How to Project Rental Property Revenues to Determine Real Estate Investment Profitability

During the course of a real estate analysis, when an analyst or real estate investor is trying to determine whether a rental property is profitable and might offer a good investment opportunity or should be dismissed, analysts and real estate investors commonly evaluate the property’s future revenues.

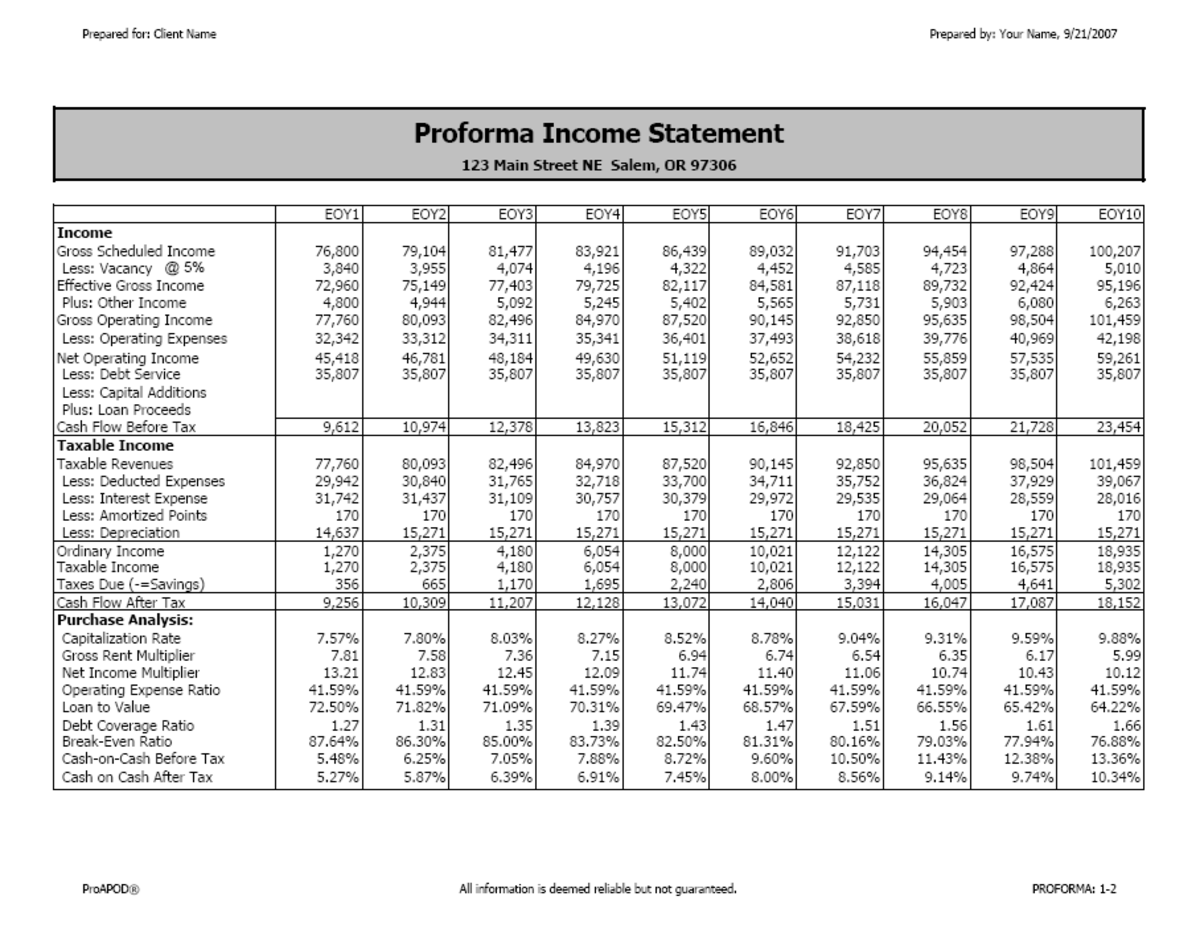

The idea is to project what the property’s income and operating expenses will be for perhaps as many as ten years based upon some assumptions and then deduct for loan repayment in order to arrive at an estimate of what the property’s cash flows and rates of return become for those future years.

The concept is straightforward.

Increase the income and operating expenses annually by some estimated percentage rate to arrive at a net operating income (income less expenses), then deduct the mortgage balance owed for that particular year to compute the property’s cash flow and subsequent rates of return.

The proforma income statement (or proforma) is generally the report used to project these revenues, and in this article, we’ll discuss just some simple basics to give you the idea. Please visit my website if you care to see a complete proforma.

How to Create a Proforma

You can choose one of two methods. You can use a spreadsheet or you can invest in a real estate investment software solution that provides the forms and will create a proforma income statement for you.

Either way, a proforma must start with a set of numbers that reflect the property’s current financial position, i.e., income, operating expenses, and loan payment. This will represent year one.

Next, make an estimate as to how much you think income and expenses will increase annually (use separate percentage rates for each if you wish) and multiply your starting numbers by these rates to calculate for year two, year two’s numbers again for year three, and so on out as many years as you deem necessary (ten years is typical). Be sure to include the loan payment for each of those years.

Finally, for each year, subtract the operating expenses from the income to determine the rental property’s net operating income then subtract the loan payment to arrive at the cash flow (or more specifically, cash flow before taxes).

For a more elaborate income statement that shows cash flow after taxes, sale proceeds, cap rate, return on equity and so on, you will need to include tax information such as depreciation, mortgage interest, amortized loan points and the investor’s marginal tax rate, a projected selling price for each of the years, and a round of additional computations for the rates of return.

Start with year one and then add each of the figures to the following years.

You can inflate a sales price in exactly the same manner you did for income and expenses or select another way to project a sales price such as with a cap rate, gross rent multiplier, or set dollar amount.

The depreciation rate depends on whether the rental property is residential (a home rental or apartments), or non-residential (commercial use).

The loan will also have to be amortized so you can determine the amount of interest paid during each year.

You can find information regarding the depreciation schedules online if you’re planning to construct your own proforma, otherwise a good real estate investment software solution will have it built in to the program and you will just have to fill in the forms.

Whatever method you choose, though, real estate investment software or a spreadsheet, here are a few considerations for you to keep in mind about your statement.

1. You are essentially looking to analyze the cash flow and other performance measures resulting from changes to such variables as income, operating expenses, and property value over some number of future years.

2. Because it consists of projected estimates, don’t rely solely upon a proforma income statement to make your investment decision.

3. Also, because it is speculative, you might not want to construct your proforma out further then ten years.

4. Always use realistic income and operating expenses to begin with and inflate them annually by a reasonable percentage rate. The same would be true with the projected selling price of the property.

Again, this article on intended to acquaint you with the report, so please visit my website so you can see a completed proforma income statement. Here’s to your success.

About the Author

James Kobzeff is a real estate professional with over thirty years experience and the owner/developer of ProAPOD Real Estate Investing Software.

Need Help?

- Real Estate Investment Software - Complete Rental Property Analysis

Real estate investment software that makes it easy to perform a complete rental property analysis. Create cash flow and marketing presentations in minutes. Easy to use real estate software solutions. - Real Estate Calculator Online | Calcs + Definitions + Formulas

Calculate and learn the definitions and formulas for dozens of real estate investment returns online. Mimics the financial calculations in a handheld but easier.