may have decided to overpay your mortgage in order to be debt free quicker. However if you are worried that you can only afford $100 a month and you think it is not worthwhile to invest this money into a mortgage overpayment, think again.

The example to the right shows you how as little as $100 can cut years off a mortgage home loan as well as help you reduce the amount of interest you pay your mortgage home loan provider. Even if you have as little as $50 spare each month it is still a good idea to pay your mortgage down.

The mortgage overpayment calculation to the right is using an interest rate of 5%. Of course the interest rate can fluctuate and be less or much more.

Where can I find an overpayment mortgage calculator

So now I have got you hooked on overpaying your mortgage you will be wanting to know where to find an overpayment mortgage calculator. The good news is that there are lots and lots of these online.

I use the overpayment mortgage calculator at fool dot co dot uk because I am from the UK. If you perform a search for overpayment mortgage calculator you will find the most relevant ones for your country. You can use the one at the fool website, and just convert the £ sign into a dollar or euro sign.

Mortgage overpayment calculator

Does a mortgage overpayment calculator encourage you to pay your mortgage off quicker

Problem with overpayment mortgage calculator

While an overpayment mortgage calculator is an effective way to check how long you have left to pay and how much interest you are saving by paying your mortgage off early, they are not totally stable. By this I mean that if the interest rate gradually increases or decreases your calculations will no longer be valid. Similarly if you borrow more money on your mortgage home loan the calculation will not be valid.

However you can revisit the overpayment mortgage calculator and re-enter the new interest rate or amount owed. This will then recalculate the number of term years and months left to pay, as well as the amount of interest saved by paying off early.

Tips on how to overpay your mortgage quicker

Now that you have seen the advantages of a mortgage overpayment calculator and you know how it works, how do you feel about it? Do you like the idea of overpaying your mortgage quicker? Let's face it who doesnt! It is much easier than you think to overpay your mortgage quicker. Here are some tips on how to overpay your mortgage quicker.

- Collect coins in a moneybox. I collect £1 coins (as I in the UK), but you can collect cents, euros or dollars. Place any loose change you have in your purse in this money box. Every two months empty this money box and use the coins to overpay your mortgage.

- Use coupons to save money on your groceries and restaurant bills and use the money saved to overpay your mortgage.