Personal Budget Fresh out of College

Executive summary

One of the major issues in America and the youth of today is financial responsibility is thrown out the window. According to the Blaze.com only 32% of Americans actually put together a budget each month to track expenses and income, and only 30% of the population have a long-term financial plan that shows saving and investment goals. Americans are even worse with saving according to PBS, 66 million Americans have $0 saved and only 28% have 6 months’ worth of savings. Upon graduation I plan on using the powers of budgeting and saving to keep myself in good financial standing and to provide myself with a secure future. In the sections below I have broken down my income for the first year after graduation. This budget shows where my money will be spent and the savings I can generate each month. With a starting salary of $64,836 I will be given a monthly income of $4,038.19 after taxes and will ultimately be able to save $562 at the end of each month.

Intro

My name is Cody and I have been studying Civil Engineering at Rochester Institute of technology. This past May I graduated with a Bachelor’s of Science in Civil Engineering, this project I created represents my projected future earnings and the expenses I will endure upon graduation and living on my own. My desire was to move to Dallas Texas to acquire a position with an engineering firm or construction management company. Both provide equal starting pay but I chose to work for an engineering firm.

Analysis

When I was hired by JDJR Engineers & Consultants I was offered a starting annual salary of $64,836. I found this starting salary on salary.com and is the average starting salary for an entry level engineer in Dallas, TX. My gross monthly income according to paycheckcity.com will be $5,403 but after federal withholding ($951.48), social security ($334.99), and Medicare ($78.34) my net pay comes to $4,038.19 per month. The state of Texas does not have any income tax so that is not included in my budget.

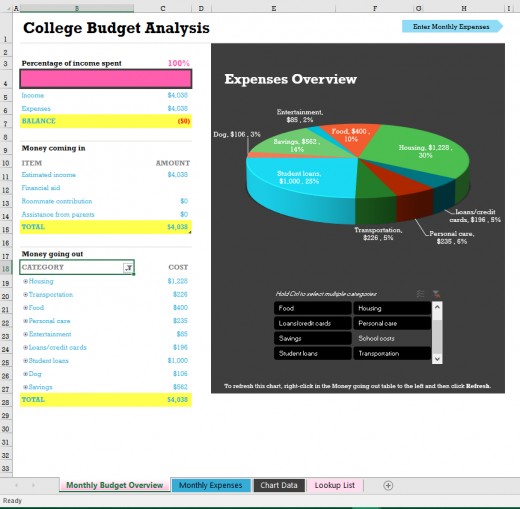

I currently use a budget analysis worksheet I created in excel for my current finances and that is what I used to calculate all of my expenses for this project. I currently have 9 categories which include housing, transportation, food, personal care, entertainment, loans/credit cards, student loans, dog expenses and savings. Each of these have subcategories that cover almost every aspect of living that I could come with. All of my estimated costs of each item was either obtained from various websites (which are cited in my bibliography) or current expenses that most likely won’t change like my cell phone bill, Netflix, credit cards, etc.

Housing

The largest category of my monthly expenses is housing roughly every month this category will cost about $1,228. Included in this is my rent, more than likely will be moving out to Texas by myself so for the time being I decided to get a single bedroom apartment which will cost about $997 for rent on average in Dallas. Also included in housing is my utilities which will cost about $231 per month, this covers electric, gas, water/sewer, cell phone, internet and Netflix since I will opt out of cable.

Transportation

Next is transportation totaling $266 per month, I recently got a solid reliable car so I will not be leasing or purchasing a new one for quite some time. I do a lot of driving and travelling and on average I will drive about 15,000 miles per year so that is what each of the following calculations is based off of and each calculation is broken down to monthly costs even though some only occur every few years. I can last a week on 1 tank of gas which comes out to be roughly $40 a week or $160 a month. My total maintenance cost monthly is about $60, this includes 3 oil changes a year at $73 each, front and back brakes ($450) and 4 tires ($750) changed roughly every 3 years based on mileage. I also included the cost for annual registration and inspection.

Other Categories

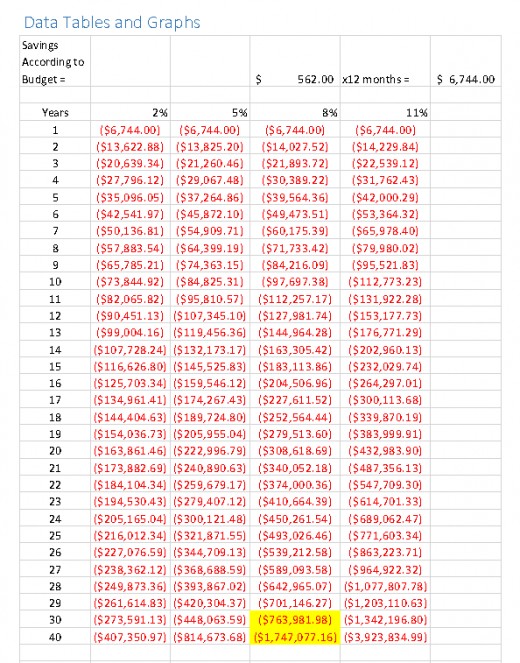

As for food I budget my $100 a week, usually this is $75 for groceries and $25 for eating out if I so choose. Personal care covers all my insurances, clothing, laundry and medical costs like prescriptions, this comes out to be about $235 a month. Entertainment is a fairly small category totaling $85 including concerts (2 a year), gifts for birthdays/holidays, Spotify and sporting events (I have to see my Cowboys play 2x year). Although these are things that are purchase at one time I broke it down to monthly costs to see what I would need to save monthly to cover the costs without dipping into savings or other expenses. I currently have 3 credit cards that I’m making payments on which total $196 a month. Other loans I will have is my student loans, I’m not exactly sure what this will cost monthly but I plan on pay the maximum so I estimated $1000. Finally, is the expenses for my dog that I plan on getting, on average the first year of owning a dog costs about $106 per month including all the shots, medicine, food and toys but this is said to drop to $500 a year after the first year. After adding everything up I am left with $562 to put towards savings/investments. In the Data Tables and Graphs section is savings schedule of my savings calculated over 30 years at 2%, 5%, 8% and 11%. When comparing the difference between 8% at 30 years and 40 years you can’t help but notice the huge jump in savings. In my case there is a jump of almost $1 million, $983,095.18 to be specific. The is a significant jump in 10 years especially when compared to the jump in the previous 10 years from the 20-year mark to the 30. I think this shows the benefit of being patient with your money and continuing to save. An extra $1 million when you are retired can go a very long way.

Conclusion

Upon first looking at the savings that can be created by simply putting money away really puts the idea of saving money into perspective and the financial benefits it carries. When I was younger and working my first job I was excited to actually have my own money but was not conscience of the powers of saving. I would save for objects like video games or clothes all things that don’t really matter. As I got older I realized the power of saving, if my car broke I had the money to fix it and didn’t have to borrow money from my parents. Having money stashed away is one of the key factors in order to become successful along with the benefits of budgeting which I did not learn until the later stages of college when I was living on my own. Budgeting allows you to see where all your hard earned money goes and can help you save more money in the long run. Seeing all your transactions spread out and grouped into categories will show you where maybe you can cut back like that $5 coffee from Starbucks every day. By cutting out that single coffee will save you $25 a week, $100 a month. That’s $100 more a month you can put away into savings or maybe towards an investment that can earn you money down the road. This project has given me the opportunity to examine in detail my future finances and begin to plan my future. The benefits of saving and budgeting are exponential and will provide me with a hopefully successful and financially stress free life.

Budget

This content is accurate and true to the best of the author’s knowledge and is not meant to substitute for formal and individualized advice from a qualified professional.

© 2019 Cody Jarvais